Ethereum (ETH) Inflation at Almost 5,000 ETH, But It Might Become Deflationary Again

Ethereum should have been the first deflationary cryptocurrency on the market from the top 100, but the nonexistent utilization of the network brought us to the point of Ethereum’s inflation catching up with the pre-Merge network.

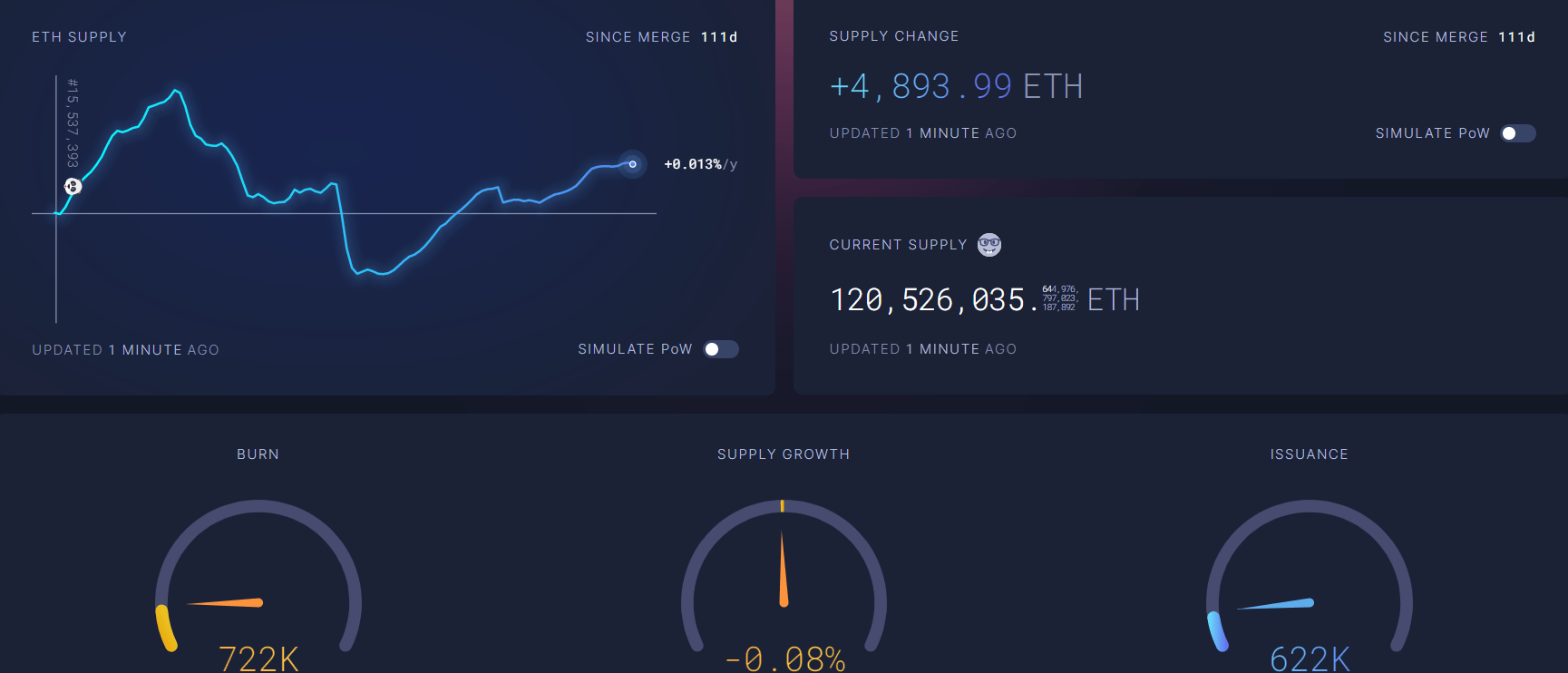

At press time, the issuance of the network has reached a worrisome milestone. Almost 5,000 ETH have been issued since the Merge update was implemented on the network. The reason behind such a large surplus is the lack of network utilization, which leads to the descending price of each transaction.

With lower fees, the amount of ETH sent to burn decreases significantly, making Ethereum less deflationary or straight up inflationary. Considering the expectations of institutional and retail investors, the positive issuance of Ethereum leads to the degraded performance of ETH on the market, according to tendencies we have been seeing throughout 2022.

Things might change

Luckily, things for cryptocurrency investors might change earlier than expected by the bearish community — today. According to the network activity of Ethereum and a couple of alternative blockchains, we are seeing a surge in activity on numerous projects, making it clear that the demand for decentralized projects is recovering, which is a bullish case for Ether.

Unfortunately, this is not enough to push the burn rate of the second biggest cryptocurrency on the market back to values we witnessed back in 2021. However, a modest increase in the utilization of the blockchain will lead to a swift drop in inflation and make Ether more scarce.

At press time, Ethereum is trading at $1,250, with a 2.85% increase in the last 24 hours, making continuous attempts to break through the local resistance level reflected in the 50-day exponential moving average.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  DigiByte

DigiByte  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur