Ethereum Making Breakout Attempt: Crypto Market Review, October 24

The last few weeks were tough for the cryptocurrency market, as most assets entered and did not exit local resistances despite negative netflows on exchanges and appearing signs of accumulation. Today, however, some assets are showing some important reversal signs.

Ethereum’s attempt to break through

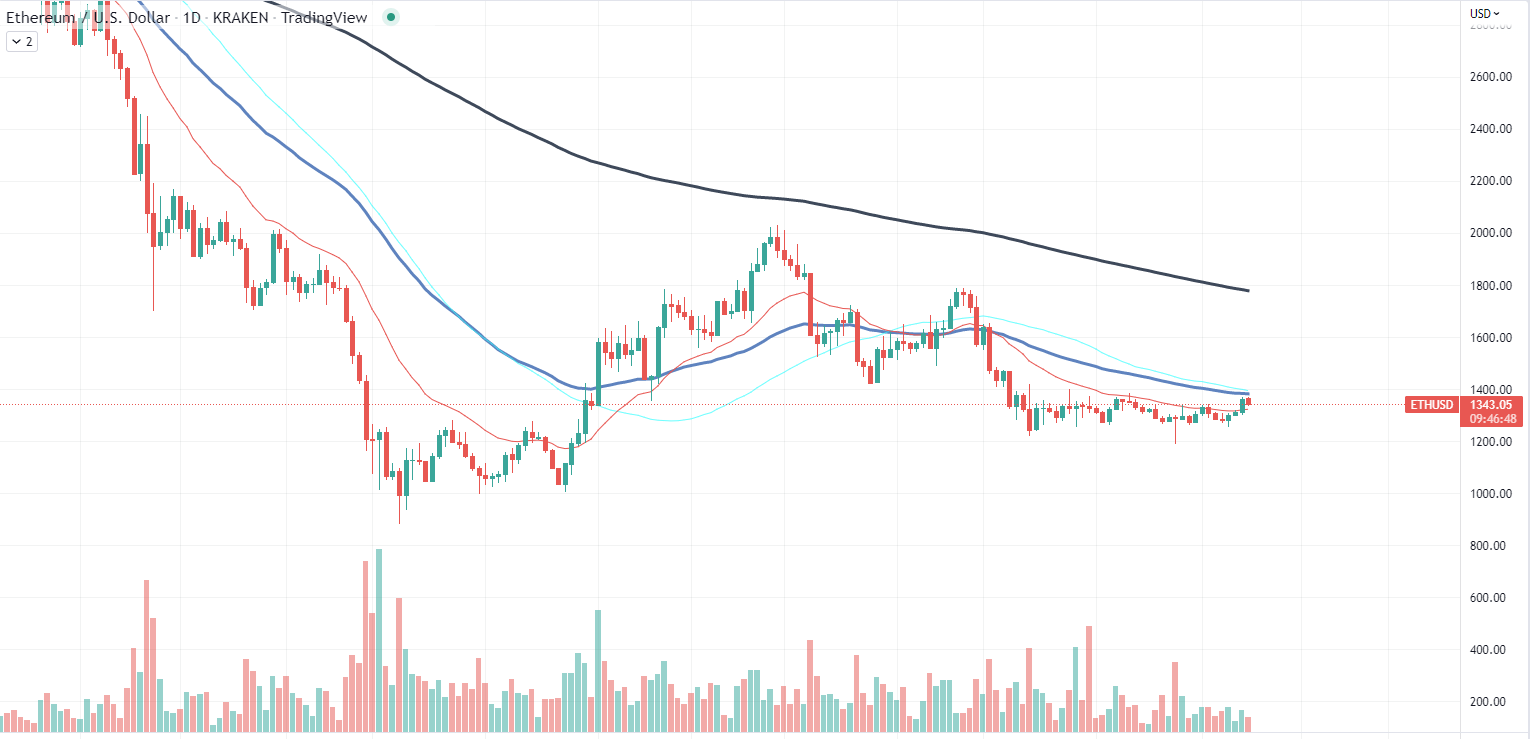

On Oct. 23, Ethereum had a strong swing up that pushed it right to the local resistance level of the 50-day moving average. Unfortunately, today, bears became more active and are now pushing the second biggest cryptocurrency on the market to new lows. However, the breakthrough attempt shows that bulls can still take control.

Prior to the breakout, Ethereum entered the consolidation channel, which could be a major sign of an upcoming reversal since the asset has avoided further downward pressure and successfully started moving sideways, which is a positive factor for an asset that aims at reversing.

The next target for Ether would be the breakout through the 50-day moving average, which acts as a resistance level for it. For more than a month, the moving average acted as a guideline for Ethereum that could not find enough support from investors to make a breakthrough attempt. Luckily, the fading volume profiles show that Buterin’s coin is slowly getting out of bears’ claws.

Shiba Inu’s first reversal sign

A fading volume profile is not a prerogative of Ethereum only. According to the same indicator, SHIB bears are also losing power on the market despite the continuing downtrend on the memetoken.

In the last 20 days, Shiba Inu lost more than 14.5% of its value, coming dangerously close to the year’s low. However, the fading volume on the market brings investors some hope for an upcoming reversal.

The fading trading volume is a general sign of an upcoming reversal as traders tend to lose their power to push assets in a certain direction as time goes by and funding does not rise. Unfortunately, data shows that there are no fresh inflows appearing on the market, and SHIB will simply enter a prolonged consolidation instead of bouncing upward.

Generally, markets are moving in uncertainty, waiting for macro events to happen that greatly affect the cryptocurrency industry. FOMC meetings and CPI reports are two main sources of volatility for the cryptocurrency today.

Most experts still believe that the market should not expect a reversal until the beginning of 2023, considering the problematic nature of most world economies. Since Bitcoin and the cryptocurrency market in general are highly dependent on the stock market’s performance, the recovery of the U.S. economy and easing of its monetary policy will most likely affect digital assets in addition to stocks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur