Goldman Sachs Ranks BTC Above Gold, Real Estate, and 22 Other Assets

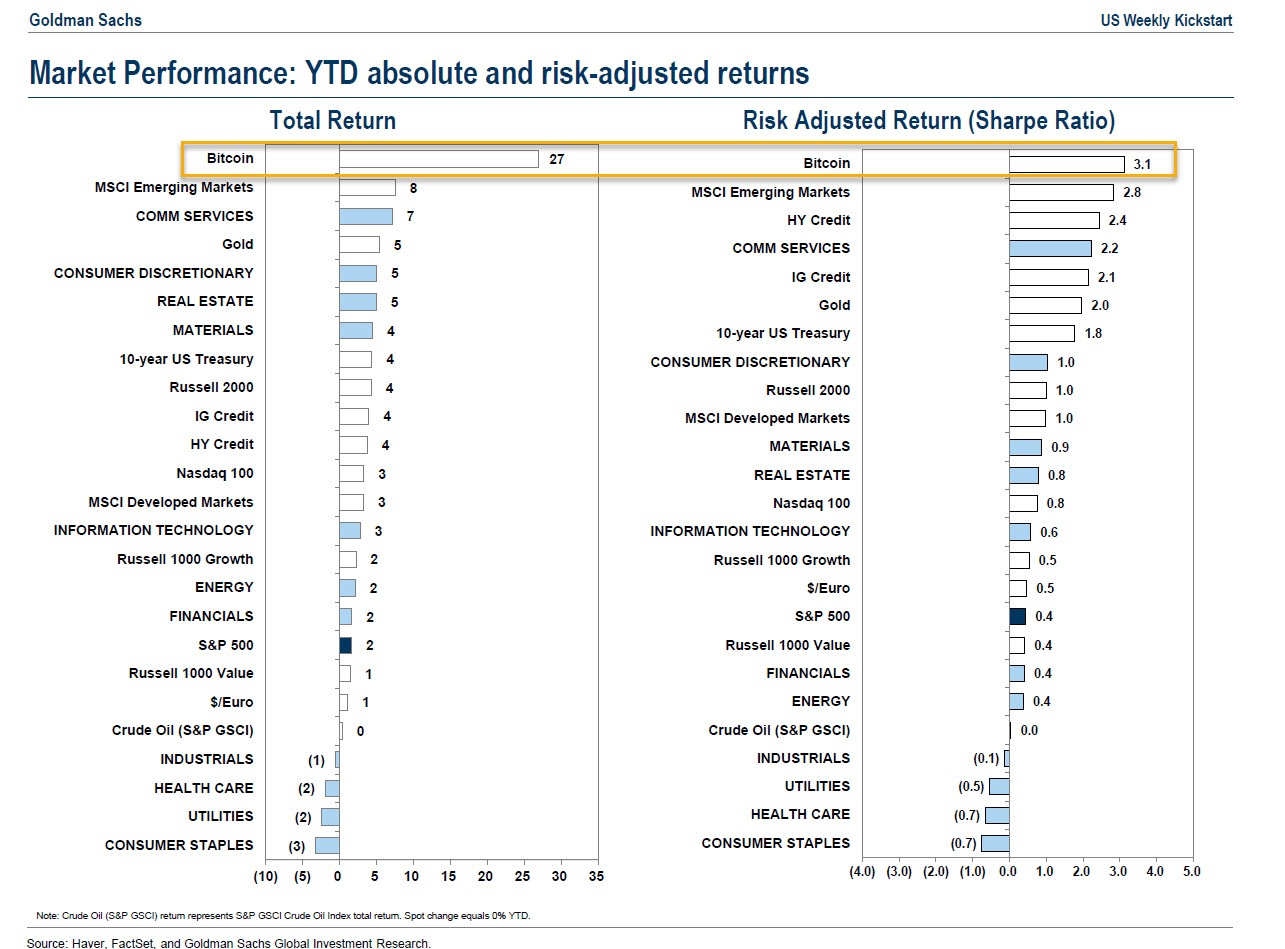

According to the year-to-date asset return of Goldman Sachs, one of the most prominent financial institutions in the United States, Bitcoin (BTC) was the best-performing asset in the world.

Goldman Sachs ranked Bitcoin above gold, real estate, 10-year US Treasury, energy, Nasdaq 100, and twenty other investment instruments. Notably, Goldman Sachs added Bitcoin to its ranking of assets barely two years ago.

Image source: Documenting Bitcoin on Twitter

Interestingly, the market tracking platform, CoinGecko, believes Bitcoin was the worst-performing investment in the 2022 calendar year. In its recent annual crypto industry report published last week, CoinGecko highlighted significant assets which performed poorly across the board, except Crude Oil and the US Dollar. However, BTC performed worst with a 64.2% drop.

Recently, Tom Dunleavy, a researcher at Messari, a data analytic firm, highlighted that the Litecoin token LTC outperformed BTC and its closest rival, Ethereum (ETH), over the past three months and one-year timeframes.

Dunleavy shared a chart illustrating that LTC investors saw over 31.% and 23.2% return on investment (ROI) more than BTC and ETH investors, respectively, from January 2022. Under the three-month window, the figures were more than double the one-year value. Litecoin also outperformed DeFi tokens with a landslide margin of 73% growth from 2022.

Litecoin has outperformed BTC and ETH over the past 3M and 1Y timeframes (ie Risk on and Risk off environments).

Efficient markets ya’ll. pic.twitter.com/fvESU3cxjG

— Tom Dunleavy (@dunleavy89) January 22, 2023

Nonetheless, Bitcoin traded at $48,086.84, 52 weeks ago, and its lowest price within the same period was $15,599. Over the last 30 days, BTC has grown by over 27%, as per CoinMarketCap. It currently trades at $22,918.78, with a market share of over $441 billion.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Algorand

Algorand  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur