Five key ways The Merge affected the Ethereum blockchain

A month has now passed since The Merge took place, switching Ethereum from a mining-based system to one focused on staking.

The launch went relatively smoothly and no major bugs have yet to emerge. But The Merge did have several significant impacts on the Ethereum blockchain that can be observed — two of which could prove tricky for the network in the long run.

Let’s take a look at some of the ways in which The Merge affected Ethereum.

Ethereum dropped its high energy consumption

The main purpose of The Merge was to change Ethereum’s current proof-of-work consensus mechanism to proof of stake. In doing so, the upgrade made the network far more energy efficient.

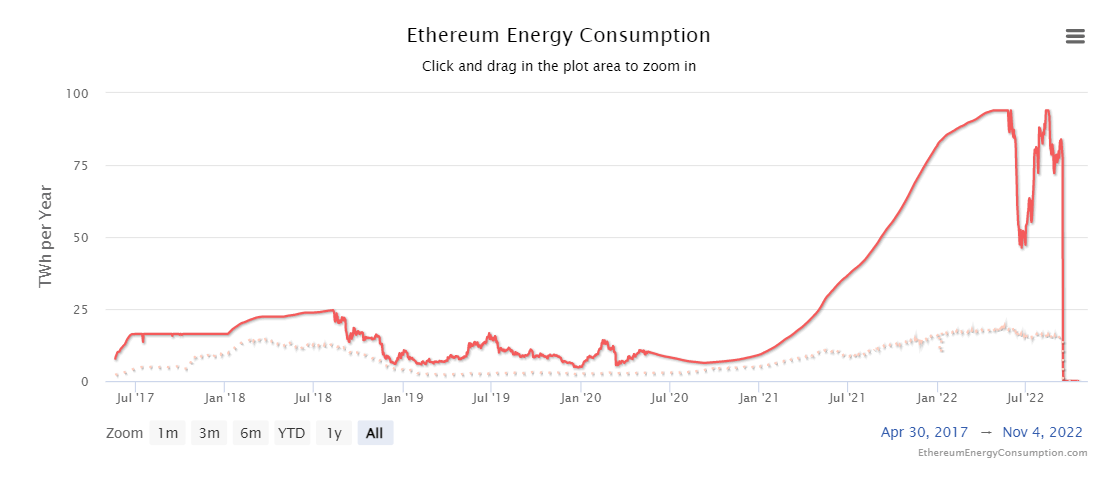

Ethereum energy consumption. Image: Digiconomist

After The Merge, Ethereum’s annual energy consumption fell from 80 TWh to merely 0.01 TWh per year, according to Digiconomist.

Using proof-of-stake, a single Ethereum transaction can be roughly translated to carbon emissions of up to 22 VISA transactions, a substantially lower carbon footprint when compared to its former design.

It’s worth noting that transactions aren’t directly linked to energy use and that this doesn’t include transactions made on Layer 2 networks.

The issuance of new ETH has fallen

After the transition, the amount of new ether being created has dropped by nearly 90%. This is a result of validator rewards being significantly smaller than the miner rewards issued under the old system.

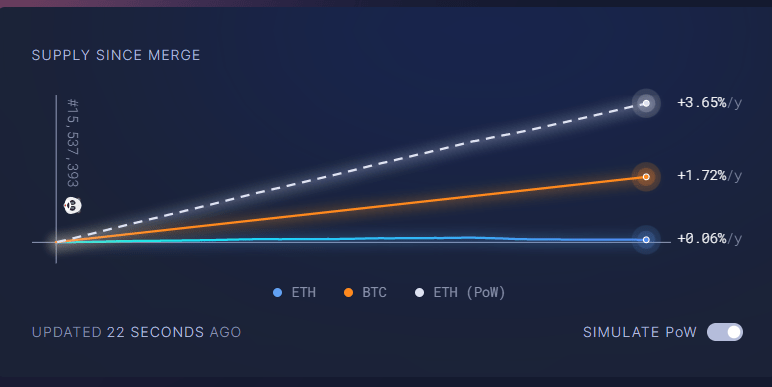

The supply of ether has increased by nearly 6,500 ETH since The Merge; otherwise, the supply would have increased by an estimated 400,000 ETH, according to data tracking site ultrasound.money. Both figures take into account the amount of ETH burned during the transaction fee process.

Ethereum’s supply growth since The Merge. Image: Ultrasound.money

As of now, Ethereum’s supply is still inflationary, with a supply growth rate of 0.06%. If activity on the network rises and more ETH is burned during the transaction fee process, it could become deflationary — where more ETH is destroyed than created each day.

Ethereum validators grew in number

Following The Merge, proof of stake validators are now running the blockchain and are responsible for processing transactions.

A day after The Merge, on Sept.16, Ethereum’s validator participation rate, the metric to see all validators expected to verify blocks, fell off by 3%. This was a temporary bump in the transition as the participation rate returned to its optimum state in a matter of days. The participation rate currently sits at 99.5%, meaning that almost all online validators are processing new blocks.

The number of Ethereum node validators has increased to over 435,000 from nearly 420,000 a month after the Merge, according to data from beaconcha.in. These validators have collectively staked about 13.2 million ether.

A few staking providers have cornered the market

A downside of The Merge is that it has resulted in a handful of staking providers controlling the majority of validators on Ethereum.

Just four providers — Lido and exchanges Coinbase, Binance and Kraken — account for more than 55% of Ethereum’s validator nodes. Lido is different from the others because it is a liquid staking protocol that passes on the validator process to other validators but it still remains a potential point of centralization.

The centralization issue is expected to be at least partially resolved after Ethereum’s next upgrade, called Shanghai, which will let users unstake their tokens from these providers and potentially enable more competition.

Shanghai is slated to take place sometime in the next year.

MEV Boost saw growing adoption amid censorship concerns

After The Merge, Ethereum validators have been increasingly using MEV Boost, a software that enables a marketplace for maximum extractable value (MEV).

This software allows block builders to run what’s called a “relay” that tells Ethereum validators which transactions they should prioritize in block production and receive MEV rewards.

MEV Boost represents a bit of a no-brainer for validators because it results in them making extra rewards, but this service has come with unwanted consequences.

While there are multiple firms that run their relays for MEV Boost, the most widely used relay is offered by Flashbots. Its relay has been censoring transactions, refusing to process any anything connected to mixing protocol Tornado Cash to comply with U.S. Office of Foreign Assets Control (OFAC) sanctions against the decentralized crypto mixer.

Currently, 47% of Ethereum blocks are built using Flashbots.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD