Ethereum Price to Soar After Merge If This Scenario Plays Out, Arthur Hayes Says

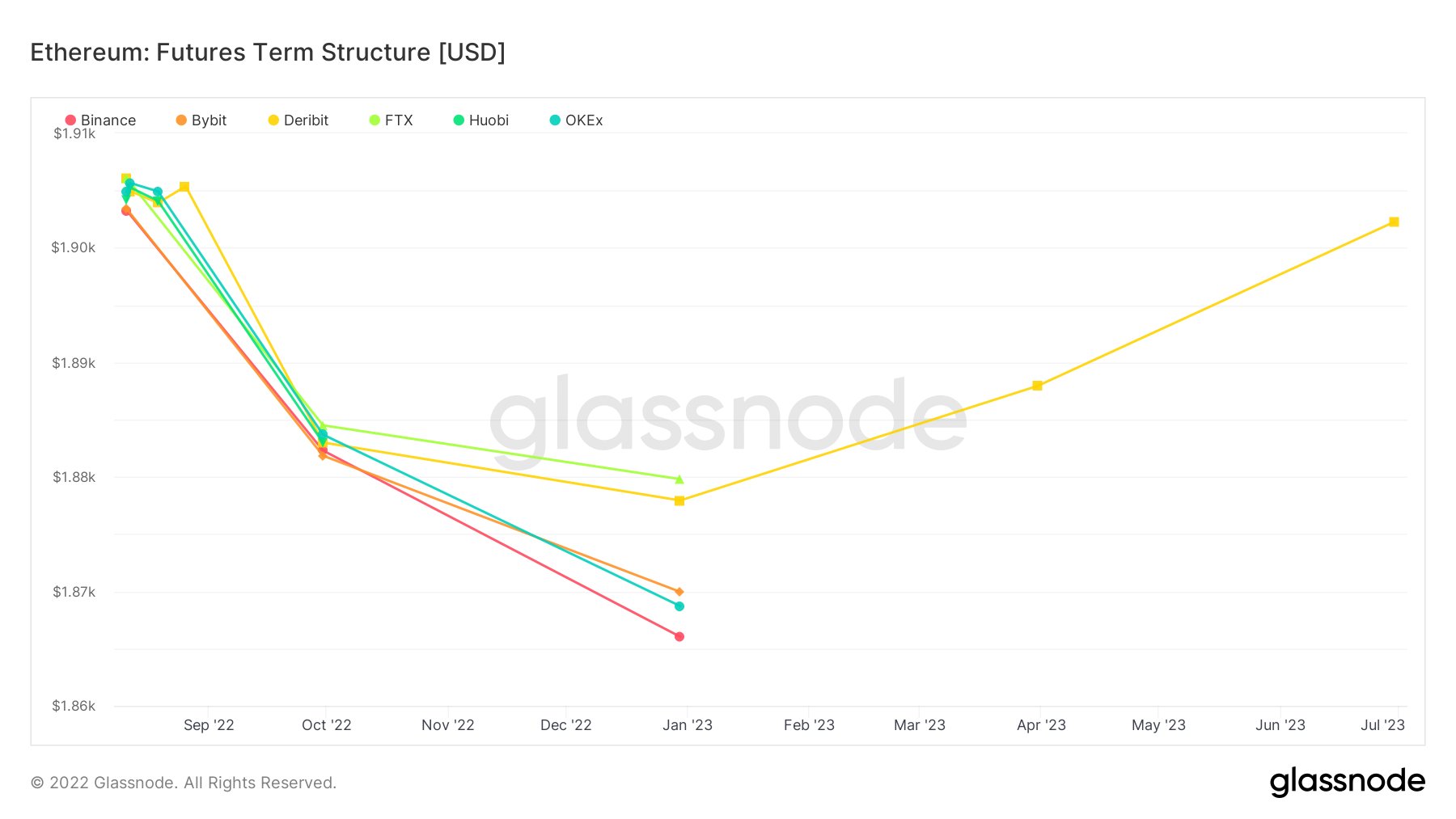

Arthur Hayes, the former CEO of the BitMEX cryptocurrency exchange, claims that the current Ethereum futures term structure may point to a significant rally after the merge.

Backwardation described a term structure where futures contracts trade lower compared to the cryptocurrency spot price.

While it might be seen as a reason to be bearish on the price of Ethereum, Hayes believes that Ethereum traders are hedging out Ethereum exposure on the cusp of the much-anticipated merge event. This adds additional selling pressure to the Ethereum spot market, according to the controversial entrepreneur.

After years of disappointing delays, some market participants believe that the upgrade could still go awry due to how monumental and technically challenging it is.

At the same time, Hayes is convinced that hedgers will have to cover their shorts, becoming net long again if Ethereum’s transition to proof-of-stake ends up being successful Speculators will also likely buy into the “triple halving” narrative. Market makers will have to reverse their positions by going long spot and shorting Ethereum futures.

Such a scenario could potentially push the price of Ether sharply higher.

As reported by U.Today, Ethereum developers recently confirmed that the merge is now on track the merge upgrade is going to take place on Sept. 15.

Last week, Hayes predicted that the price of Ethereum would be able to soar back to the $3,500 level after a successful merge event. In fact, he believes that the second-largest cryptocurrency could even touch $5,000 if this is accompanied by a Fed pivot.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur