BTC Rises 2.7X Post 2019 Pull Back, Is there an Impending Surge?

Co-Founder of Mechanism Capital Andrew Kang tweeted that Bitcoin (BTC) went through a similar pullback in 2019’s echo bubble before its spiked 2.7 times its price. Moreover, he stated that parameters like momentum, price action/timing, market structure, positioning, and sentiment had little effect on this hike.

During the great echo bubble of 2019, we had a similar pullback before $BTC proceeded to rip 2.7x

Momentum, price action/timing, market structure, positioning, and sentiment are almost mirror images of that snapshot in time pic.twitter.com/lYeMFYWhPY

— Andrew Kang (@Rewkang) January 25, 2023

Meanwhile, during the past week BTC was trading in the red zone for the first two days of the week, as shown below. BTC was priced at 21.29K when the markets opened for trading. Just after the markets opened, the currency tanked to the red zone and reached its lowest price of $20,611 on the first day of the week itself.

BTC/USDT 7-day Trading Chart (Source: CoinMarketCap)

However, during the early hours of the third day, the bulls came to BTC’s rescue and pulled it out of the red zone. The bulls helped BTC reach its maximum price of $23,243 during the last hours of the third day. Since the coin reached the green zone it has been trading in the $22.5-23.25K range during the latter part of the week.

As Kang mentioned, this may be the pullback that BTC is going through just after the 2019 echo bubble. However, BTC is up 1.90% in the last 24 hours and is priced at $22,683, at press time.

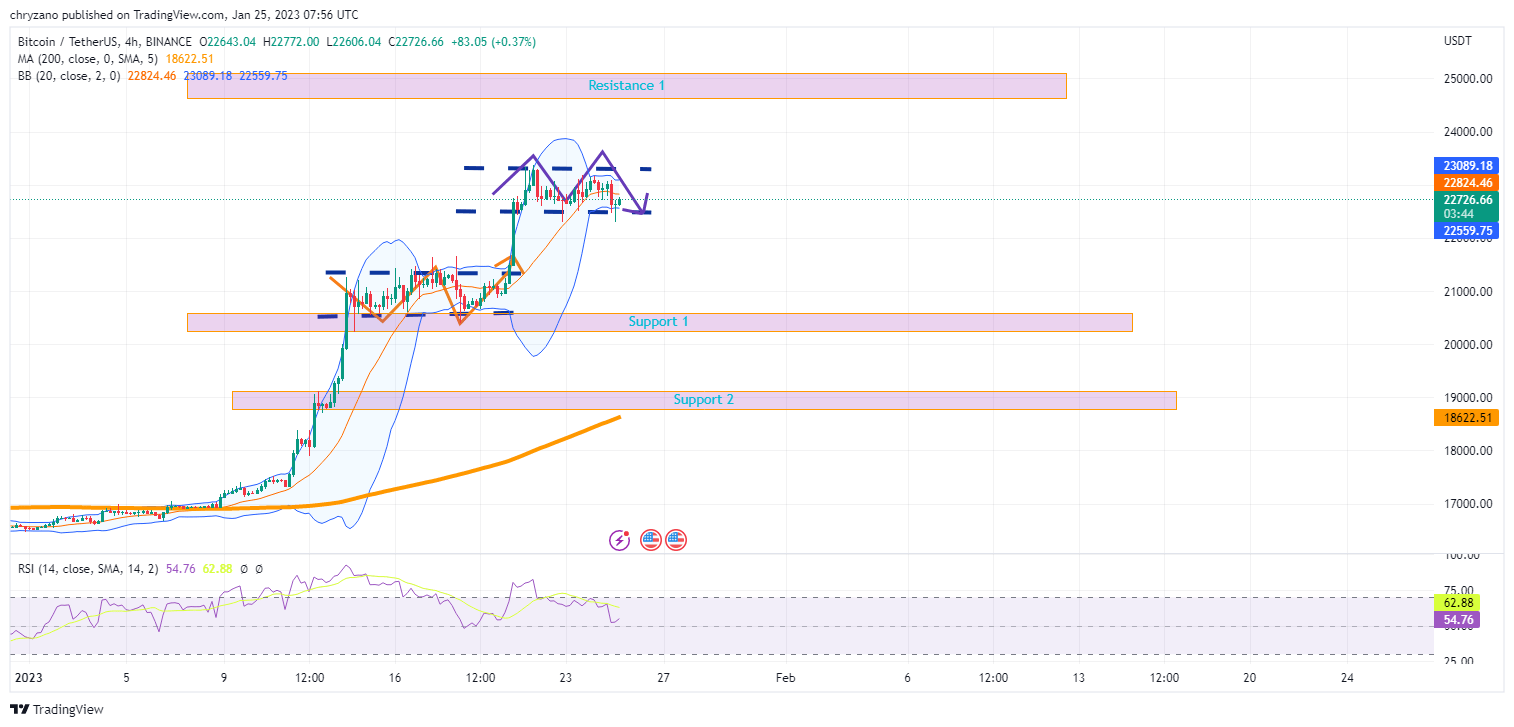

As shown in the chart below, BTC fluctuated taking the form of letter W, Double bottom (Denoted in Orange) when it was consolidating. The formation of the W denotes a bullish reversal and this is reciprocated in BTC’s behavior as the currency rose from $21,478 to $22,740.

BTC/USDT 4-hours Trading Chart (Source: TradingView)

Currently, BTC is moving sideways and traversing an inverted W-pattern or M-pattern (Double Top). As such, a bearish reversal could be on the cards. When considering the double tops BTC formed, the second top is lower than the first. This denotes the resistance of the bears and the exhaustion of the bulls.

Meanwhile, those who held a long position after the formation of the W (bullish reversal) should consider whether they should still go long. However, having said that, this could be another position for BTC to consolidate before it surges again. Additionally, the Bollinger bands are contracting, and this seconds the consolidation of BTC.

But the question lies in whether there is yet another surge in BTC after consolidating. Will the bulls catapult the top coin to resistance 1 or higher? Or will the bears take over the market?

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Ren

Ren  Augur

Augur