Here’s How Legendary Investor Peter Lynch’s Strategy Would Work in Crypto

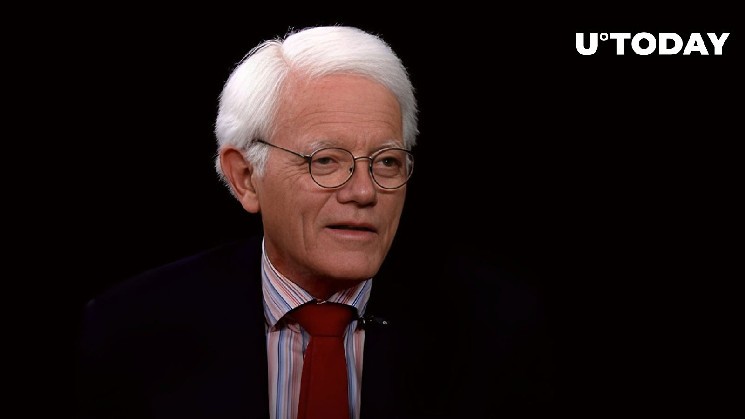

Peter Lynch is regarded as one of the most accomplished investors of our era. From 1977 to 1990, Lynch managed Fidelity Invest’s Magellan Fund, which delivered an impressive average annual return of 29.2%. Under his leadership, the fund’s assets grew from $18 million to $14 billion, thanks to the «Growth At a Reasonable Price» (GARP) strategy that combines principles of value and growth investing. Educational writer Zerko Ika applied it to the crypto world.

Investing in industries or specific companies one is familiar with can help one uncover undervalued assets. In the crypto context, this might involve focusing on a specific niche such as DeFi, NFTs or Layer 2 solutions. Conducting thorough fundamental analysis before investing in any altcoins is essential for success. Lynch coined the term «Ten Baggers» to identify stocks with the potential to grow tenfold from their original purchase price.

Peter Lynch is one of the most successful investors of our time.

He grew an Investment fund from million to billion.

I deep-dived into his legendary ”GARP” strategy and adapted to crypto.

Here is how you can take advantage of it and improve your profitability.

1/21 ?? pic.twitter.com/AKHDu8rGR1

— ZERO IKA ?️ (@IamZeroIka) April 16, 2023

Value-investing principles dictate that paying attention to negative rumors about a company can lead to lower purchasing prices. In the crypto world, FUD (Fear, Uncertainty and Doubt) can be harsh, but it can also offer buying opportunities. For example, when news of a lawsuit against Binance’s CEO by the CFTC caused the price of BNB to drop by 5% daily, this created an opportunity for savvy investors.

Diversification can reduce risk, but it can also dilute profitability and make it harder to manage investments. Striking the right balance between diversification and concentration is crucial.

Regular portfolio reviews can help maintain a healthy mix of investments and counteract cognitive biases, such as sunk cost bias. This involves monitoring your holdings, rebalancing your portfolio, evaluating potential new projects and cutting losses on underperforming assets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Ontology

Ontology  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Nano

Nano  Steem

Steem  Hive

Hive  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur