Euphoria Turns Into Fear, Bitcoin Retraces From $25,000 High

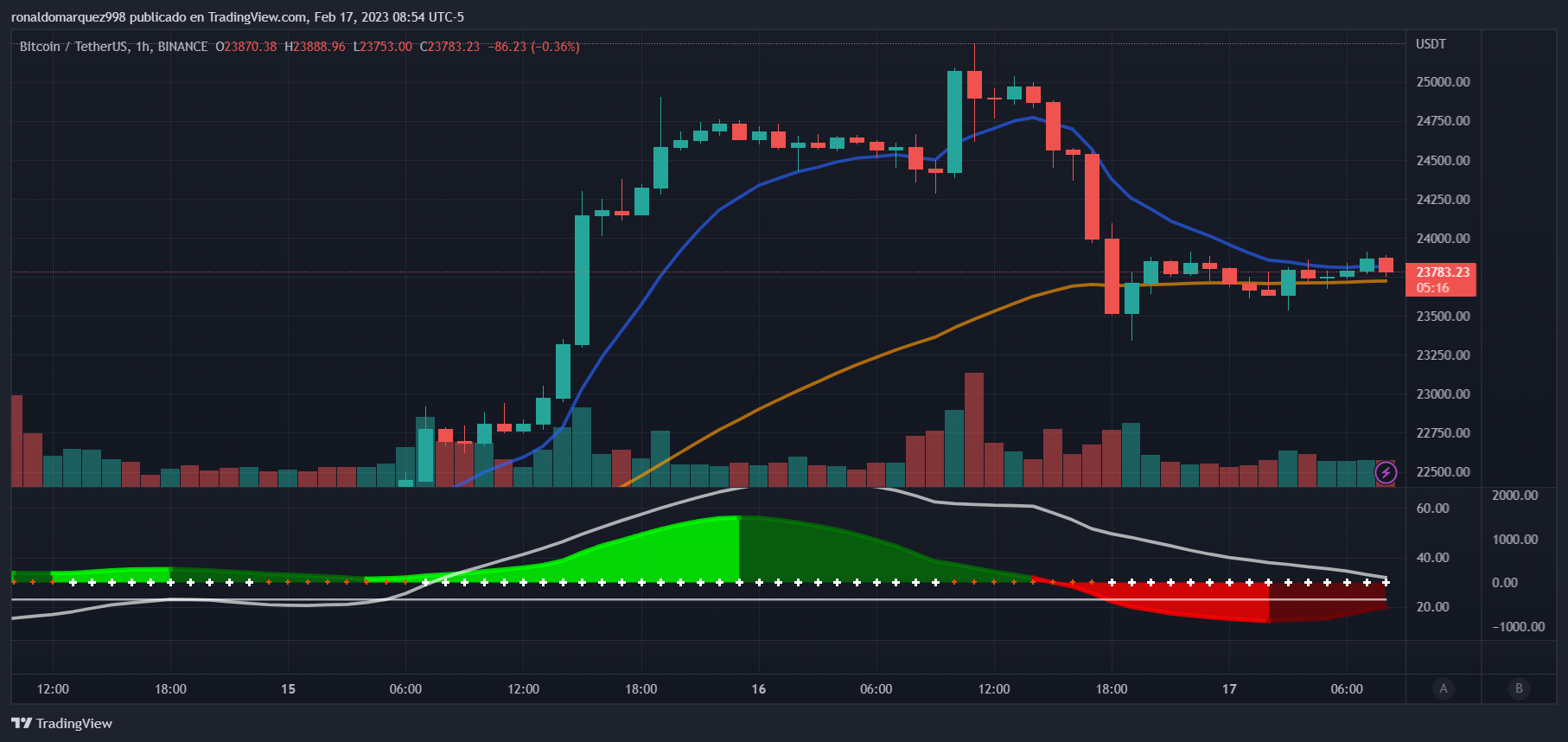

Bitcoin began the week climbing to its highest level in 2023. Against all odds, the largest cryptocurrency on the market reclaimed the $25,000 level for the first time since August 2022, only to be rejected hours after reaching the milestone.

What looked like a full-throttle run to $27,000 has turned into fear. Coinglass data shows that investors experienced Fear of Missing Out (FOMO) liquidations in the last 24 hours, with $69 million liquidated in Bitcoin alone.

Related Reading: Dogecoin Down 3%, Here’s The Metric That Signaled This Decline In Advance

Can Bitcoin Continue Its Bull Run And Reach New Yearly Highs?

With the Federal Reserve’s (Fed) efforts to control the pace of inflation not entirely successful, its policies could lead to another 50 basis points (bps) interest rate hikes and an extended period of the hawkish policy, which would hurt the crypto market.

This could freeze Bitcoin’s uptrend price action and form a range at the $23,500 support line or a significant drop down to the $19,000 support for a retest of the level.

Bitcoin is consolidating at the $23,500 level, representing a 2.5% drop in price over the past 24 hours. However, Bitcoin has remained in the green over the last seven days, with a gain of 9.2% after the recent spike to $25,000.

The billionaire and Co-founder of the Gemini exchange Cameron Winklevoss, addressed the recent Bitcoin price performance and the spike to $25,000, well above the levels last seen when FTX collapsed.

For Winklevoss, this signals that the crypto industry has moved beyond the painful chapter of the 2022 bear market and that the crypto space will “not be defined by it.”

What Has Caused the Spike In The BTC Price?

The recently increased Securities Exchange Commission (SEC) regulatory actions towards the crypto industry and the exchanges providing services in the U.S. jurisdiction caused capital to flee from the stablecoins into the top cryptocurrencies in the market.

According to Bitazu Capital Co-founder Mohit Sorout, Bitcoin has triggered the Dollar Cost Average (DCA) indicator, which measures the performance of Bitcoin when investing on a dollar-cost averaging basis. Sorout states that this indicator has only flashed three times in the BTC market’s history.

Each time this indicator signal flashed, the price of Bitcoin displayed massive rallies. In 2015, the price of Bitcoin jumped 7400%, in 2019 to 160%, and the last time this indicator flashed, the price of Bitcoin reached its new all-time high of $69,000 with a 640% rally. February 16 marked the 4th time this indicator signaled a possible start of a newly formed bull market.

Some investors attribute the recent rally to a “short squeeze” and the fact that investors are regaining confidence in the crypto industry and the opportunities to make profits amid the current macroeconomic conditions.

Related Reading: Bitcoin Price Gets Rejected At $25,000, But Is This The End?

Bitcoin is trading at $23,800 at press time, testing the $23,500 support line; if it holds, the price action can retest the resistance level at $25,000. Despite the challenges the crypto industry has been experiencing, investors seem optimistic and hungry to gain exposure to risk assets.

Featured Image from Unsplash, chart from TradingView.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur