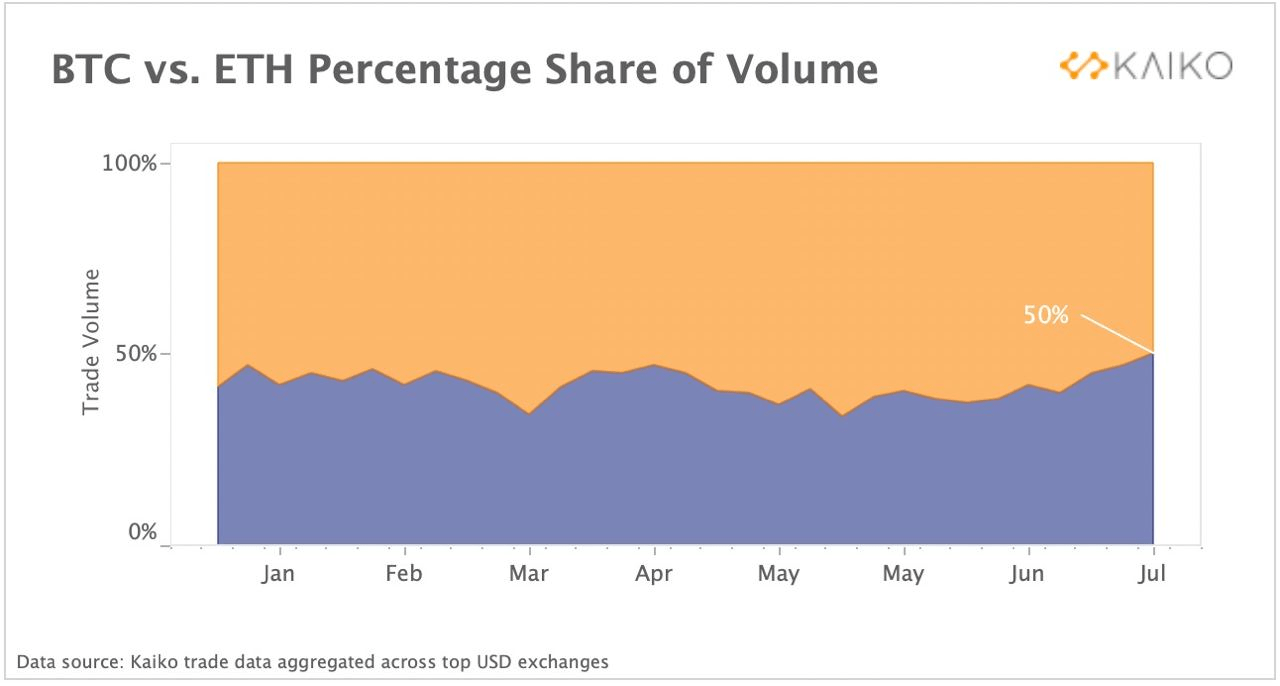

Ethereum’s trading volume hits 50% parity with BTC for first time in 2022

After the surge in prices over the last month, the cryptocurrency sector finally reclaimed the $1 trillion market capitalization with the two largest assets by market capitalization Bitcoin (BTC) and Ethereum (ETH) leading the rally.

Moreover, ETH’s market share of trade volume achieved 50% parity with Bitcoin’s for the first time in 2022, as published by Kaiko on August 1. While its market value of around $210 billion is still half the size of the world’s biggest cryptocurrency.

As Kaiko reported, ETH outperformed Bitcoin in July due to strong inflows in spot and derivative markets. This spike has been noted across most exchanges possibly indicating a return of investors. Further, an increase in the average trade size is the exact opposite of what has been witnessed in the downtrend so far in 2022.

Bullish ETH

As previously reported by Finbold, the origin of Ethereum’s bullishness is rooted in the latest update on the Merge upgrade that will see the blockchain transition from the Proof-of-Work (PoW) protocol to Proof-of-Stake (PoS).

In other words, the announced software upgrade enables a move from the current system of using miners to a more energy-efficient one using staked coins.

Furthermore, ETH overtook BTC in the options market for the first time in history on August 2, with open interest (OI) of Deribit Ether options valued at $5.6 billion, exceeding the OI of Bitcoin valued at $4.6 billion by 32%.

As for Bitcoin

Currently, BTC is testing newly-won support levels influenced by geopolitical uncertainty. Although it is considered that the most prominent cryptocurrency has reacted well to the Fed’s latest policy, uneasiness over the current situation between the US U.S. and China regarding the visit of House Speaker Nancy Pelosi to Taiwan is reflected in the market.

At the time of writing, BTC is trading $22.800, down in value 2.49% in the last 24 hours. This loss comes even as tech stocks traded up this morning, which crypto tends to follow.

Bitcoin’s current price behavior makes it difficult to anticipate what will happen in the near future since it appears to be participating in a short-lived bear market bounce.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Basic Attention

Basic Attention  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  Ren

Ren