Flamingo to optimize FUSD rewards for borrowers, reduces FLM inflation rate

Flamingo Finance plans to optimize rewards rates in favor of FUSD borrowers to bring the FUSD stablecoin into parity with US $1. Additionally, the FLM token inflation rate has decreased, which took effect at 9:00 a.m. (UTC) on Tuesday, Jan. 17.

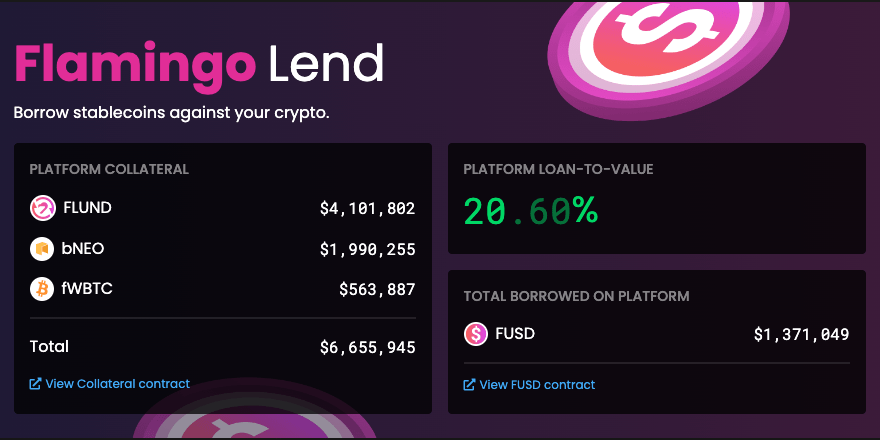

FUSD is an over-collateralized stablecoin backed by FLUND, bNEO, and fWBTC, and can be minted on the Lend module of the Flamingo DeFi platform. Since its Jan. 10 launch, Neo’s new stablecoin has not been able to maintain its peg to $1, trading between $1.02 and $1.10. At the time of press, there is approximately $1.3 million in total FUSD borrowed from Flamingo, with roughly $6.6 million in FLUND, bNEO, and fWBTC backing the token.

Source: Flamingo Finance

The Flamingo team currently theorizes that the reasoning for the price differentiation is that more people are purchasing FUSD on the market than are minting the stablecoin backed by other ecosystem assets. As the total supply for the FUSD token is currently low, the free market pressure is increasing the token’s price to meet the demand. To address the disparity between the target price for the stablecoin and its current value, Flamingo intends to change the incentive structure, and has identified two primary FUSD token holders: buyers and borrowers.

When minting FUSD, a borrower must take out an over-collateralized loan and maintain its loan-to-value ratio to avoid liquidation. If the LTV gets too high, the protocol can exit a user’s position and claim all the underlying collateral used to mint FUSD. The potential for liquidation increases the necessity for active monitoring as rapid price fluctuations in cryptocurrency markets can quickly impact a loan’s health. The debtor may need to add more collateral to keep a loan in good standing if the market value of its underlying assets drastically decreases.

Conversely, a buyer can purchase spot FUSD on the market, removing the need to actively monitor markets as a borrower does.

Normal and Borrower Rewards

To address the inequities between the two types of FUSD users, Flamingo intends to introduce new rewards pools: normal rewards and borrowers’ rewards.

Normal rewards will be distributed to anyone that contributes to one of the four liquidity pools using FUSD as a pair (i.e., FLM/FUSD, fWBTC/FUSD, bNEO/FUSD, and fUSDT/FUSD). The Flamingo team estimates that 20% – 25% of the current FLM minting rewards will go to these FUSD users.

The remaining 75% – 80% of FLM rewards will be distributed to users who have both borrowed FUSD against their FLUND, bNEO, or fWBTC assets and contributed to any of the four FUSD LPs.

Looking forward, the Flamingo team intends to share the algorithm that will distribute these rewards and the exact rewards figures. The new rewards distribution will hopefully incentivize more users to mint FUSD and increase the floating liquidity of the stablecoin. In the announcement, Flamingo noted, “It will make it more attractive to lend FUSD, building up the supply of FUSD so Flamingo can handle adding extra utility for FUSD without the token’s price going up.”

FLM Token Inflation Rate Reduction

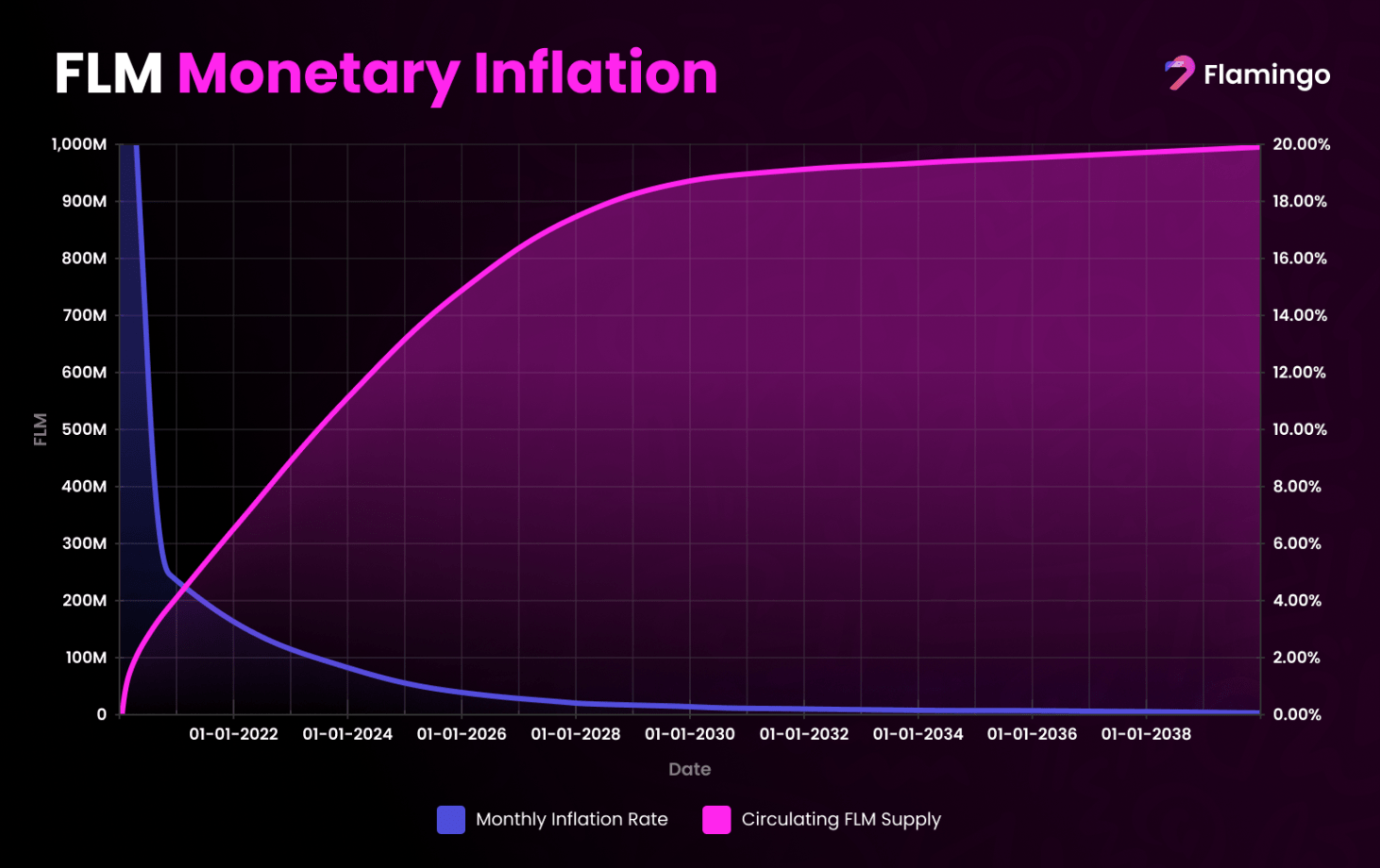

The Flamingo team is also decreasing the FLM token inflation rate from 2.55% to 2.34%. FLM is released through a pre-defined minting function, with the tokens distributed to the market as rewards for participating on the Flamingo DeFi platform. The inflation rates represent the amount of FLM released annually divided by the current circulating supply. Over time, FLM mint rates will decrease as the circulating supply increases, as shown in the image below.

Source: Flamingo Finance

At the time of press, the Flamingo Discord server stats show that the total circulating supply is approximately 437.5 million FLM tokens. At a hard-capped supply of 1 billion, the remaining FLM will be released over the next 16 years.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Zcash

Zcash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur