‘Extreme demand’ for BTC at $20K creating new support levels: Glassnode

“Extreme” demand at the $20,000 price point for Bitcoin (BTC) appears to have forced the coins back into the hands of investors who care less about price while creating a new realized price level.

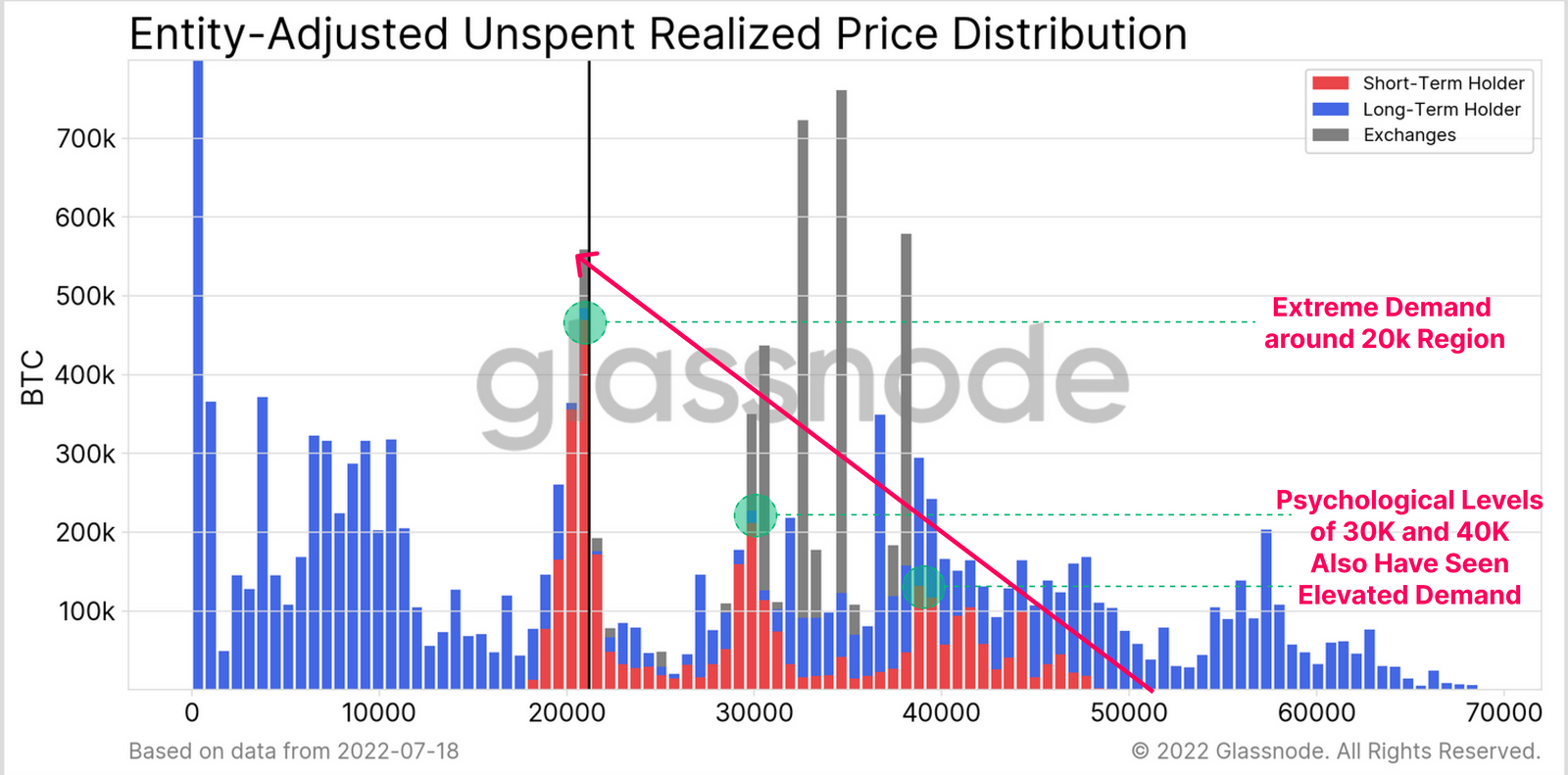

In the latest The Week OnChain Newsletter published on July 25, Glassnode’s UkuriaOC pointed to “extreme demand” around the $20,000 region, noting that at each psychological price level from $40,000 to $30,000 to $20,000 creates a new group of short-term holders (STHs).

The Glassode analyst noted that much of the supply that new STHs bought during that drawdown has not been sold even though prices are significantly down. This may be due to less price sensitive buyers, or those who care more about Bitcoin fundamentals than investment gains, driving demand.

Between late April through June, BTC price has fallen 55% from $40,000 to a low of about $18,100 according to CoinGecko.

Glassnode wrote that this suggests the newly-minted STHs are price insensitive buyers with more confidence in Bitcoin, adding that their conversion from a STH to a long-term holder (LTH) who does not sell for at least 155 days would help confirm this.

“It would be constructive to see these STH held coins at the $40k-$50K level start to mature to LTH status over coming weeks, helping to bolster this argument.”

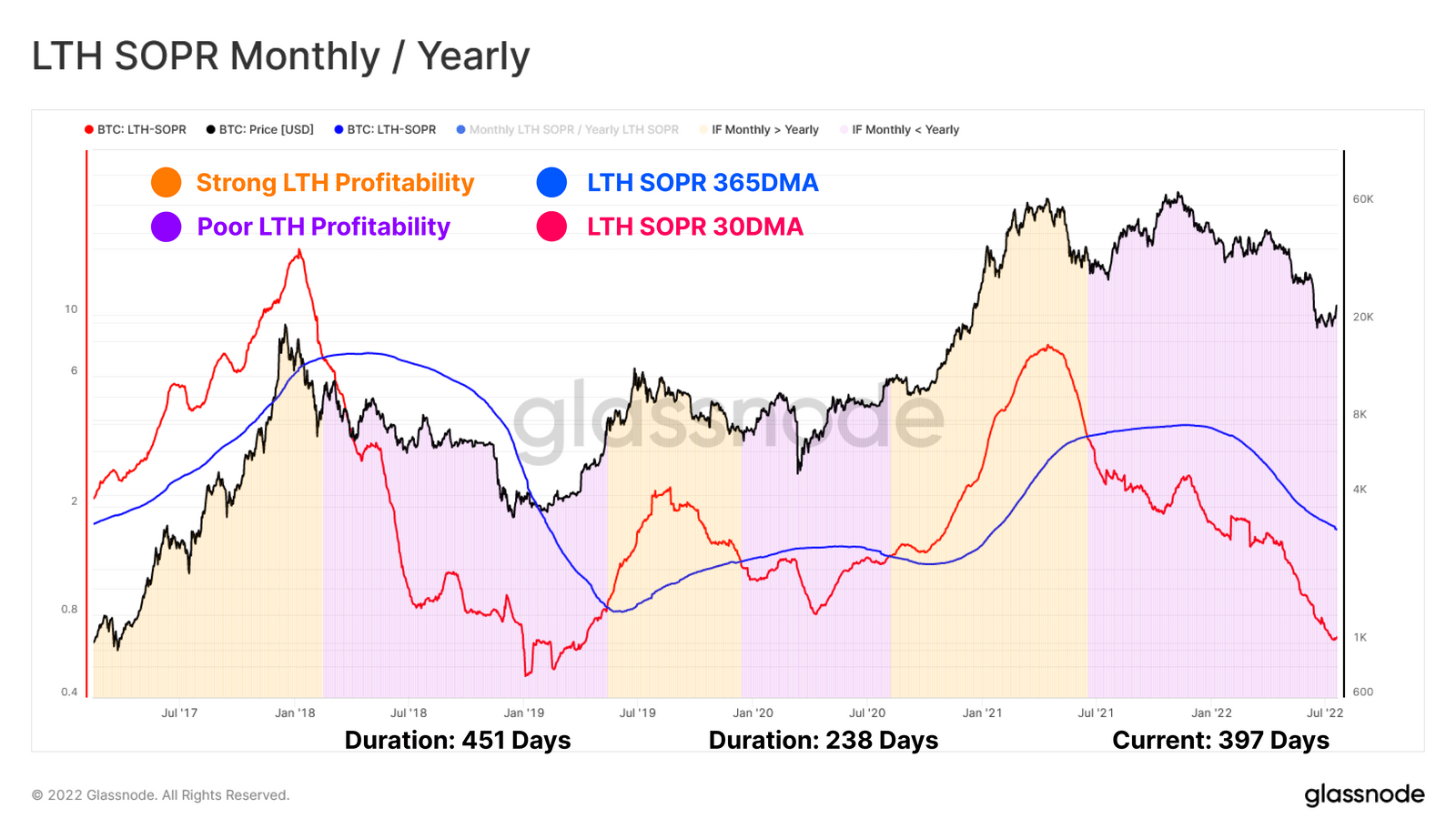

In this current bear market, confirmed LTHs have locked in nearly 400 days straight of yearly profitability performing better than 30-day profitability.

This is nearly the same duration that LTHs experienced during the 2018 bear market. Glassnode wrote that this suggests losses are being locked in by LTHs which, if the previous argument holds, means the new buyers have less price sensitivity than the cohort who sold, meaning they could become the newest group of LTHs.

Another point of note in the report is that “unprecedented forced selling” from crypto companies amid mass liquidations and bankruptcies created conditions ripe for a relief pump.

Related: The battle between crypto bulls and bears shows hope for the future

The report concludes by stating that while the “worst of the capitulation may be over,” BTC could remain in this low range for some time as the cost basis for new coin buyers has diverged below the realized price for only about 17 days straight. Previous bear cycles have endured low divergences between 248 and 575 days.

BTC has retreated 3.1% over the past 24 hours to trade at $21,146 at the time of writing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond