Ethereum, Ethereum Classic, Lido Finance Plummet on Eve of Merge

Merge-related cryptocurrencies, including Ethereum (ETH), Ethereum Classic (ETC), and Lido Finance (Lido), have posted severe losses over the past 24 hours.

Ethereum dropped 8.82% over the past 24 hours and trades at around $1,515 after bouncing off from its support at $1,500 earlier today.

Ethereum is now down 68.95% from its all-time highs of $4,891.70 recorded in November 2021, per data from CoinMarketCap.

On a weekly note, ETH is down 4%, hitting a new weekly low after the months-long bull run fueled by the upcoming merge.

Ethereum Classic, a hard fork of Ethereum executed following the 2016 DAO hack, has also slumped by 15.12% over the past 24 hours and leads the losers among the top 20 cryptocurrencies by market cap.

As of this writing ETC, the 19th-largest cryptocurrency with a market capitalization of $4.66 billion, changes hands at $34 apiece, per data from CoinMarketCap.

The day’s losses put ETC down 80.60% from its all-time highs of $176.16 recorded in May 2021.

Lido Finance’s native token, LDO, dropped over 16.71% earlier this morning, per data from CoinMarketCap.

LDO is changing hands at around $1.83, down 90.10% from its all-time highs of $18.62 recorded in November 2021.

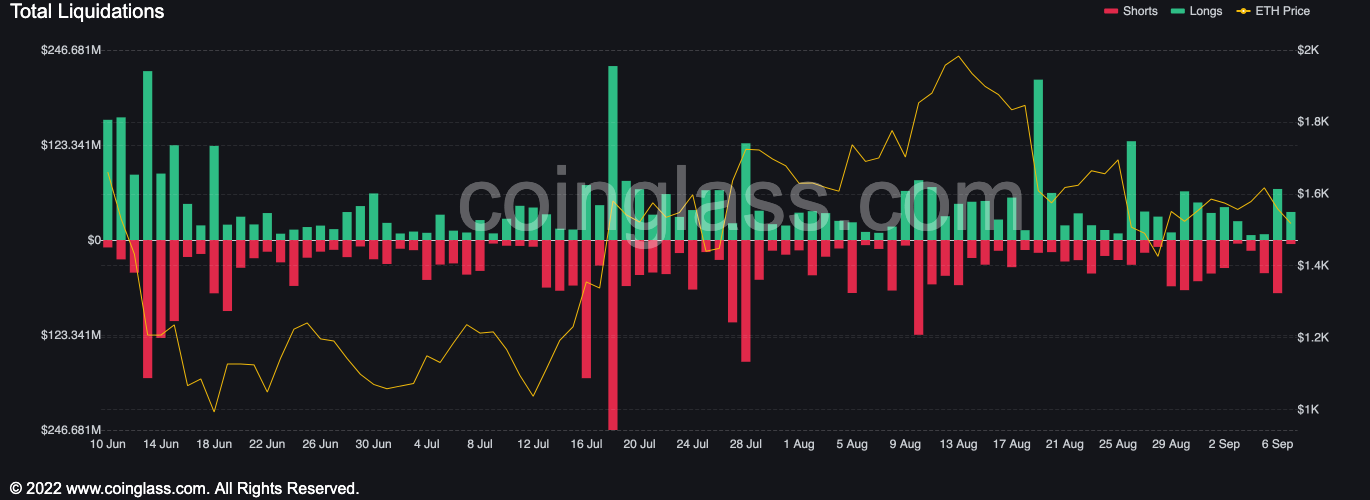

Red bars indicate short liquidations; green bars indicate long liquidations. Source: Coinglass.

Ethereum short and long positions totaling $107.76 million were liquidated over the past 24 hours, per data from Coinglass. Ethereum Classic follows Ethereum with $38.69 million liquidated over the same period.

Bitcoin, the leading cryptocurrency, has also lost 5.98% over the past 24 hours, hitting a new two-month low.

The entire market capitalization again fell below the $1 trillion mark, too, plummeting 5.72% over the past 24 hours, per data from CoinMarketCap.

Ethereum merge hype wanes

The primary reason behind the fall of these tokens could be due to dulling excitement ahead of the Ethereum upgrade, as well as the U.S. dollar’s strengthening alongside the Fed’s aggressive rate hikes.

With the merge expected to go live next week, the future after the event has raised some concern for investors, which may be fueling today’s sell-off.

This talk will stop once the post-merge rug pull happens, likely the day it’s announced as successful.

After that, welcome to $700.

I say this as an $ETH long…going to take years for a new ATH.

You still in with that long of a wait big balls Anon? ?

— Craig Mako (@CraigMako) September 7, 2022

Investors have also raised concerns surrounding the potential centralization of Ethereum following the merge.

The fact that it’s backed by $ makes it a safe choice for every investor but on the contrary there are concerns about centralization and control (BlackRock will serve as a strategic partner in Circle)@jazzveleG @parisis2019

— Iasonas Apostolakis (@IasonApostol) September 7, 2022

“Lido’s dominance of the liquid staking market (& the broader market where it has a 31% market share) has raised centralization concerns,” tweeted a Twitter user.

With the Fed meeting later this month, a 50 basis-point hike cannot be ruled out either, as reported by Reuters.

The aggressive monetary policy of the U.S Fed to combat four-decade high inflation has also led investors to shy from high-risk assets.

Leading stock indices, including Nasdaq Composite (IXIC) and S&P 500, have shed over 9% and 6% over the past month, respectively.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Siacoin

Siacoin  Nano

Nano  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur