Following a 30% Drop in 2 Weeks, Where’s the Bottom for ETH? (Ethereum Price Analysis)

Any optimism for a rally is fading quickly as the Merge upgrade date approaches. Two weekly candles closed in red, warning of the formation of a bearish structure. Ethereum lost approximately 30% of its value over that period.

Technical Analysis

By Grizzly

The Daily Chart

Ethereum is forming a lower low on the daily chart. The structure, followed by the formation of lower highs and lower lows, can be the precursor of continuous declines. So far, the bears managed to erase the 50% increase from July (in yellow).

Let’s assume that the DXY index, which has just broken the last high, continues its upward trend. In this case, Ethereum is likely to test the horizontal support at $1,300 in the short term, which intersects with the 61.8% Fib golden level (in green).

The end of the downward trend could come only if the price forms a higher high and higher low. Until then, the bearish bias remains strong.

Key Support Levels: $1450 & $1300

Key Resistance Levels: $1600 & $1750

Daily Moving Averages:

MA20: $1719

MA50: $1602

MA100: $1521

MA200: $2166

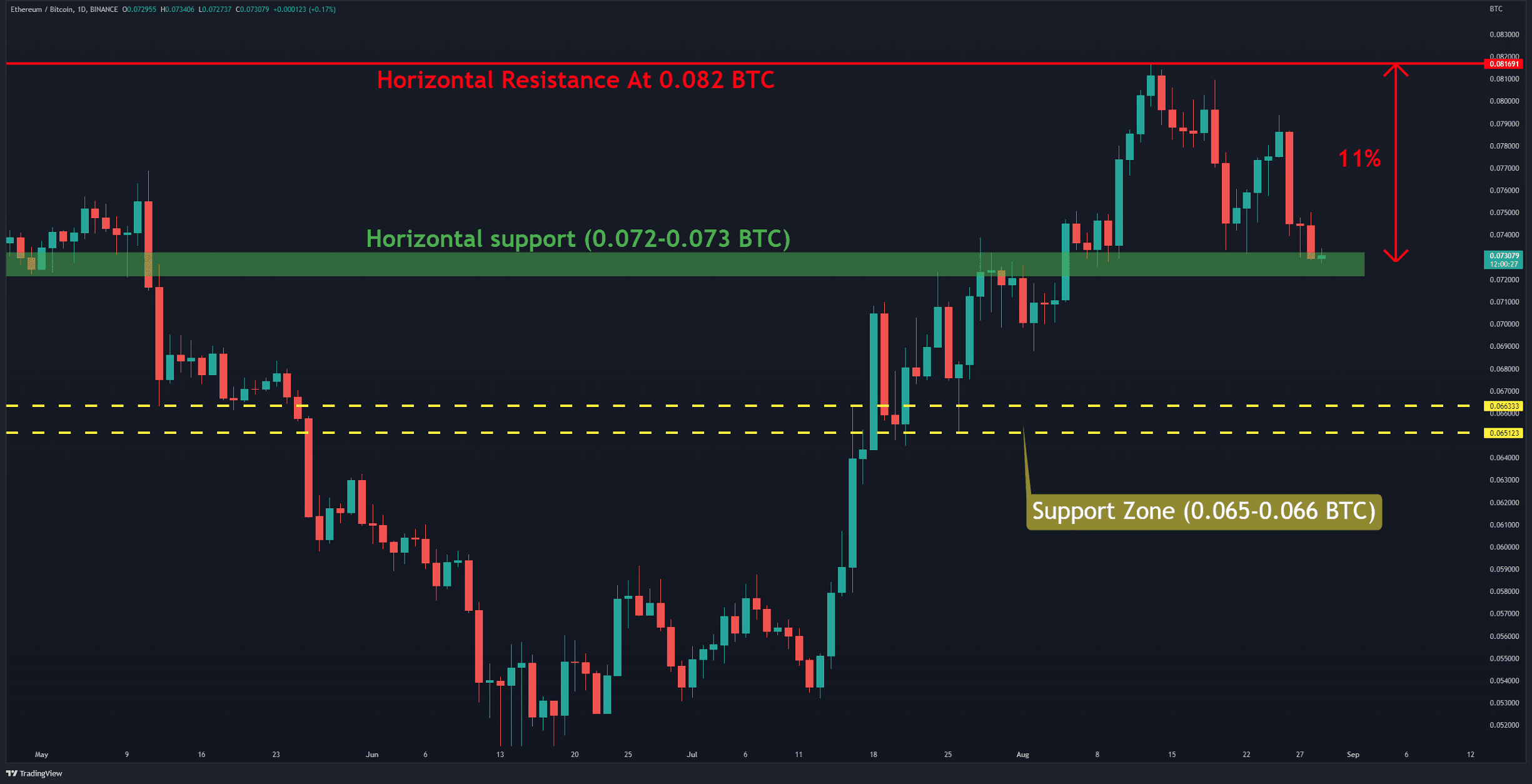

The ETH/BTC Chart

Against Bitcoin, the bears pushed the price down 11% in the last two weeks as attempts to retest the horizontal resistance at 0.082 BTC (in red) had little effect. The pair is currently trading near horizontal support in the 0.072-0.073 BTC range (in green). A close and break below this level could trigger the start of a corrective wave. The target of such movement is considered in the range of 0.065-0.066 BTC (in yellow).

Key Support Levels: 0.0.073 & 0.065 BTC

Key Resistance Levels: 0.083 & 0.088 BTC

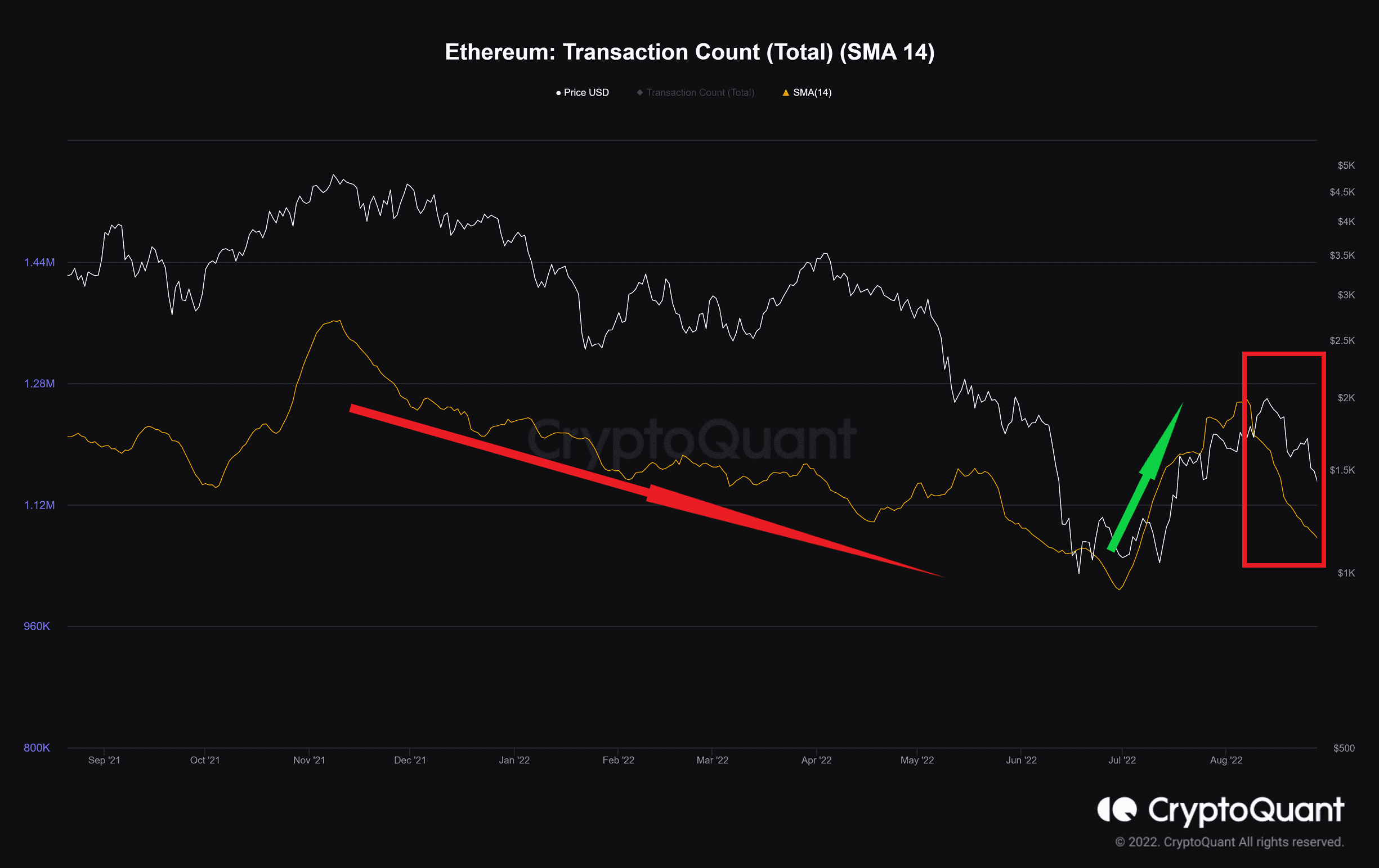

On-chain Analysis

Transaction Count (SMA 30)

Definition: The total number of transactions where the transfer of tokens has been executed.

The number of transactions on the network, which had an utterly downward trend since the all-time high, increased sharply during the recent bullish leg. This was likely due to recently released news about the Merge.

Interestingly, before the start of the current correction, this index dropped. This can often be considered a warning for an incoming drop.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Qtum

Qtum  Synthetix

Synthetix  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur