Ethereum, 200 days after The Merge: $4 billion in ether not added to supply

Exactly 200 days after Ethereum switched from the energy-intensive proof-of-work consensus mechanism to proof of stake, the impact of the network’s tokenomics change have been made clear.

When The Merge took place it lowered the amount of rewards given to those running the network. Combined with the previously introduced burning mechanism — that burns a portion of fees generated through transactions — this has had the effect of reducing the supply of ether.

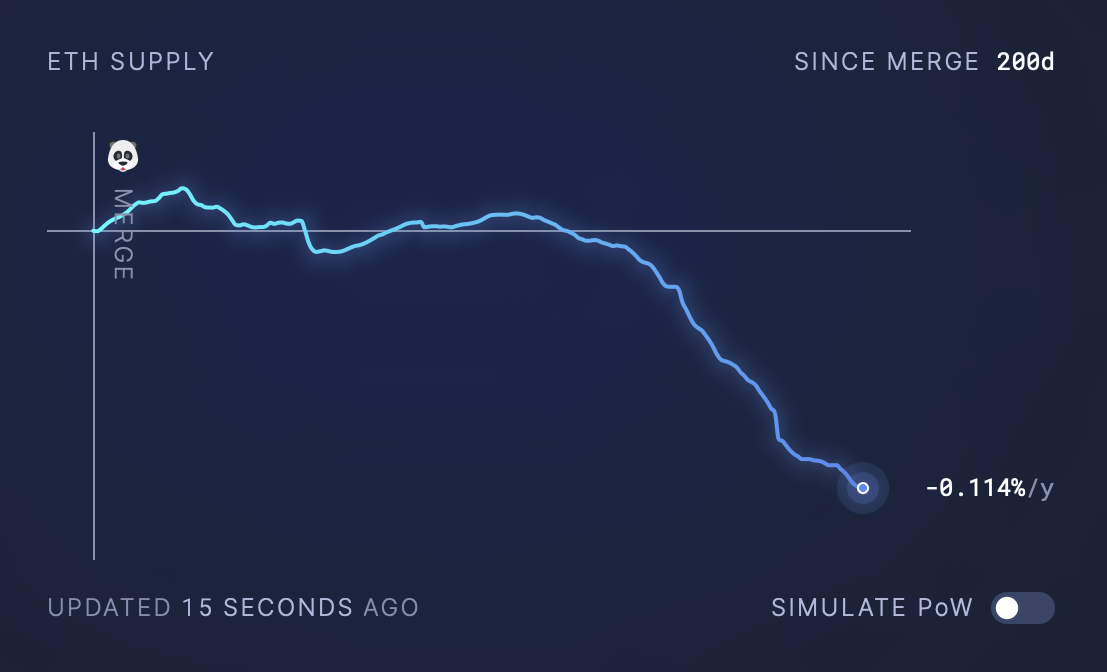

Since The Merge, the total supply of ether decreased by 75,000 ($134.5 million), representing an annual decrease of 0.114%. For comparison, were The Merge never to happen, the total supply of ether would have increased by 2.2 million — worth more than $4 billion at current prices.

The total supply of ether has decreased steadily over recent months. Source: ultrasound.money

Ethereum’s Shanghai upgrade to unlock staked ether

With The Merge, however, came the temporary inability to unstake staked ether — an action that will become available shortly when Ethereum’s Shanghai upgrade is implemented on April 12.

Shanghai will allow those who staked ether to withdraw their staked coins — but not all at once — and staking pools will be able to determine when they release the rewards.

Coinbase, for example, stated that it would begin accepting unstaking requests 24 hours after Shanghai completes. However, the exchange also noted that «demand for unstaking will be high soon after the upgrade and it may take the protocol weeks to months to process unstaking requests.»

Ether staking behemoth Lido Finance shared its expectations that stETH withdrawals won’t launch on the mainnet until around mid-May — after code audits are complete and a two-week safety margin has been observed.

The potentially lengthy wait times are primarily due to technical on-chain limitations. Only 16 partial withdrawal requests — which comprise only staking rewards — can be processed every approximately 12 seconds. Because of this, the queue to withdraw when Shanghai goes live may become lengthy. Full withdrawals — when a validator completely removes itself from the Ethereum blockchain — may also take a relatively long time.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond