Ethereum Transaction Fees Drop: Network Cools After a Busy Month

The average transaction fee for Ethereum (ETH) has declined to $7.34 from $20 at the height of last month’s meme coin frenzy.

Decentralized exchange (DEX) volumes partially drove the surge in Ethereum fees while traders waited for centralized exchange listings.

DEX Meme Coin Volumes Drove Ethereum Fees in May

Uniswap recorded higher trading volumes than Coinbase in the first week of May. The decentralized exchange saw $1.2 billion compared with $948 million on Coinbase.

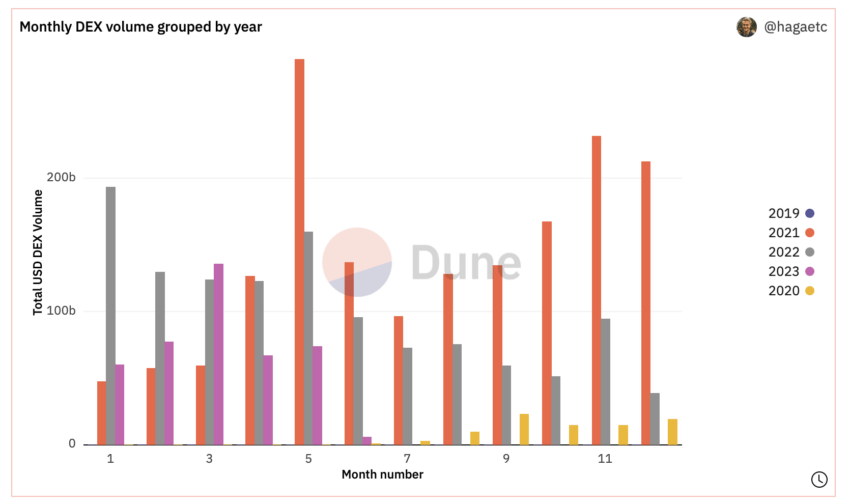

Combined DEX volumes rose to $74 billion in May from $67 billion the previous month, according to hagaetc’s Dune Analytics DEX volume dashboard.

Monthly DEX Volumes | Source: Dune Analytics

The top 10 meme coins driving the rise in gas fees included wrapped ETH, Tether, TROLL, APED, and BOBO.

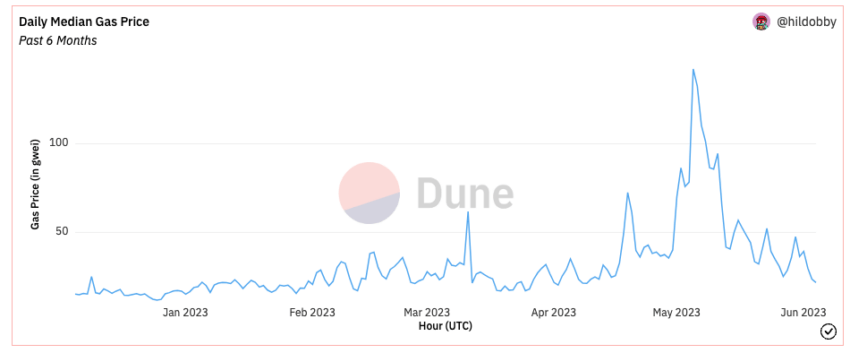

Gas prices rise during times of increased activity on the Ethereum blockchain. Maximum-Extractable Trading Value bots also contributed to the rise last month.

Most of the meme coin transaction activity occurred on Layer 2 networks Arbitrum, Optimism, and Polygon.

So-called Layer 2 blockchains attempt to reduce gas fees by performing computations off the main chain. Ethereum co-founder Vitalik Buterin alerted the community to bugs in the largest Layer 2s that could force validators to fork the main network.

Since the May peak, the daily median price of gas in gwei, or one billionth of 1 ETH, fell from 142 in May to 22 in June at press time.

Daily Median Ethereum Gas Prices | Source: Dune Analytics

Ethereum’s recent Shapella upgrade enabled withdrawals of ETH locked in a vesting contract on the Beacon Chain. Locked ETH entitles validators to a share of the rewards earned for securing the network.

Network activity after the upgrade resulted in more staking than withdrawals.

Dencun Will Improve Throughput Through Blob Transactions

Imminent Ethereum upgrades will include groundwork for increased transaction throughput.

The Dencun revision will implement the logic for a new transaction type with an extra “blob” of data that costs less than a similar amount of call data.

This “proto-danksharding” upgrade indirectly reduces gas fees by stacking a predetermined number of blob-carrying transactions in a single block.

A multidimensional fee market will vary transactions for blob-carrying transactions based on supply and demand. Blob data is only visible to the Beacon chain consensus layer and is deleted after thirty days.

Ethereum developer Dankrad Feist tested the number of blobs per block on Ethereum’s mainnet. He recommended the specifcation change to increase the number of blobs per block target to three to six, up from two to four.

Developers expect Dencun to roll out in the second half of 2023.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur