Ethereum About To Be Hit Hard by Price Correction As Bitcoin and Stock Market Weaken: Analyst Benjamin Cowen

Popular crypto analyst Benjamin Cowen says that he expects Ethereum (ETH) to witness significant levels of pain as Bitcoin (BTC) and the equities market hint at downward moves.

In a new strategy session, the technical analyst tells his 768,000 YouTube subscribers that the NASDAQ, S&P 500, Bitcoin and Ethereum all look ready to at least test recent lows.

With Ethereum being significantly more volatile than Bitcoin and the stock market, Cowen points out that ETH’s critical technical support is much further away than the other assets. In a downturn across all risk assets, the analyst says Ethereum would be hit the hardest.

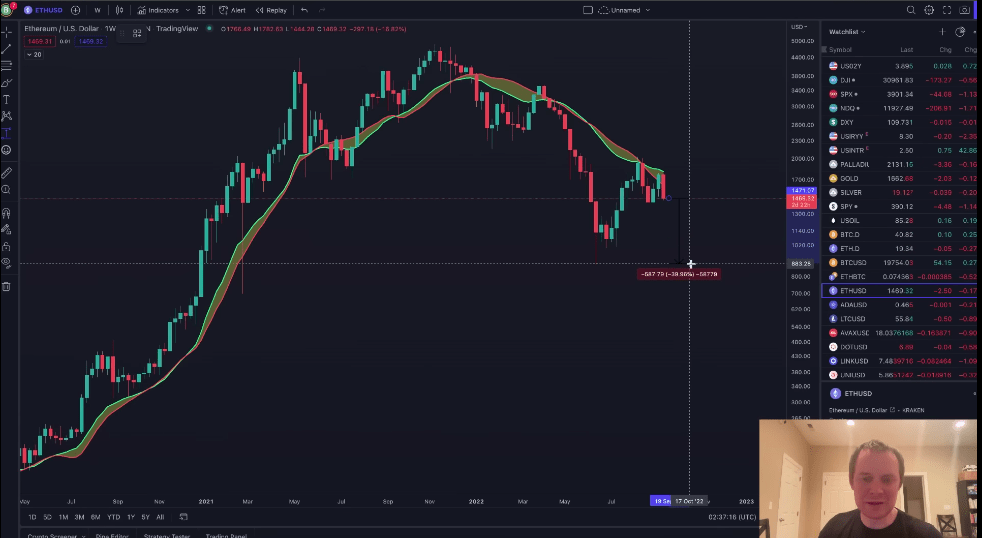

“Certain indices like the NASDAQ and the S&P 500, they are starting to flirt with the idea of going down and at the very least retesting the prior low and potentially putting in a lower low. Now the one thing to consider on this is if Ethereum retests its low – this is really important and this is why I want to make it clear how more volatile assets like Ethereum can really underperform Bitcoin in a bear market – imagine the S&P retests its low and we see that propagated across risk assets. If the S&P retests this low (3,636, points), then Bitcoin is likely to test its own low and Ethereum would likely do the same.

The problem with that is for Ethereum to retest its prior low, it would need to go down 40%, but for Bitcoin to retest its own prior low, it would only need to go down approximately 10%.

So this is a big difference, and this is one of the main reasons I think that the Ethereum Bitcoin (ETH/BTC) valuation simply looks like another distribution phase.”

Source: Bejnamin Cowen/YouTube

Not responding to its successful merge to proof of stake, Ethereum is trading at $1,451, down nearly 20% in the last seven days.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Holo

Holo  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur