Ethereum: Shapella Upgrade – A Catalyst for Price Growth?

A profit and loss analysis conducted by CryptoQuant indicates that the upcoming Ethereum Shapella upgrade, set to occur on April 12, 2023, may not result in the expected increase in selling pressure.

The Ethereum Shapella upgrade, scheduled for April 12, 2023, merges elements from two Ethereum Improvement Proposals, “Shanghai” and “Capella.”

This update will enable stakers and validators to withdraw their assets from the Beacon Chain.

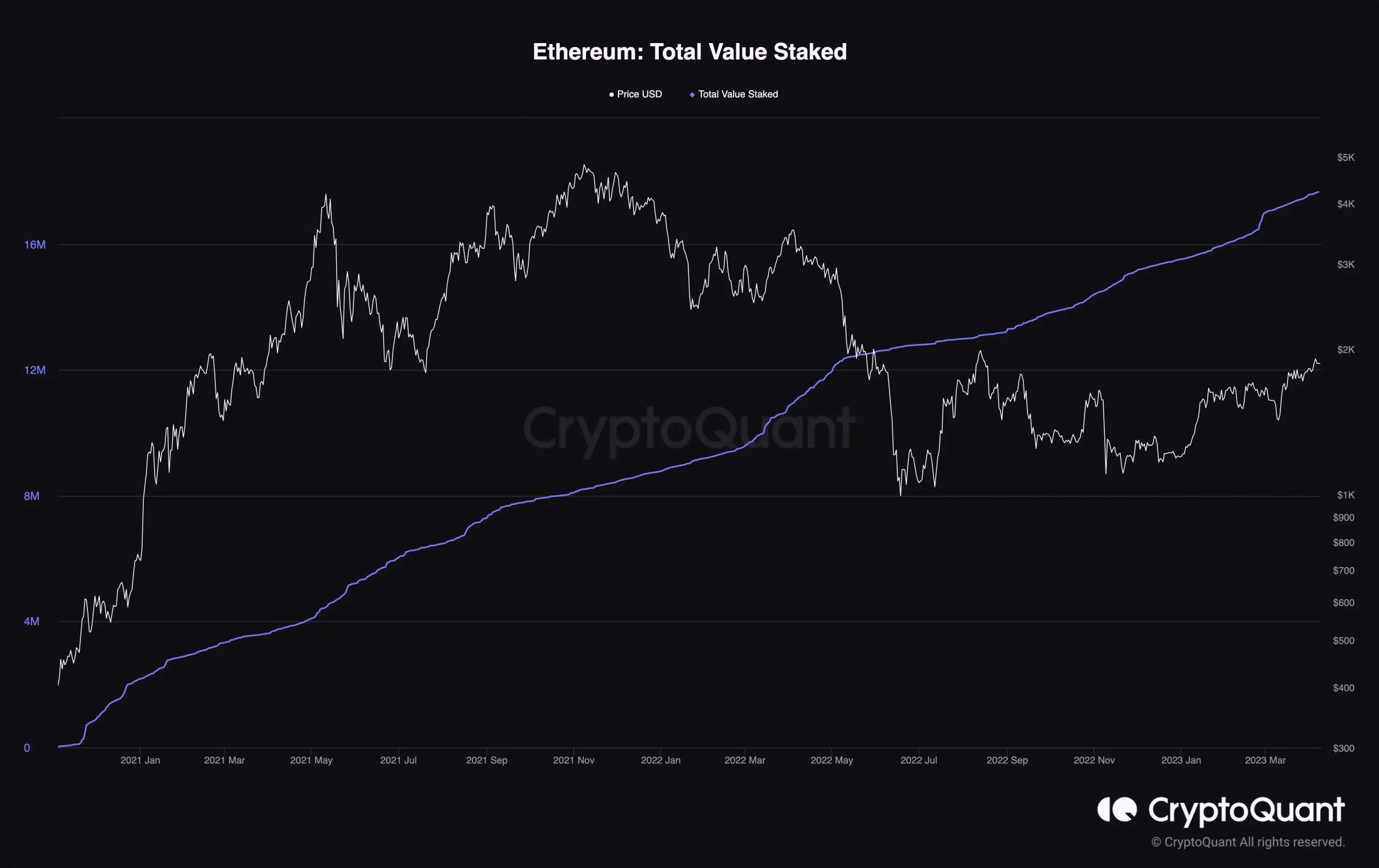

This development is significant as staked Ether accounts for roughly one-seventh of the total supply of around 16 million coins.

Over half of the staked ETH is currently operating at a loss, and the Lido pool has a substantial portion of deposits underwater.

Given this situation, CryptoQuant predicts that the selling pressure may be less than anticipated, assuming that holders may prefer to wait for a price rebound before liquidating their assets.

1 reason why we still think ETH selling pressure will be lower than expected after the Shanghai Update

– Profit and Loss Analysis

??— CryptoQuant.com (@cryptoquant_com) April 5, 2023

The divergence between exchange and non-exchange addresses may signal a rise in demand for ETH, and the Shapella upgrade is expected to have an impact on the Ethereum ecosystem.

? When splitting the largest #Ethereum addresses into exchange vs. non-exchange addresses, we can see them moving in opposite directions. The 10 largest exchange addresses are near #AllTimeLow levels, while the 10 largest non-exchanges continue ascending. https://t.co/fBBQSErETL pic.twitter.com/Xc0CdNITYF

— Santiment (@santimentfeed) April 6, 2023

Ethereum Price

Ethereum’s price could potentially rise beyond the $1,940 horizontal resistance level, reaching resistance levels of $2,440 and $3,400.

It is more likely that the 0.382 and 0.5 Fib retracement resistance levels will correspond to a local top, especially the former, as it aligns with the previous channel’s resistance line.

At the time of writing, ETH is trading at $1,866 after gaining 2.5% on the weekly chart.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur