FTX Token Declared a Security, Does it Set a Dangerous Precedent for the Binance Coin?

The US SEC has called FTX Token (FTT) a security. Does it set a dangerous precedent for the Binance Coin (BNB)?

The Securities and Exchange Commission (SEC), in a complaint against Alameda Research CEO Caroline Ellison and the co-founder of FTX Gary Wang, has claimed FTT as a security. Caroline Ellison and Gary Wang pleaded guilty on Wednesday, Dec. 21, according to the U.S. attorney for the Southern District of New York.

FTX Token, a Security

The SEC referred FTT sale as a security in the 38-page complaint filed by the SEC to the U.S. District Court Southern District of New York. The SEC claims that “From the time of its offering, FTT was offered and sold as an investment contract and therefore a security.”

The complaint makes bold claims that “The FTT materials made clear that FTX’s core management team’s efforts would drive the growth and ultimate success of FTX,”

Miles Deutscher, the renowned crypto analyst, believes that this move from the SEC “could set a dangerous precedent for other tokens.”

Binance Coin in Trouble?

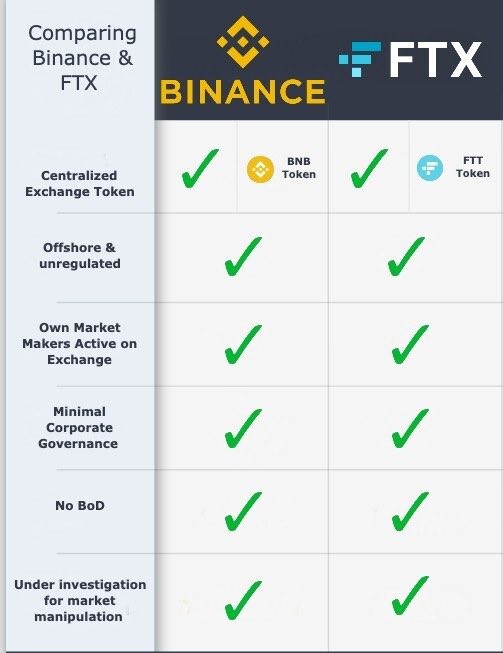

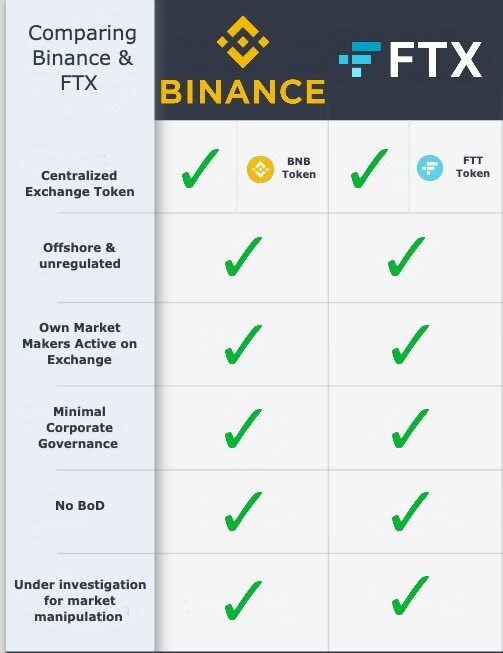

After the collapse of FTX, Binance is facing the heat from the crypto Twitter. The community has pointed out similarities between BNB and FTT. There are speculations if Binance will meet the fate of FTX.

Crypto experts have pointed out, “It is possible that Binance uses its own coins (Binance USD stablecoin and BNB token), which are in the top 10 capitalizations, for reinvestment. If the assumption is correct, the risk of a cascading liquidation cannot be ruled out, following the example of FTX.”

Source: Twitter

The similarities between BNB and FTT have also led to speculations if the SEC will classify BNB as a security by the SEC. The community believes that FTT being declared a security set a dangerous precedent for all the exchange tokens like BNB.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  NEM

NEM  Zcash

Zcash  Decred

Decred  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur