Hidden Patterns in Bitcoin 4-Year Cycle

The buzz around the Bitcoin 4-year cycle has grown louder in recent years, becoming a widely-discussed topic among crypto enthusiasts and market analysts. The cycle, marked by significant events and trends in the crypto market, has aroused curiosity and intrigue in both seasoned participants and newcomers.

However, the causes and implications of the Bitcoin 4-year cycle are often misunderstood or oversimplified. Examining the factors that shape it, including the halving, macroeconomic influences, and human behavior, may benefit investors.

Bitcoin Halving: A Decisive Catalyst or a Self-Fulfilling Prophecy?

One of the most intriguing aspects of Bitcoin’s behavior is the “halving.” This is a predetermined event in which the number of new BTC generated and distributed by the network is cut in half.

Currently, about 900 Bitcoins are produced daily. In the forthcoming halving, scheduled for late Q1 or early Q2 of next year, this figure will decrease to 450. The previous halvings in 2012, 2016, and 2020 have marked significant turning points in Bitcoin.

The halving impacts Bitcoin’s price due to a simple supply-demand principle.

Bitcoin Issuance. Source: MacroMicro

When the halving occurs, even if Bitcoin demand remains steady, the reduction in supply can create an imbalance, pushing prices upwards. This price momentum can trigger a multi-year bull market in Bitcoin.

As the cycle progresses, the initial impulse from the halving diminishes, yet the momentum continues, carrying the market forward.

The Ripple Effect: Liquidity Dispersion in the Crypto Market

As the bull market matures, liquidity spreads from Bitcoin to other cryptos, such as Ethereum, and eventually to riskier, long-tail assets.

This dispersion continues until the inflow of new funds into the crypto market cannot sustain the increasing number of assets driven by correlation with the major cryptocurrencies and the new projects being created.

Bitcoin Halving Effect. Source: Glassnode

When this unsustainable point is reached, the market collapses, reversing the dispersion of liquidity. Funds flow from long-tail assets back into Bitcoin and Ethereum, providing a reset point for the liquidity cycle.

This liquidity flow pattern is not unique to the crypto market but is characteristic of traditional financial markets.

The Human Factor: Behavioral Dynamics and Market Psychology

Beyond halving and liquidity cycles, another vital factor shaping Bitcoin’s market behavior is the psychological dynamics of market participants. To understand this better, one must delve into Bitcoin’s on-chain data.

Bitcoin’s price and the profitability of active network participants significantly influence the market dynamics. Indeed, market participants who have accrued substantial unrealized profits are more likely to sell during market downturns, fearing the loss of these gains.

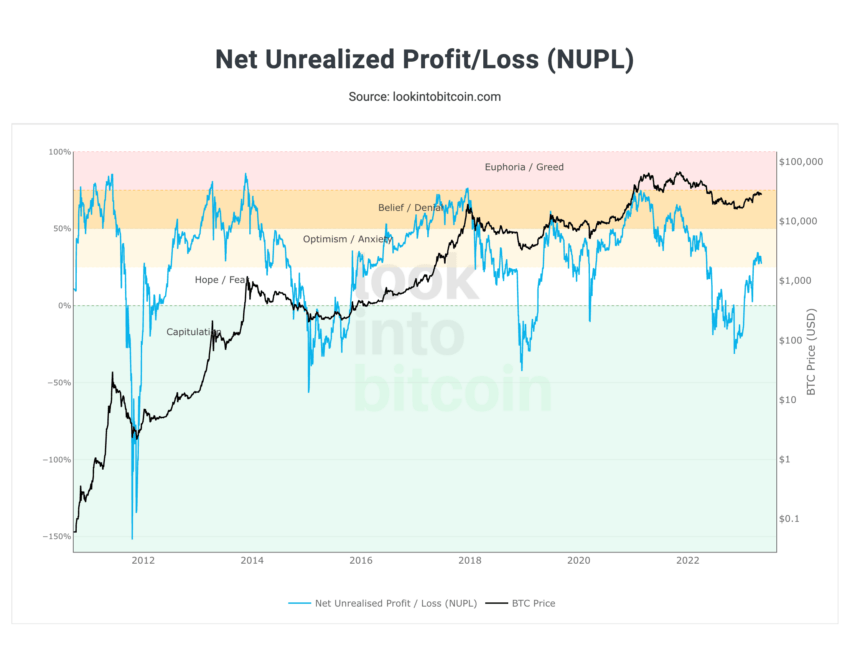

Bitcoin NUPL. Source: LookIntoBitcoin

Moreover, individuals who enter the market after a significant price rise are typically less experienced or less convinced about the asset’s long-term value. These factors result in a more volatile holder base than the stable base seen during bear market lows.

Profitability and Holder Base: The Key Drivers Behind

When discussing profitability, one often refers to a series of metrics categorized under cost basis. These include realized price, a proxy for the network’s aggregated cost basis, and the short and long-term holder realized price.

These metrics help understand the state of the market – whether it is in unrealized losses or gains.

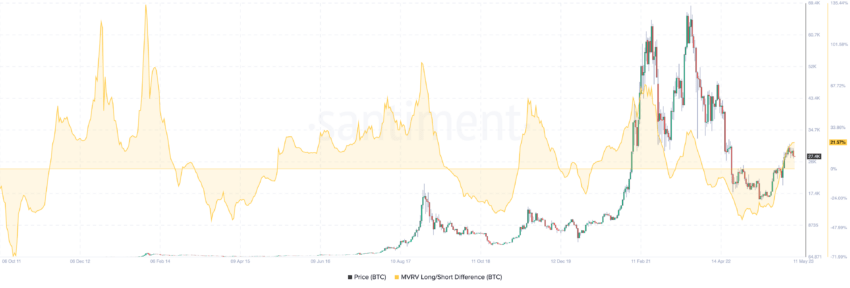

Bitcoin MVRV. Source: Santiment

The change between the market price and the aggregated cost basis can be measured using the Market-Value-to-Realized-Value (MVRV) ratio.

High readings of MVRV, indicating large amounts of unrealized profits, have historically marked the peak of Bitcoin 4-year cycles.

Miner Influence: A Diminishing Force in Bitcoin 4-Year Cycle

Historically, Bitcoin miners have significantly impacted the market, acting as pro-cyclical forces.

Miners accumulate Bitcoin when it is profitable during bull markets and are forced to sell during bear markets.

Bitcoin Fees to Reward Ratio. Source: CryptoQuant

However, the term capitalization metric shows that their influence on the market has decreased.

The Global Macro Picture: A Rising Influence

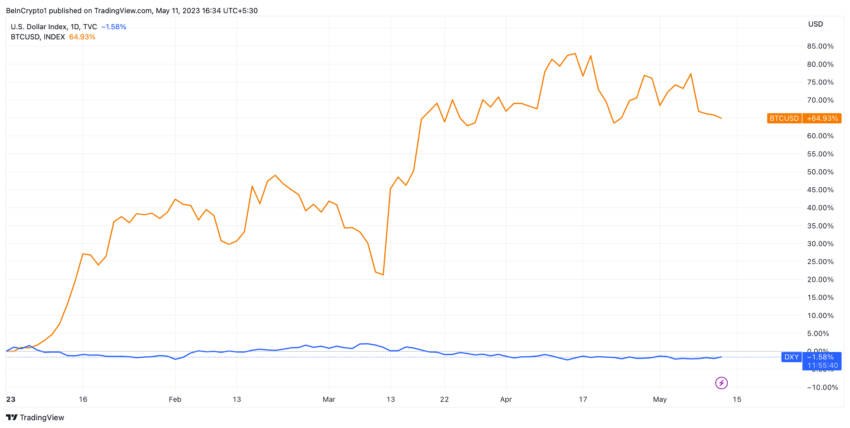

Historically, Bitcoin has maintained some isolation from global macroeconomic factors. However, it becomes more susceptible to these influences as it integrates more with the traditional financial system and garners more adoption by institutional investors.

For instance, fluctuations in the US dollar’s strength, changes in monetary policy, and geopolitical tensions can now directly impact Bitcoin’s market behavior.

Bitcoin Against DXY. Source: TradingView

People often consider Bitcoin, much like gold, as a safe haven asset during economic crises or financial market instability.

Thus, during periods of heightened risk or uncertainty in the global economy, one might see a surge in demand for Bitcoin, which can push its price upward.

Regulation: The Wild Card

The role of regulatory factors in shaping Bitcoin’s market behavior is considerable and can often be unpredictable. While some countries have embraced Bitcoin and other cryptocurrencies, others have imposed stringent regulations or outright bans.

Positive regulatory news can drive Bitcoin’s price upwards, while negative news can trigger steep declines.

Crypto Regulation Worldwide. Source: Statista

For instance, when countries like Japan and South Korea recognized Bitcoin as a legal payment method, its price had a significant positive impact.

Conversely, when China announced a crackdown on Bitcoin mining and trading, it led to a sharp market downturn.

Preparing for the Next Bitcoin 4-Year Cycle

A complex interplay of factors shapes Bitcoin’s market behavior. These include its inbuilt halving mechanism, liquidity cycles, the psychology and behavior of market participants, the influence of miners, global macroeconomic factors, and regulatory developments.

Understanding these factors can give investors and market participants valuable insights into Bitcoin’s potential price movements.

Despite this, one should not consider these factors as definitive predictors due to the crypto market’s highly volatile and unpredictable nature. Instead, one should use them as tools to assess probabilities and manage risk.

As Bitcoin continues to evolve and mature, the factors influencing its market behavior may also change. Therefore, staying updated with the latest developments in Bitcoin and the broader cryptocurrency market is crucial.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur