Ethereum Tests $2,000 For The First Time in 74 Days, Here’s What’s Next (ETH Price Analysis)

The bulls have been in control of the market for more than a month. They have managed to push the price by more than 100%. The majority of this rally has been without a considerable correction, begging the question if one is pending following the test of the critical $2K level.

Technical Analysis

By Grizzly

The Daily Chart

Buyers still dominate the market and push the price up. They were able to return to the $2,000 level after 74 days.

In the meantime, a critical resistance zone is blocking Ethereum. It is formed as a result of meeting the horizontal resistance in the $2200-2300 range (in red), the descending line resistance (in yellow), and the 200-day moving average (in white). A close above this zone can extend the rally to $2,700.

On the other hand, the Relative Strength Index (RSI) has reached above 70, which can be a warning sign. If Ethereum performs similarly to April 2022 and November 2021, it will likely take a break by touching/before touching the resistance zone. In this case, it can be expected that $1700-$1800 will be retested.

Key Support Levels: $1800 & $1500

Key Resistance Levels: $2160 & $2300

Daily Moving Averages:

MA20: $1705

MA50: $1436

MA100: $1600

MA200: $2258

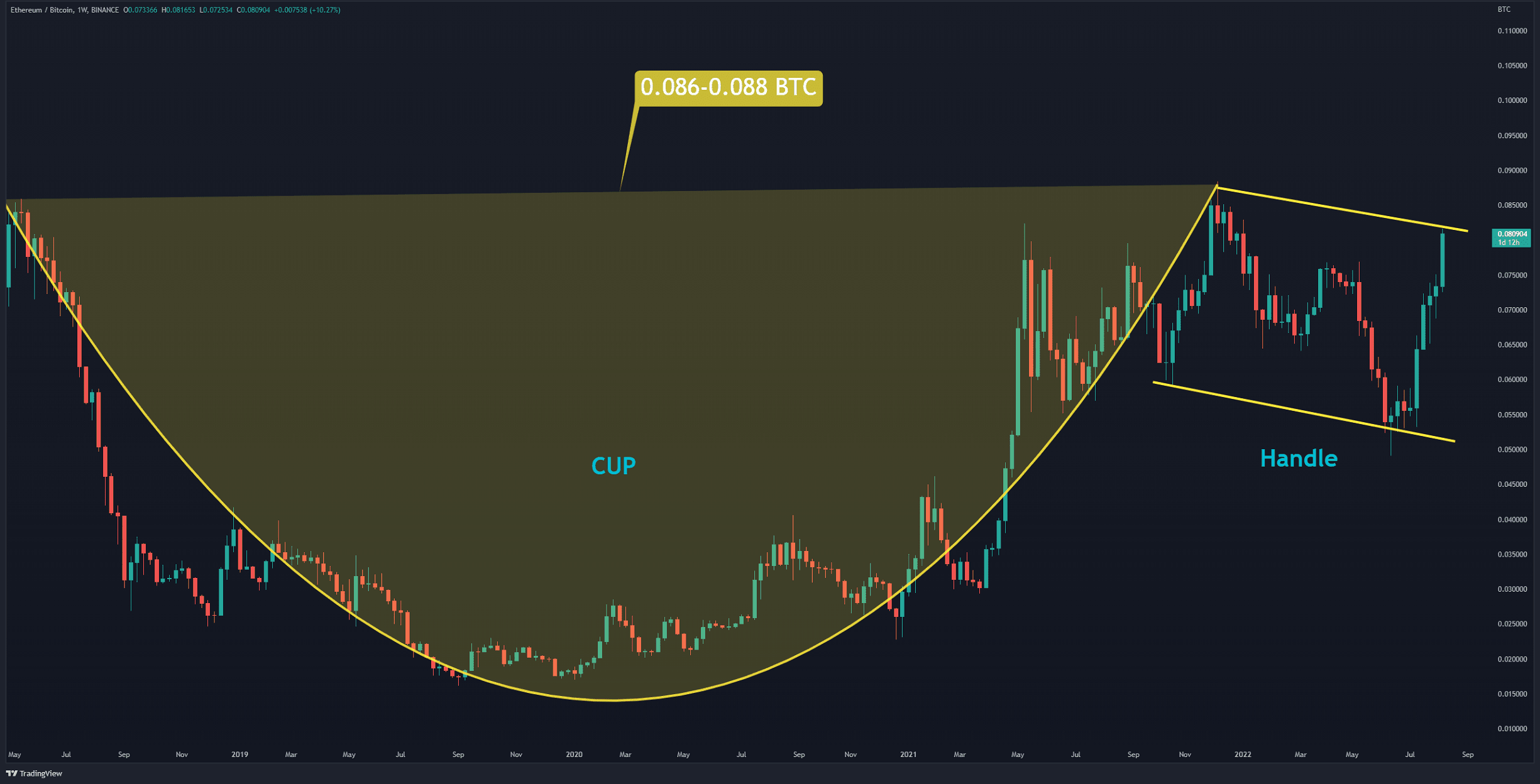

The ETH/BTC Chart

Against Bitcoin, the price is forming a cup and handle pattern (in yellow). The top of this pattern is in the range of 0.086 to 0.088 BTC. If the bulls can flip this level, it signals a bullish rally. Such a move can push ETH up to the target of 0.16 BTC. As long as the Ethereum fluctuates above 0.07 BTC, the bullish structure remains strong.

Key Support Levels: 0.0.75 & 0.07 BTC

Key Resistance Levels: 0.083 & 0.088 BTC

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur