Ethereum (ETH) Price has More to Lose, Crypto Experts Predict

As the price of Ethereum (ETH) follows in Bitcoin’s footsteps and the bearish regime continues to launch assaults, experts anticipate that ETH will continue to decline. To put this into perspective, ETH’s price has been hovering close to the $1,617 barrier over the previous several days.

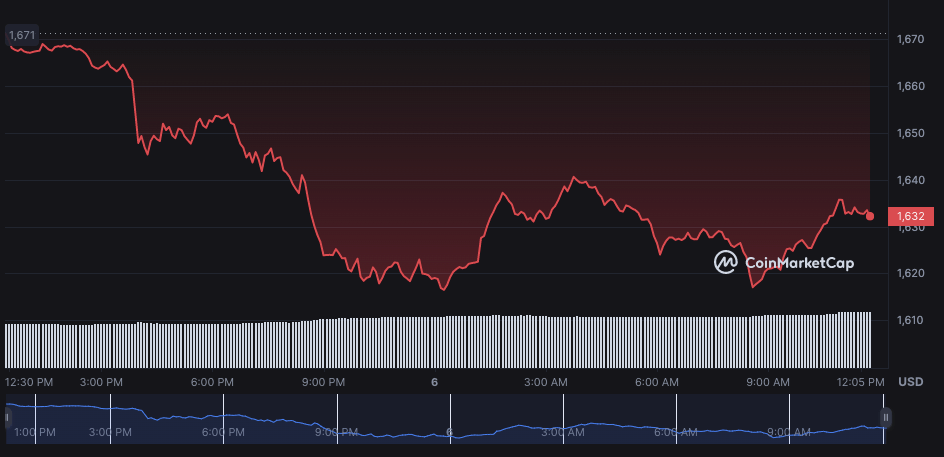

ETH/USD price chart, source: Coinmarketcap

The typical outcome of a tense consolidation close to an overhead resistance is allegedly a breakout to the upward. However, if the bulls fail to hold their positions, ETH could retest its recent low point of $1,510 and be vulnerable to breaching $1,500, according to speculations from proponents.

TraderSZ, a Twitter personality, believes that $1590 would be the next downside target if the market participants start pushing lower again. With the markets at such low valuations, many analysts expect ETH/USD to plummet, and TraderSZ believes that $1590 could be the bear’s target.

$ETHUSD 1590 would be next downside target if we start pushing lower again pic.twitter.com/cnLLWZQfPo

— TraderSZ (@trader1sz) February 6, 2023

On the other hand, amid a request for comments, Arseny Myakotnikov, Managing Partner at Input PR & Marketing Agency, states that with the Ethereum token burn event, the security tightening of the protocol is showcased in the refusal of validators to process transactions emanating from suspicious crypto mixers. Arseny adds:

This stance on integrity is a source of attraction for institutional investors with a projection that they may draw on it as a means to stack up on the coin ahead of Bitcoin when the global economy recovers.

Coinmarketcap reports that the Ethereum/U.S. Dollar exchange rate is now at $1,632.77, with a 24-hour trading volume of $7,509,967,464. Also, Ethereum has lost 2.26 percent in the past day. A total of 122,373,866 ETH coins are in circulation, and its current market cap is $199,808,717,454.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur