Ethereum’s (ETH) Price Rally Set To Persist, On-Chain Data Shows

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has regained its bullish momentum and is continuing its bull run. The cryptocurrency has managed to break multiple significant resistance levels since rebounding from the $1,000 area in November 2022, signaling a potential upward trend in the market.

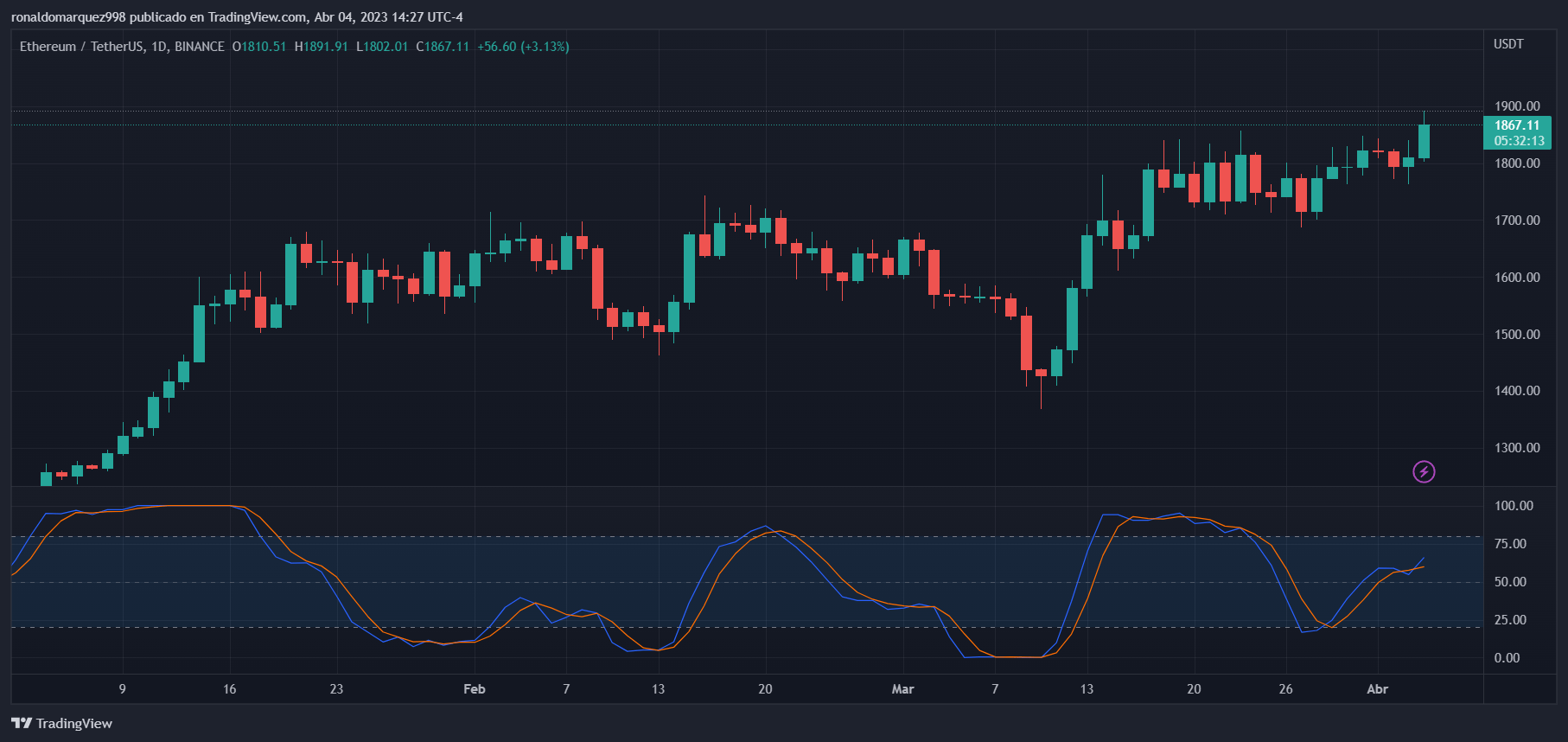

Ethereum is trading just below the $1900 mark, representing uncharted territory since August 2022. Despite breaking its correlation with Bitcoin, the question remains whether Ethereum can continue its upward trend and reach new yearly highs by surpassing the $2,000 milestone.

Related Reading: Bitcoin Indicators Points To Imminent Resistance Break, Study Shows

Will Ethereum Maintain Its Bullish Trend?

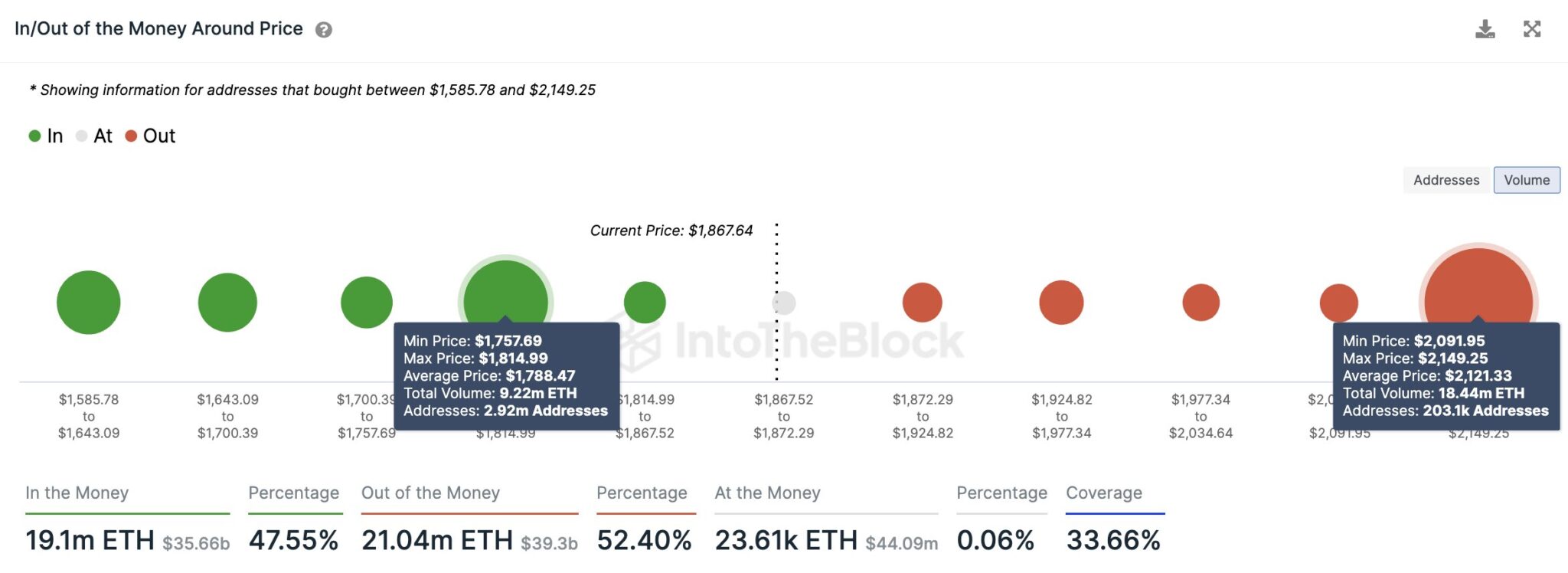

According to a recent Twitter post by crypto analyst and trader Ali Martinez, on-chain data reveals a potential breakout above the $1,900 level. According to Martinez, the next critical resistance area for Ethereum is between $2,100 and $2,150.

In addition, over 200,000 addresses had purchased over 18 million ETH at the $2,100-$2,150 level, as seen in the chart above, making it a crucial resistance area for Ethereum’s price action in the mid-term.

However, if Ethereum can maintain its momentum and surpass this resistance level to establish it as support. In that case, the cryptocurrency is well-positioned to reach new yearly highs and potentially consolidate above the $2,000 mark, further solidifying its upward trend.

2019 Fractal Mirrors Bullish Pattern For ETH

Another interesting trend has emerged in Ethereum’s price action, dating back to its diagonal breakout in 2019. Crypto Analyst under the pseudonym “Woetoe” has identified a blue fractal in ETH’s charts that could offer valuable insights into the cryptocurrency’s future price movements.

According to Woetoe’s fractal, Ethereum could potentially experience a significant uptrend shortly. This prediction is bolstered by the upcoming Shappella upgrade, represented by the vertical red line, which could further drive Ethereum’s price upwards.

In addition to its recent surge, Ethereum has also seen a high rate of liquidations, with approximately $30 million worth occurring within just 24 hours at the $1,880 level, as Glassnode data shows.

It is now crucial for ETH to maintain its current level as a support and potentially consolidate above the $1,900 mark. However, if Ethereum fails to consolidate at this level, it is likely that a healthy pullback will occur, potentially pushing its price action toward the $1,830 mark.

As of this writing, Ethereum is trading at $1,867, reflecting a gain of more than 2% over the last 24 hours. The cryptocurrency has posted significant gains in wider time frames, with 8.5% and 7% profits in the seven-day and fourteen-day periods, respectively.

Related Reading: Dogecoin Price Forms A Falling Wedge Pattern, Can Price Touch $0.11?

Featured image from Unsplash, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur