Is Bitcoin Headed to $21K or Will the Bulls Bounce Back? (BTC Price Analysis)

After forming a bearish three-drives reversal pattern, the price has recently dropped below the neckline, delivering a significantly bearish signal for the short-term outlook. As of now, BTC faces an important support region at $21K.

Technical Analysis

By Shayan

The Daily Chart

As expected, the three-drives pattern resulted in a trend reversal and a decline in the price. Bitcoin was recently rejected below the neckline and is consolidating with very little momentum.

However, a pullback to this broken neckline is necessary to confirm the change in Bitcoin’s recent bullish trend. If a pullback occurs, the price will potentially enter a mid-term downward stage, returning the fear to the market.

BTC’s following support levels are $21K and the 200-day moving average, standing at $19.7K.

The 4-Hour Chart

After forming a major swing at $25K, Bitcoin’s price initiated a downtrend, forming an ascending wedge pattern. Following an impulsive bearish move, the price reached the wedge’s lower boundary at $22K and began consolidating.

Bitcoin currently faces a significant support area consisting of the wedge’s lower boundary and the $21K major support level. Presently, the bearish momentum has decreased.

As a result, the price will possibly enter a short-term range stage, demonstrating the battle between buyers and sellers at this vital price area.

To conclude, a breakout from the wedge in either direction will determine the mid-term direction of the price.

On-chain Analysis

Miners are a vital cohort among market participants, and their selling behavior deeply affects the market as they have a large number of coins. They also impact the market in terms of traders’ sentiment.

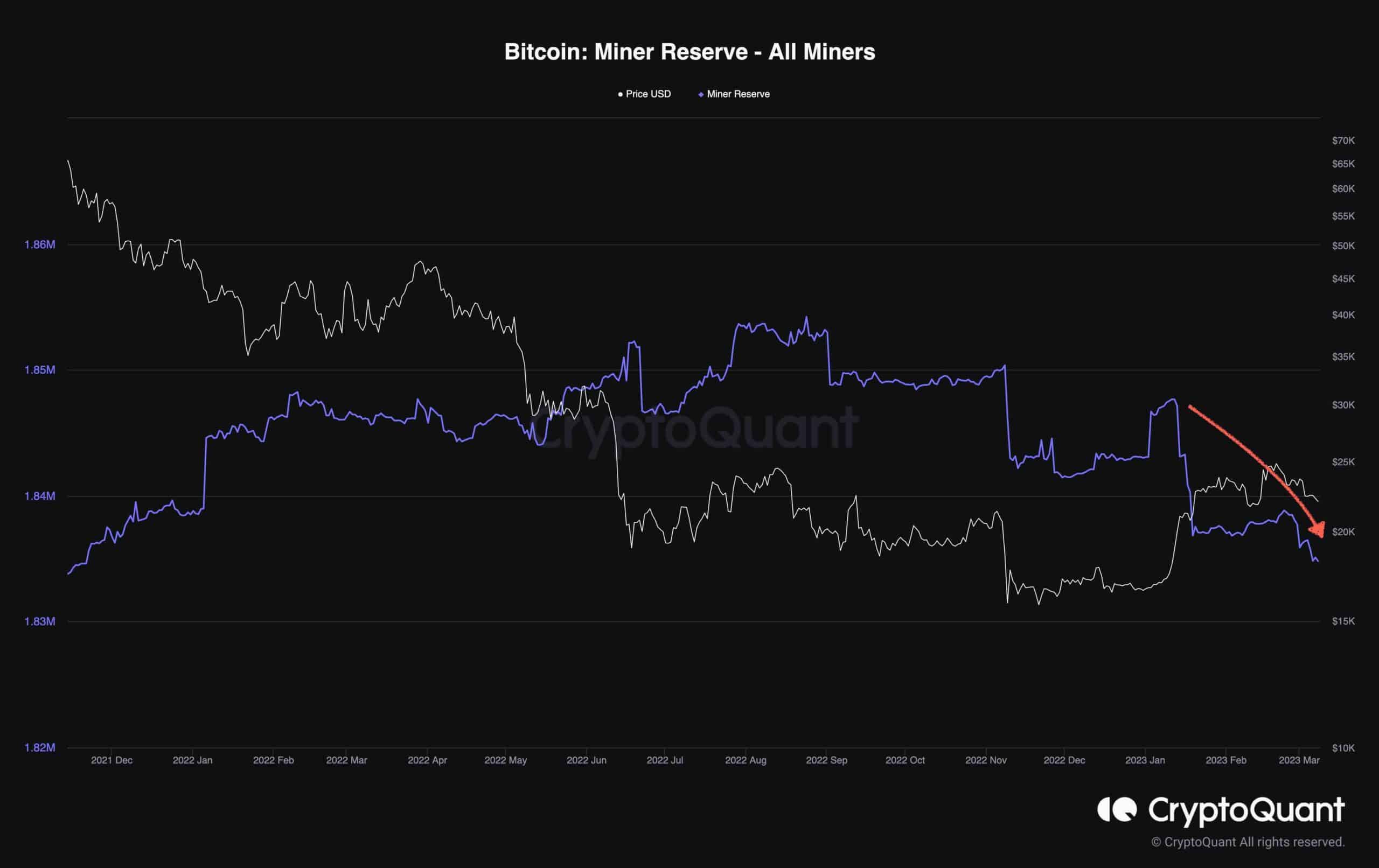

This chart demonstrates the miner reserve metric, measuring the number of coins held by the miners’ wallets. Despite many on-chain metrics indicating bullish signs during the recent stage of the market, the miner reserve metric has entered a bearish trend and reached new yearly lows.

This shows that the recent bullish spike in BItcoin’s price has provided a great chance for the miners to offload their assets, controlling their expenses. This selling behavior could end up as a mid-term bearish sentiment in the market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur