Institutional Investors Pile Into Ethereum (ETH) at Highest Rate Since November 2021: CoinShares

Leading digital assets manager CoinShares says Ethereum (ETH) institutional investment products just had their biggest week in over a year.

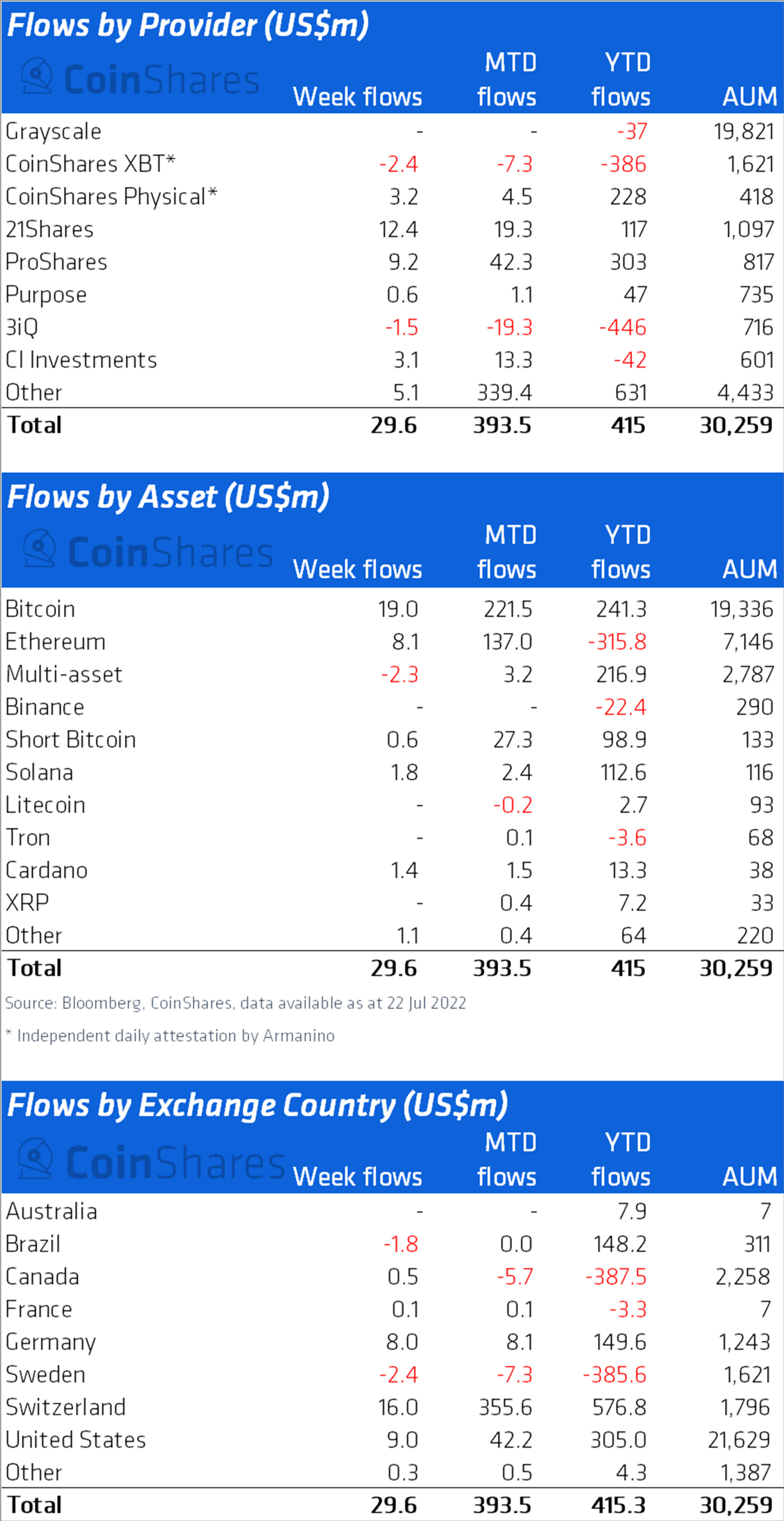

According to the latest Digital Asset Fund Flows Weekly report, late trade reporting added $120 million to the previous week to ETH’s weekly inflows of $8 million, making it the largest on record since June of 2021.

“Ethereum saw inflows totaling $8 million, while the corrected prior week data saw inflows totaling $120 million. These inflows mark the largest single week of inflows since June 2021 and imply a turning point in sentiment after a recent 11-week run of outflows. It also suggests that as The Merge progresses to completion, investor confidence is slowly recovering.”

Source: CoinShares

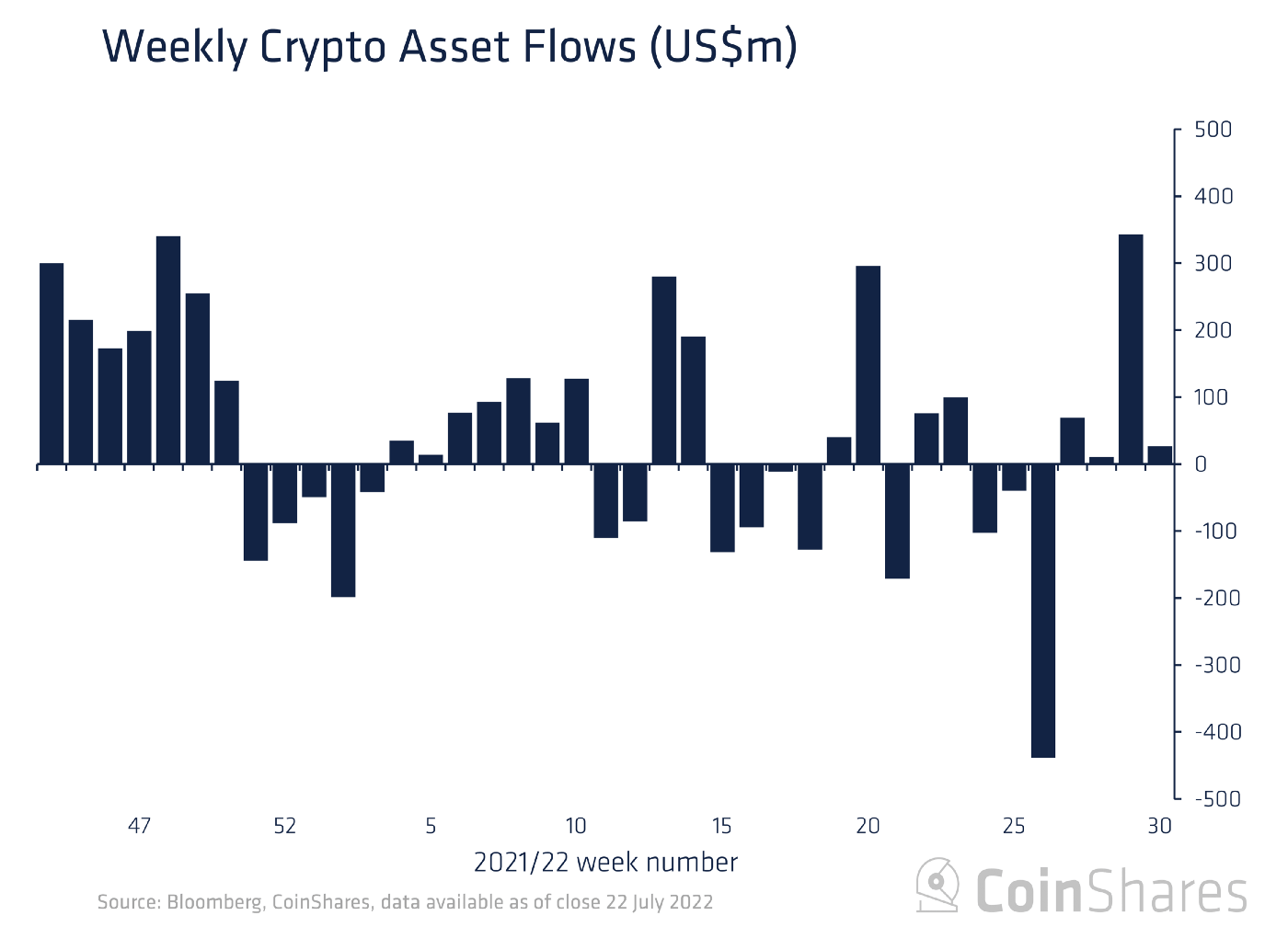

Late reporting of the previous week’s trades also raised digital asset investment products from $12 million in inflows to $343 million.

“Digital asset investment products saw inflows totaling $30 million last week, while late reporting of trades from the prior week saw inflows corrected from $12 million to $343 million, marking the largest single week of inflows since November 2021.”

Source: CoinShares

Corrections from the previous week also gave Bitcoin (BTC) its biggest week of inflows in three months.

“Bitcoin saw inflows totaling $16 million last week with the prior week of inflows corrected to $206 million, the largest single week of inflows since May 2022.”

Altcoins Solana (SOL) and Cardano (ADA) enjoyed $1.8 million and $1.4 million of inflows, respectively, while multi-asset digital investment products suffered $2.3 million of outflows.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Monero

Monero  Stacks

Stacks  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Cronos

Cronos  OKB

OKB  Maker

Maker  Theta Network

Theta Network  EOS

EOS  Algorand

Algorand  Gate

Gate  KuCoin

KuCoin  NEO

NEO  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Zcash

Zcash  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Siacoin

Siacoin  Basic Attention

Basic Attention  Qtum

Qtum  Dash

Dash  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Waves

Waves  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Bitcoin Diamond

Bitcoin Diamond  Energi

Energi  HUSD

HUSD  Augur

Augur