Ethereum Price Analysis: ETH Declines to $1,814 After Bearish Momentum

The Ethereum price analysis is dictating a sudden decrease in price after an already rising bearish trend. The bearish momentum that is increasing is likely to be seen in the near future, as the bulls remain sluggish at this point. The bulls were currently in control of the market a few hours before the price drop in today’s trading.

If the bears keep up their momentum, then ETH/USD can go down to $1,812 in the near future. However, also if the bull can put up enough pressure ETH/USD can possibly go up to $1,840 in the near term.

The ETH token is down by 0.34% and currently trading at $1,814, as of the time of writing. The 24 trading volume is also on the decrease at the moment, and it is currently at $6.25 Billion, while the market cap is currently at $218 billion, with a loss of 0.25 percent.

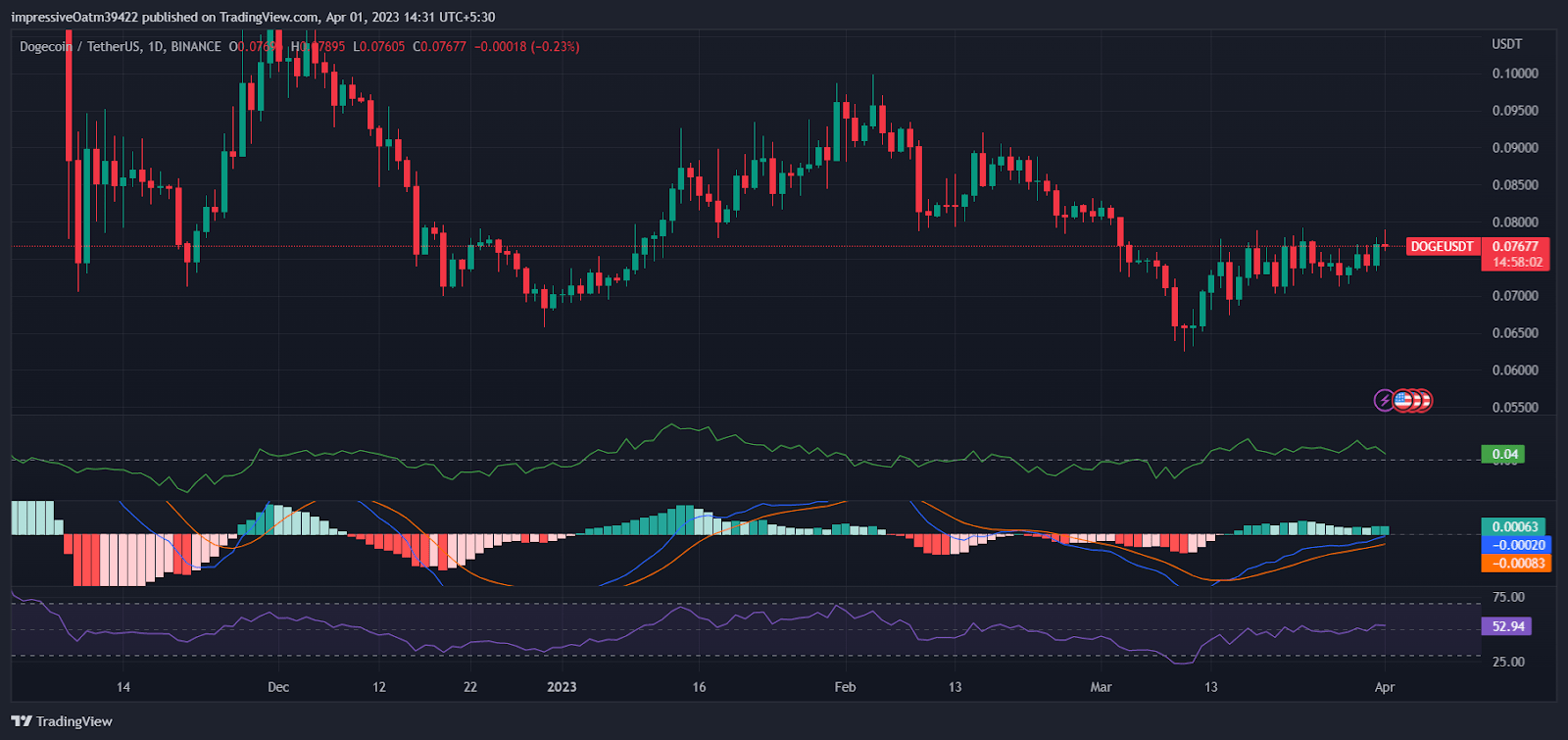

ETH/USD 1-day price chart: Bearish activity is at $1,814 as ETH levels shrink further

The 24-hour Ethereum price analysis is dictating a bearish activity in the market, as the prices decline further. The bulls and bears are struggling to take control of the market, and it is difficult to predict which way the market will move. But currently, the bearish momentum is more dominant, as the bulls have completely lost their grip on the markets, and it’s unlikely they will be able to regain their strength anytime soon.

ETH/USD 1-day price chart. Source: TradingView

The Moving Average (MA) value is going $1,775, which is still above the SMA 50 curve. This is giving hope to the buyers, although the volatility is decreasing, which is giving an opposite signal as per the Ethereum price analysis. The Bollinger bands are converging with the upper Bollinger band present at $1,853, while the lower Bollinger band is at $1,660, suggesting that the price will remain range bound in the near future. The Relative Strength Index (RSI) is at the level of 58.86, indicating that ETH/USD will not reach any extreme levels in the near future.

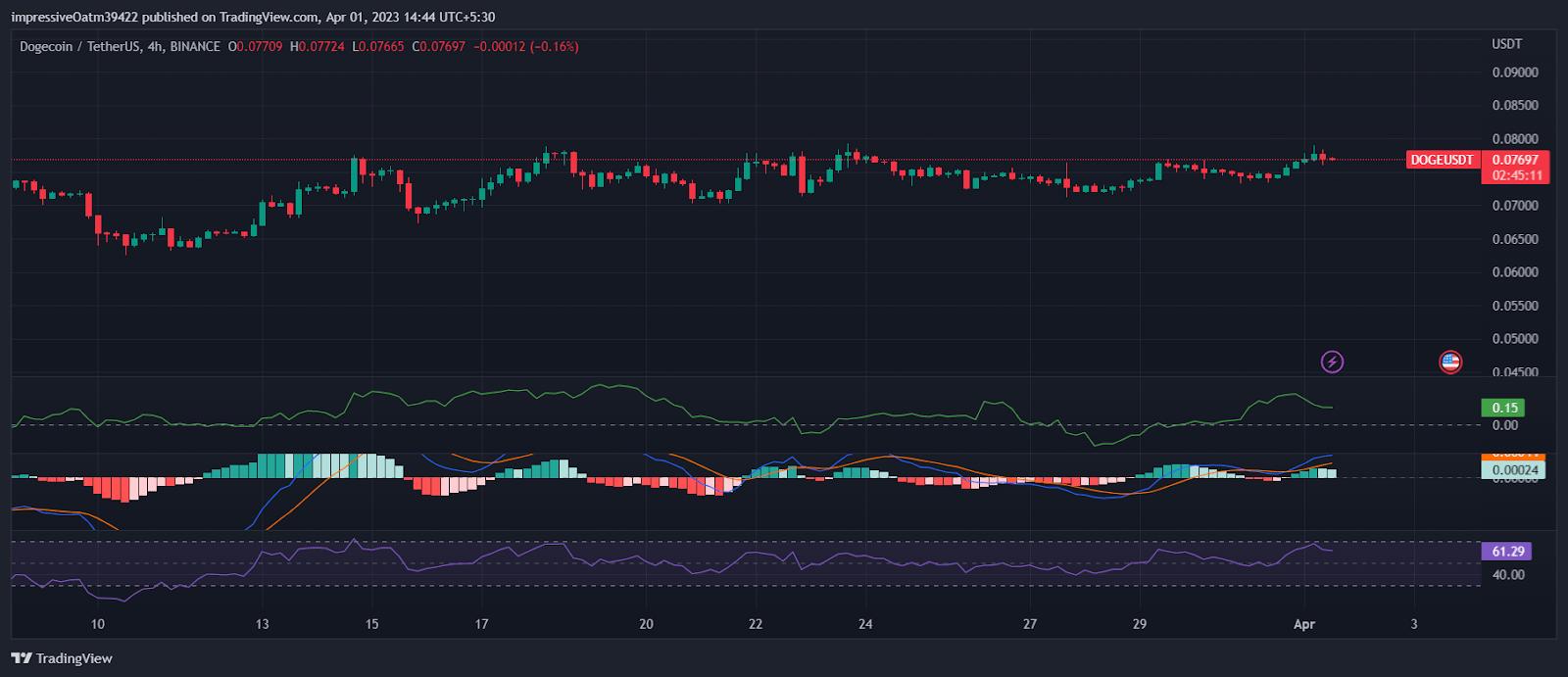

Ethereum price analysis: Recent developments and further technical indications

The 4-hour chart for Ethereum price analysis shows that a small overtake has taken place from the bears, which caused quite a damage in today’s trading session, intensifying the bearish momentum. The momentum has been relatively stronger as the price has dropped drastically; however, support has also appeared as the price has slightly recovered back to $1,812 during the last few hours. Nevertheless, the trending line is going towards the negative side now.

ETH/USD 4-hour chart. Source: TradingView

The hourly Moving average (MA) is currently at the $1,820 level, just near the current market price. The Bollinger bands are narrowing on the chart as the upper band is at $1,838, while the lower band is at $1,777. The RSI indicator has also lowered, and after recovering a bit, the indicator is trading at an index of 1,820.

Ethereum price analysis conclusion

Overall, the Ethereum price analysis is trading in a sideways pattern, as the buyers and sellers are still struggling to take control of the market. The trend line is going toward the negative side, suggesting that the bears are dominating. The buyers need to gain some strength and push back the price above the $1,840 level.

While waiting for Ethereum to move further, see our Price Predictions on XDC, Cardano, and Curve.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Holo

Holo  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur