Ethereum (ETH) maintains its position despite facing sell-offs!

Ethereum’s attempt to shift toward a greener validation process was made completed on September 15, 2022. ETH already has a huge network which was made possible only because of its incentive focus validation usage of Proof of Work, which rewarded miners.

After reaching an expansion zone, there is no longer a need to build the network; hence, Proof of Stake makes more sense. Despite moving towards a Proof of Stake, ETH stakers will be gaining a 5% yield as a guaranteed return as of 2022.

Ethereum is gradually progressing towards greener means; hence, the outlook for this token could turn positive in the long run. Proof of Stake is a lot more complex to tackle compared to Proof of Work.

To provide yield, ETH will have to add more tokens to its supply, but the greater challenge is posed by the burning of ETH tokens. ETH will thus have a slightly neutral or negative increase in volumes; hence it would be safer to consider ETH as a deflationary cryptocurrency.

Ethereum has reached a market capitalization of $160 billion and has been on a slight profit-booking stance since its official completion of the crypto merge. Ethereum token has started to move upwards to new highs, but the merger announcement has taken its toll.

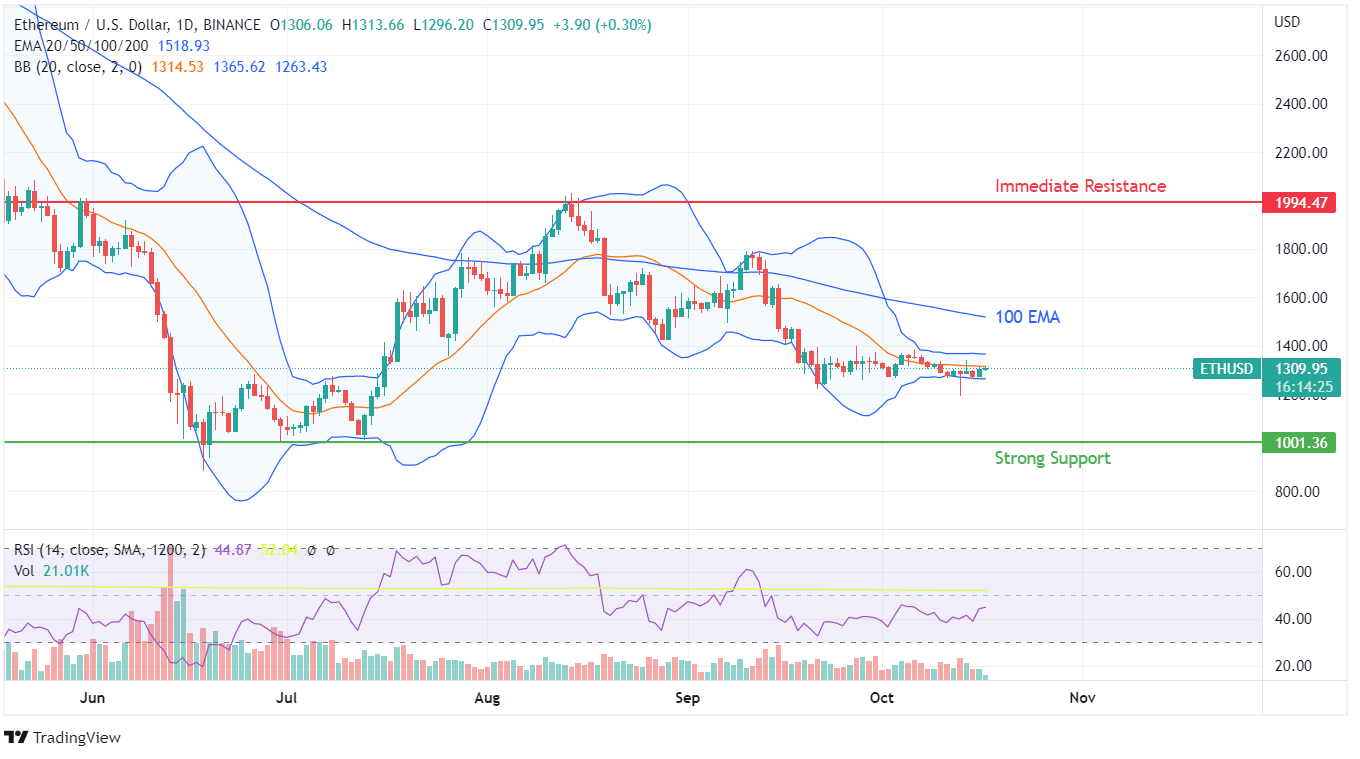

What seems like buyers’ fear about the prospects of a Proof of Stake ecosystem resulted in a huge decline in less than a week. Since hitting around $1.2K, ETH is showing resistance to further decline, which is a positive aspect of ETH tokens.

Ethereum’s price action has showcased restraint from sellers despite a panic reaction, but this heading has moved toward consolidation for the last month. The long-term outlook for ETH is not yet clear, but consolidating action will prompt buying, eventually leading it beyond $2000 in the short run.

Transaction volumes, RSI, and MACD indicators are yet to declare a stronger price movement, but volumes retaining their previous levels is a sign that Proof of Stake has had no impact in the use case of Ethereum. The daily volatility has been less than 3% in the last month. Before investing, read more about the token and its prediction for the next few years.

On weekly charts, the consolidation is confirmed to get support from the $1250 levels. $1500 would be the short-term resistance for ETH, followed by $1800, which would be a significant upside movement. The immediate resistance near $2000 would resist the swift movement of the ETH token.

The difference between support and resistance will impact the movement of ETH with higher volatility in case of prolonged consolidation. The narrowing price action range showcased in Bollinger Bands creates the ambient scenario for a strong movement in either direction. Since supports are more active, the breakout should move in an upward direction.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond