Ethereum price analysis: ETH bounces from $1,150, slowly headed lower again?

Ethereum price analysis is bullish today as we have seen a strong retrace slightly above $1,150 end with a slow reversal over the last 24 hours. ETH//USD is now ready to continue even lower and head towards the $900 previous swing low.

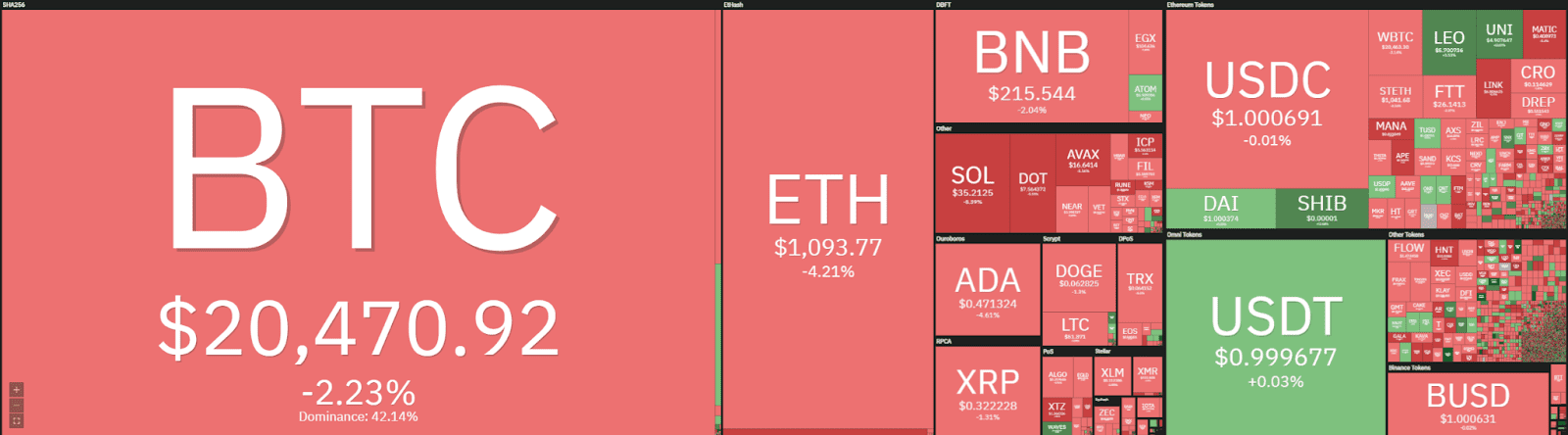

Cryptocurrency heat map. Source: Coin360

The market has traded in the red over the last 24 hours as resistance levels were reached across the board. Bitcoin declined by 2.23 percent, while Ethereum a more significant 4.21 percent. Meanwhile, Solana, Avalanche, and Polkadot were the worst performers, with over 5 percent declines.

Ethereum price movement in the last 24 hours: Ethereum fails to reach $1,250, moves back below $1,150

ETH/USD traded in a range of $1,073.88 to $1,185.43, indicating substantial volatility over the last 24 hours. Trading volume has declined by 19.27 percent, totaling $14.28 billion, while the total market cap trades around $132.67 billion, resulting in a dominance of 14.71 percent.

ETH/USD 4-hour chart: ETH looks to continue lower?

On the 4-hour chart, we can see the Ethereum price action starting to test the downside again, indicating that another push lower should follow later in the week. Once the momentum starts going, ETH/USD should look to break past the $900 support.

ETH/USD 4-hour chart. Source: TradingView

Ethereum price action has started to lose bearish momentum over the past week. After small tests of the downside last week, ETH/USD made the last push lower on 18 May 2022. From there, a strong reaction higher followed, indicating exhaustion of selling pressure.

Further tests of $1,150 resistance followed earlier this week, with further upside briefly reached late yesterday. However, the next resistance at $1,250 could not be reached. Therefore, the market is not yet reversed the current several-week bearish momentum.

Likely the current drop below $1,150 indicates that more downside will soon follow. Likely Ethereum price will head even lower over the next 24 hours, with the $900 previous low as the next target.

Considering the declining bearish sentiment, we do not expect another strong lower low to be set. The most likely target to the downside is the $800 psychologically important price mark.

Otherwise, if a higher low is set, we could see the first sign of trend reversal. In this scenario, it is crucial to see ETH/USD break above the $1,150 and $1,250 previous resistance levels.

Ethereum price analysis: Conclusion

Ethereum price analysis is bearish today as we have seen reversal signals over the last 24 hours after the $1,250 mark could not be reached. ETH/USD has already moved back below $1,150 local resistance, indicating that a strong push to the downside should soon follow.

While waiting for Ethereum to move further, see our guides on Best Litecoin Wallets, best places to stake $HBAR, and how to survive Crypto winter.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond