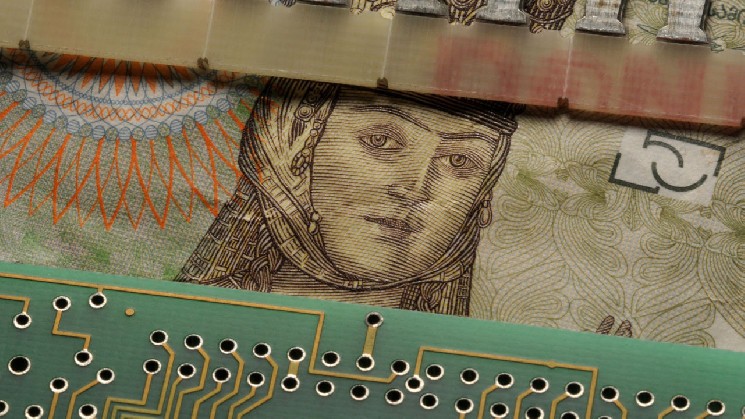

Georgia Prepares to Launch Digital Lari Pilot in First Half of 2023

The central bank of Georgia intends to publish a document detailing the concept of a national digital currency in the coming months. Other participating parties will use it to finalize their proposals for the pilot which the monetary authority plans to initiate in the first half of the year.

Financial Authorities in Georgia Gear Up for Digital Currency Trials

The National Bank of Georgia (NBG) is going to release a ‘digital lari’ whitepaper, allowing potential partners to fine-tune their proposals for the test phase of the project. A pilot version of the central bank digital currency (CBDC) was initially expected in 2022 but the NBG postponed the trials for this year.

“In the first half of 2023, we will publish the document and soon after that, together with the winning partner, we will discuss how long it would take to implement the project,” Deputy Governor Papuna Lezhava explained in an interview with the Rustavi 2 TV channel.

Several alternative approaches to testing the digital incarnation of the Georgian lari have been approved already, the official further revealed. Noting that it remains to be decided whether to continue with the realization of the project, Lezhava said:

At the first stage, it will be a rather limited pilot version. On this basis, the technical characteristics of the ‘digital lari’ will be evaluated.

“The mandate of the NBG is to ensure financial and price stability. The development of digital technologies has necessitated the development of the central bank currency and the creation of a digital version of the lari,” Georgia’s monetary policy regulator commented in a prior statement.

The bank elaborated that the need for a CBDC also stems from the need to better meet the requirements of the digital economy and increase the effectiveness of economic policy. It also emphasized that the state-backed coin will have legal tender status in Georgia.

“The digital lari will become a cheaper, more secure and faster means of payment than the current fiat lari in its cash and non-cash forms. The services of intermediaries, commercial banks or payment systems, will not be required to carry out operations with the digital lari,” the NBG detailed while highlighting that the new platform will also be able to function offline.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Maker

Maker  Gate

Gate  KuCoin

KuCoin  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  0x Protocol

0x Protocol  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Pax Dollar

Pax Dollar  Numeraire

Numeraire  DigiByte

DigiByte  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD