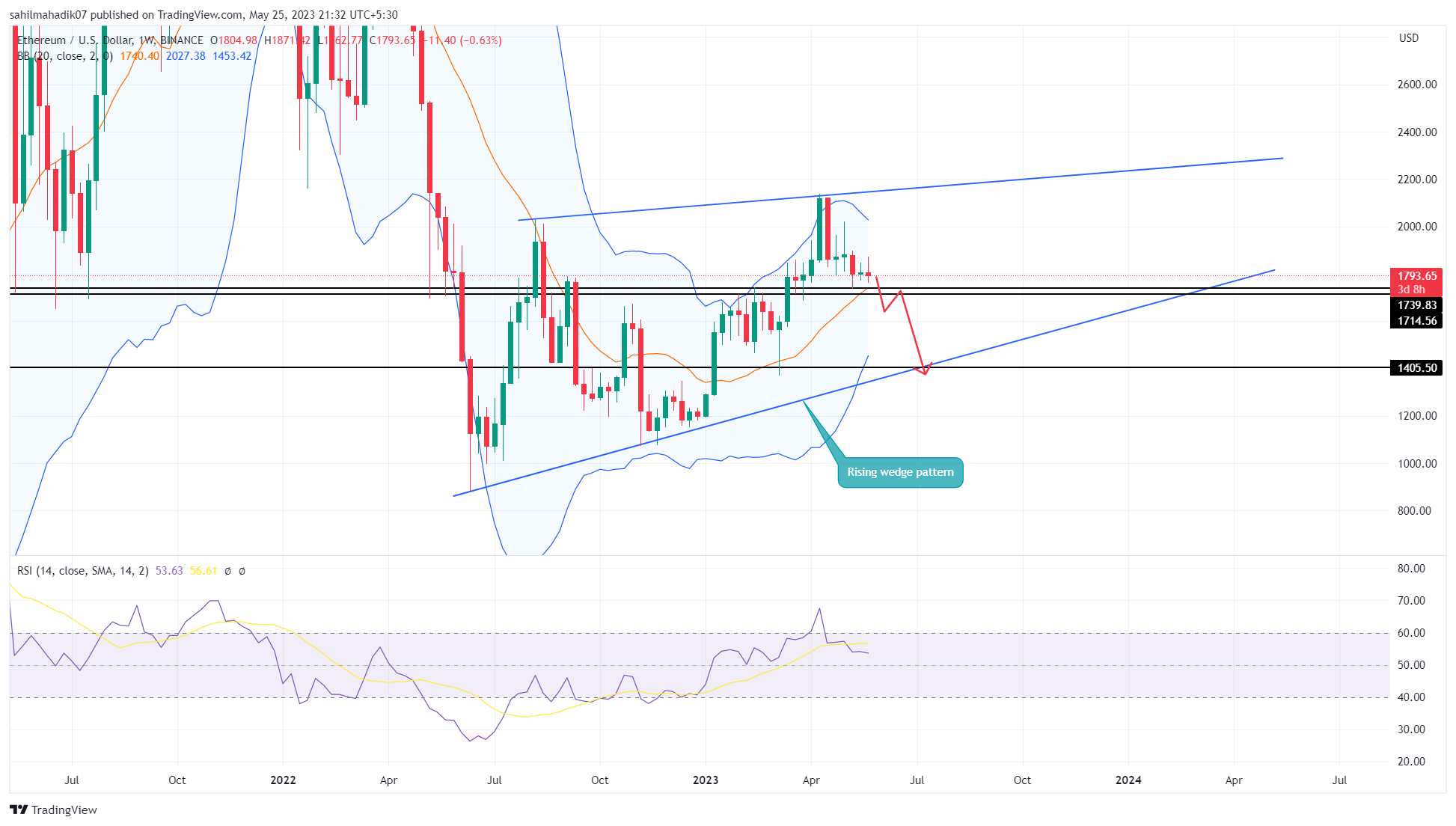

Ethereum Price To $1400? Wedge Pattern Sets ETH Price For A Major Correction

Over the past two weeks, the Ethereum price has consolidated in a narrow range reflecting the lack of conviction from buyers and sellers. However, in the bigger picture, the coin price shows the formation of a famous bear continuation pattern a rising wedge. Under this development, the ETH price is currently under a bear cycle within the pattern which projects a longer correction phase in the near future.

Also Read: Ethereum Client Releases Major Upgrade To End PoW Support, ETH Price Jumps

Ethereum Price Daily Chart

- The Ethereum Fear and Greed Index at 47% accentuates a neutral sentiment among market traders

- A breakdown below $1700 support will signal the resumption of the prevailing downfall.

- The intraday trading volume in Ether is $6.4 Billion, indicating a 0.14% loss.

Source- Tradingview

During mid-April, Ethereum price turned down from the resistance trendline of the wedge pattern and initiated a new bear cycle. From the peak of $2138, this downfall tumbles the prices by 15.48% to reach the current price of $1798.

However, with the growing indecisiveness in the crypto market, the ETH price hit a minor roadblock at $1740-$1714 support and turned sideways. Under the influence of the chart pattern, the overall setup favors a potential downfall, and therefore, the current consolidation could be a temporary detour.

Thus, if the bearish momentum is recuperated, a breakdown below $1714 support may drive the 18.5% down to hit the support trendline at $1400.

Anyhow, the coin holders can keep an overall bullish sentiment until the pattern’s lower trendline is intact.

Will Ethereum Price Poke $1400 Support?

If the ongoing consolidation phase in Ethereum price resulted in sellers’ favor with the breakdown of $1714, coin holders are likely to witness a longer correction to the $1400 mark. The potential downtrend could experience a major blockade at $1500 psychological support.

- Bollinger Band: A downtick in the upper band of the BB Indicator projects increasing selling momentum and an extra edge on short-selling opportunities.

- Relative Strength Index: The RSI slope plunge below the 60% barrier reflects additional confirmation of a downswing move.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur