Ethereum’s pending withdrawals top $3 billion after ‘bullish event,’ Shapella

Ethereum’s total pending withdrawals — the amount of ether confirmed to withdraw, including rewards — has surpassed $3 billion following the network’s high-profile Shapella upgrade.

1.48 million ether, worth $3.10 billion, is currently pending withdrawal, according to data-tracking website token.unlocks.

The estimated amount of ether dollar value available to users daily is $1.07 billion, with an estimated 257,340 ether ($536.95 million) estimated to be withdrawn over the next 11 hours.

Alongside a growing withdrawal queue, the price of ether has — against the expectations of some analysts and short sellers — increased following Shapella’s implementation. Ethereum’s native coin is currently changing hands just below $2100.

The price of ether has increased over the past week. Source: TradingView

How much ether is still staked?

The total amount of ether currently staked, excluding earned rewards, amounts to 17.23 million coins — worth $35.95 billion — and accounts for 15.34% of the total supply.

The net staking balance from yesterday — calculated by subtracting the total amount of ether withdrawn from the amount of ether deposited — is roughly -103,600 ETH (-$204.04 million). Approximately 201,840 ether has been withdrawn, while roughly 98,240 ether has been deposited.

The net staking balance since the Shanghai hard fork is a similar -112,110 ETH (-$228.72 million) — with 325,900 coins withdrawn and 213,790 coins deposited.

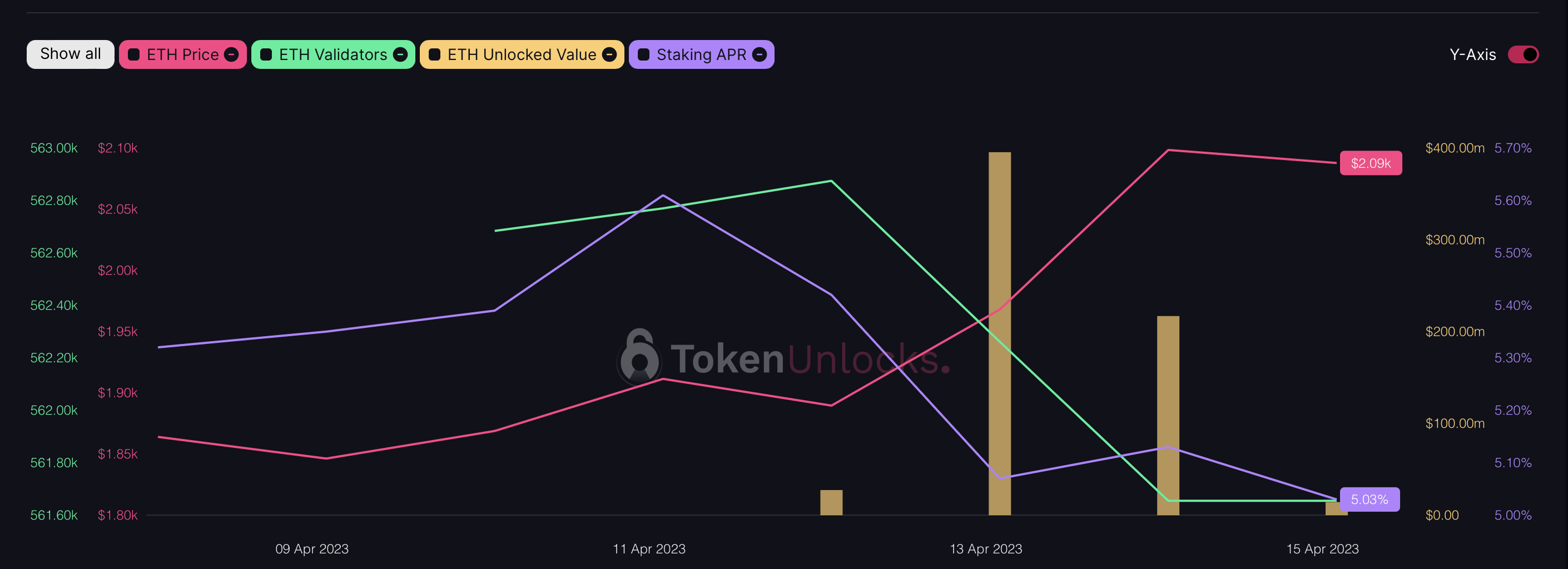

The price of ether increased while ETH validators and staking APR decreased. Source: token.unlocks.app

Kraken leading ether withdrawals

The most prominent withdrawal of staked ether may be attributed to the centralized exchange Kraken, which initiated withdrawals exceeding 551,000 ETH (valued at more than $1 billion).

Kraken’s unstaking activities were motivated by the resolution of charges imposed by the U.S. Securities and Exchange Commission, accusing Kraken of not registering its staking program in the United States. Kraken consented to pay a $30 million penalty to settle these charges.

Other centralized exchanges, such as Coinbase and Binance, have also opened up Ethereum unstaking withdrawals.

Conversely, a peer-to-peer staking pool recently deposited close to 50,200 ether.

‘A bullish event for Ethereum’

The withdrawal of staked ether has, so far, been slower than expected, according to Grayscale’s Matt Maximo and Michael Zhao.

«Although withdrawals might continue to grow in the near term, withdrawals do not necessarily signal selling, as users could be rotating validators or switching to staking providers that offer higher yields,» the analysts wrote.

«We believe that the short-term price impact from the Shanghai upgrade will be less severe than initially anticipated, attributable to the lower number of ETH withdrawals and full exits,» they added, while concluding: «Looking ahead, we think this is a bullish event for Ethereum, as reducing staking risks could boost the baseline demand for ETH.»

What is Ethereum’s Shapella?

The Shapella update for Ethereum, which is the first significant modification since the protocol shifted to a proof-of-stake consensus mechanism with last year’s Merge, was activated shortly before 6:30 p.m. EDT on April 12 at block height 6209536.

By implementing Ethereum Improvement Proposal 4895, the Shapella hard fork enables users and validators to withdraw their staked ether.

Furthermore, the Shapella update enhances the efficiency of Ethereum gas fees for specific transactions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond