Ethereum (ETH) Price Analysis for February 9

The market seems in need of a slight correction as most of the coins are in the red zone.

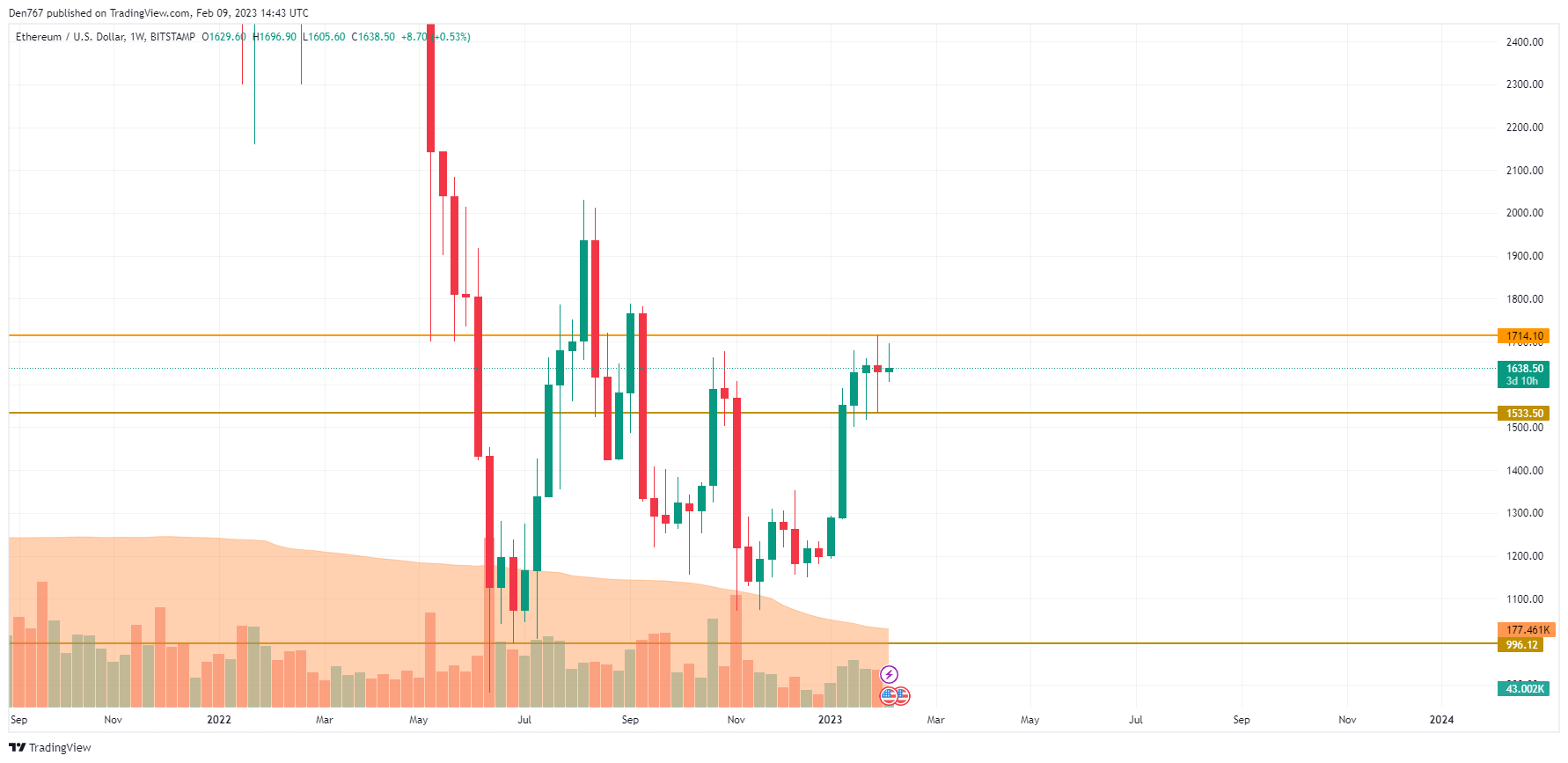

ETH/USD

Ethereum (ETH) is more of a loser than Bitcoin (BTC), going down by 1.75% over the last 24 hours.

Despite the fall, Ethereum (ETH) is looking bullish from the local point of view. The price has reached the resistance at $1,642.60 and is currently trading near it. If buyers can hold the gained initiative until the end of the day, the breakout may lead to the test of the $1,660 zone tomorrow.

On the daily time frame, neither bulls nor bears are controlling the situation as the price keeps trading sideways. Such a statement is also confirmed by the declining volume.

One can think about a possible upward move only if the rate gets back to the $1,700 mark and fixes above it.

A similar situation can be seen on the weekly chart as the price is accumulating power in the middle of a wide channel, between the support at $1,533 and the resistance at $1,714. In this case, the more likely scenario is ongoing consolidation in the area of $1,600-$1,700 so that Ethereum (ETH) could gain more strength for a further move.

Ethereum is trading at $1,640 at press time.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur