Ethereum Staking Sees Record Weekly Inflows Worth Over $1 Billion – What Next for the Ether (ETH) Price?

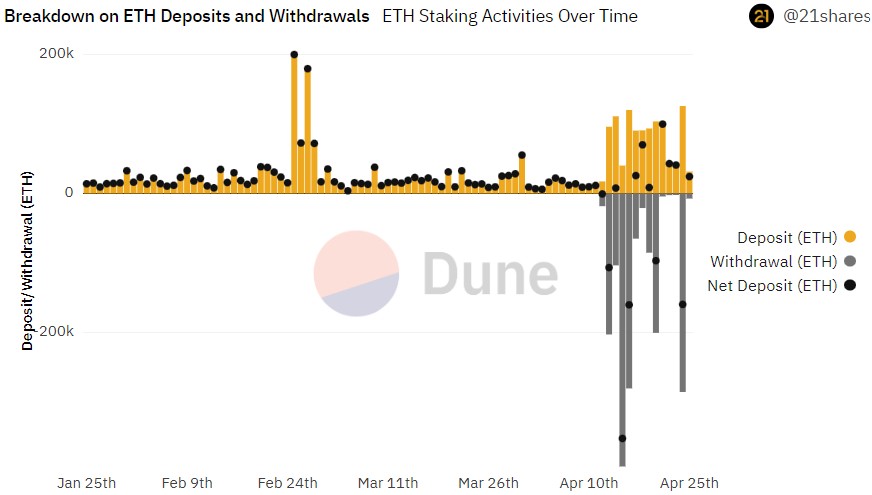

In a record week for Ethereum staking, investors moved over 570,000 Ether (ETH) tokens into the blockchain’s staking smart contract last week, according to a Dune analytics dashboard.

That’s over $1 billion worth of Ether tokens and marked the fastest weekly pace of ETH deposits into the staking contract ever.

According to the dashboard, investors requested the withdrawal of around 380,000 ETH tokens last week, worth close to $700 million at current market prices.

That marks a sharp drop off in the withdrawal requests from the week.

In the first five days after staked Ether token withdrawals were enabled by the successful implementation of the so-called “Shapella” upgrade to the Ethereum blockchain on the 12 of April, withdrawal requests reached a staggering roughly 1 million ETH tokens.

Indeed, since staked ETH withdrawal requests were enabled just under two weeks ago, withdrawal requests have exceeded new deposits by over 550,000 ETH, worth close to $1 billion at the current market price.

However, thanks to a 50,400 per day limit on actual Ether token withdrawals (other ETH withdrawal requests enter a queue) and to the surge in deposits (which enter into the staking contract instantly), the total number of staked ETH tokens has shot up since the implementation of the Shapella upgrade.

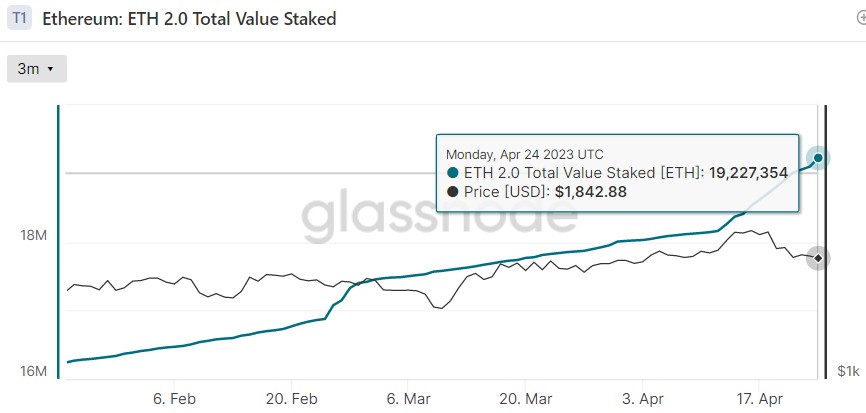

According to on-chain analytics firm Glassnode, the total number of ETH tokens staked was last at 19.227 million, up over 1.1 million since the 11th of April.

Assuming that investors continue to deposit ETH into the staking contract at a faster rate than the 50,400 ETH withdrawal limit, which has largely been the case in the last two weeks, then this number should continue to rise.

Indeed, added flexibility to the ETH staking process, which analysts say drastically reduces investor risk, is expected to entice large sums of ETH into the staking contract in the coming months and years.

Rival proof-of-stake layer-1 protocols like Cardano have staking participation rates in the region of 60-70%.

Given the total ETH supply of 120.4 million, the staked Ether current participation rate is only around 15.9%.

The limit on daily staked ETH withdrawals might deter some ETH investors given there isn’t total flexibility regarding ETH staking.

But this participation rate is still expected to rise substantially and could hit the 40-50% at some point.

That means that there could soon be between 50-60 ETH tokens in the staking contract, a drastic reduction in the readily available supply on unstaked ETH.

This, alongside Ether’s deflationary tokenomics (thanks to a transaction fee burn mechanism), means that the Ether price looks set to benefit from substantial deflationary tailwinds in the coming years.

Where Next for the ETH Price?

Post-Shapella upgrade optimism that sent ETH/USD to new 11-month highs in the mid-$2,100s proved short-lived, with ETH having since pulled back to trade more in line with its early April levels in the $1,800-$1,900s.

Indeed, Ether snapped a key short-term uptrend midway through last week, prompting calls for a retest of key downside support levels, such as the resistance-turned-support zone around $1,700.

However, ETH’s strong rebound from its 50-Day Moving Average on Tuesday could be an early sign that the latest short-term market correction is done.

ETH/USD saw a similar short-term correction to the 50DMA then recovery to new highs in mid-February.

Short-term bulls may well have their sights set on a retest of annual highs, though major upcoming macro risk events such as this week’s US GDP and inflation reports followed by next week’s Fed meeting, jobs and ISM survey data could throw a spanner in the works, if they deliver a meaningful shift to the macro narrative.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond