Institutional Interest in Crypto ETFs Cooled but Not Gone, Survey Says

Crypto’s roller coaster year has not significantly discouraged institutions from getting involved in the space via regulated fund structures, a survey found.

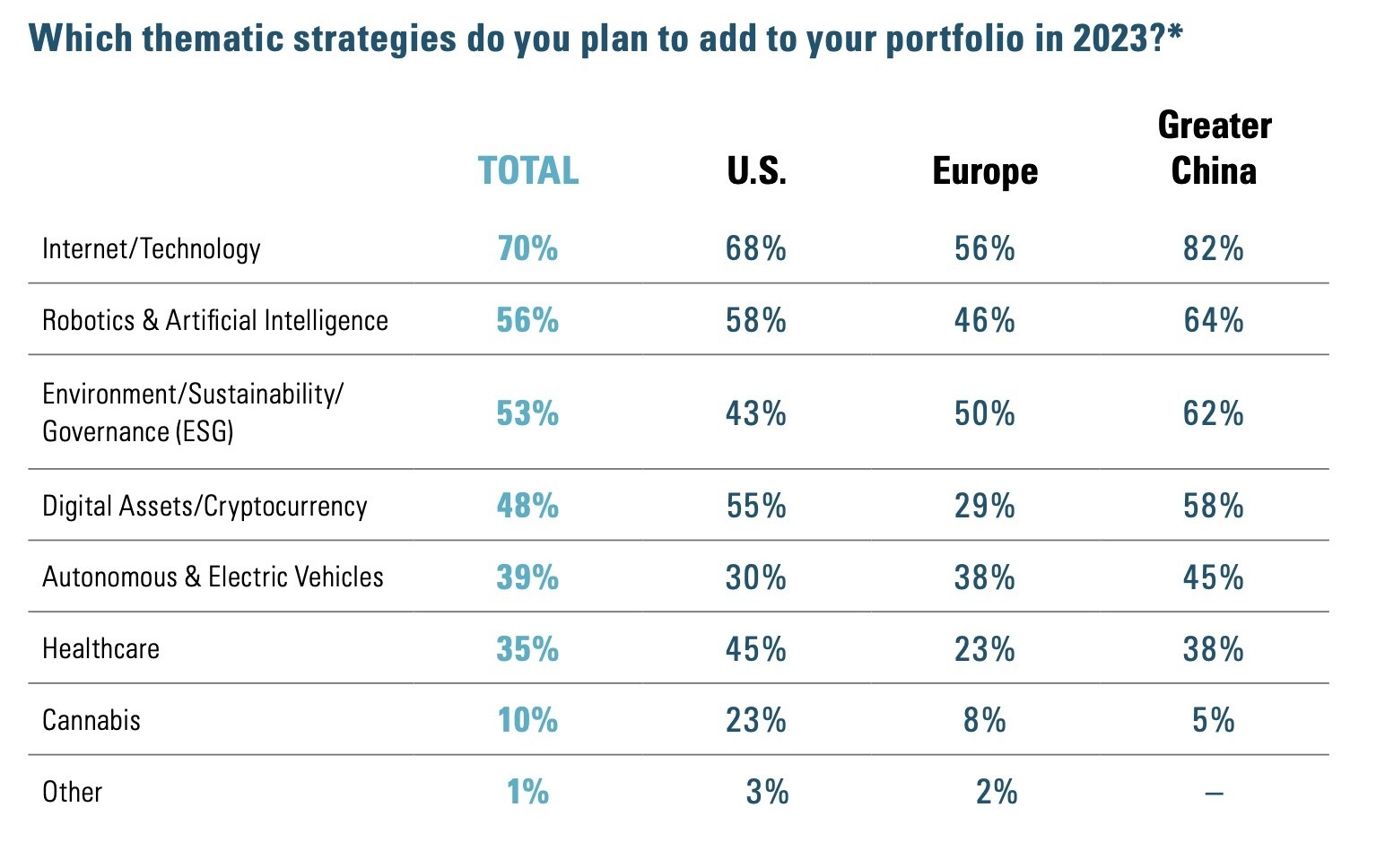

Overall, 48% of institutions surveyed plan to add crypto-related ETFs to their portfolios in 2023, according to a report by the boutique investment bank Brown Brothers Harriman & Co. This figure stood at 54% a year ago, a decline of six percentage points.

A quarter of respondents already allocating to such funds said they expect to up their exposure this year — a drop from 33% last year.

“Initiatives such as the draft regulation from the EU’s Markets in Crypto Assets proposal [are] expected to significantly derisk investments in crypto assets for asset managers and provide an additional layer of comfort for fund managers to engage with crypto exchanges,” the report said.

The findings reflect responses from 325 ETF-focused institutional investors, financial advisers and fund managers. About 40% of them manage more than $1 billion in assets.

The report comes after a study by crypto asset manager Bitwise Investments found about 80% of advisers with a crypto allocation in client accounts plan to maintain or increase those tickets this year.

Crypto ETF landscape

Interest from institutions in adding crypto ETFs to portfolios in 2023 was higher in the US (55%) and China (58%) than it was in Europe (29%).

US fund issuers have not yet gotten approval from the SEC to launch a fund that holds bitcoin directly — a spot BTC ETF. Grayscale is currently tied up in a lawsuit with the regulator after it denied the firm’s proposal to convert its Bitcoin Trust (GBTC) to an ETF.

Bitwise’s January survey found that most advisers looking to boost crypto exposure for clients plan to use equity ETFs. The largest is Amplify Investments’ Transformational Data Sharing ETF (BLOK), which has about $440 million in assets.

Another option: bitcoin futures ETFs, which first hit US markets in October 2021. The largest is ProShares’ Bitcoin Strategy ETF (BITO), which now has about $940 million in assets.

While BITO and other similar ETFs invest in front-month CME bitcoin futures contracts, Bitwise last month launched its Bitcoin Strategy Optimum Roll ETF (BITC). It’s designed to select futures contracts with the lowest level of contango.

Contango, broadly speaking, is when the projected price of a commodity under a futures contract is valued above the asset’s going spot price.

The company is hoping its differentiated strategy appeals to a certain type of investor, Bitwise Chief Investment Officer Matt Hougan told Blockworks.

“What you see usually is that traders migrate to the front-month-oriented products and investors migrate to the optimum rolls products, because academic history suggests that delivers better long-term return in most cases,” Hougan said.

Despite the difference in strategy, according to Hougan, being late to the bitcoin futures ETF landscape could still make for “a long road” to win significant assets.

The Bitwise executive said the firm, which had its spot bitcoin ETF proposal rejected last June, would likely try to bring a spot bitcoin ETF to market again once more regulatory clarity comes to light.

“Long-term, we think a spot bitcoin ETF would be a wonderful thing for investors, a wonderful thing for the crypto market,” he said. “We’re already seeing in Canada, in Germany, in Sweden, in Brazil that they work well.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Zcash

Zcash  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Nano

Nano  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Augur

Augur  Energi

Energi