Is Bitcoin in trouble? $27.6k resistance level sparks concerns

As Bitcoin (BTC) continues to trade sideways, failing to overcome any significant resistance for another week, more trouble could be ahead as the flagship decentralized finance (DeFi) asset positions itself for a downside, waiting for just one more signal to continue dropping further.

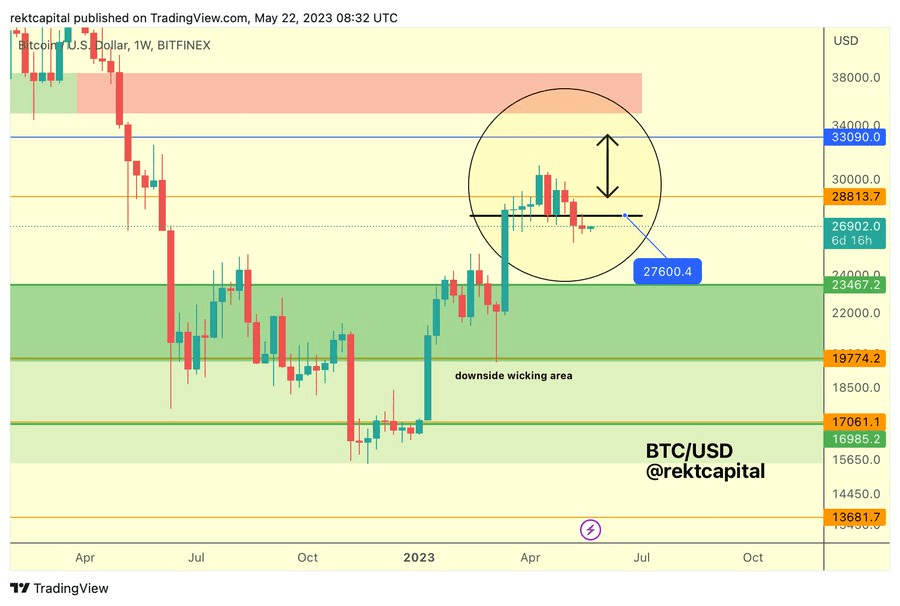

Indeed, Bitcoin has performed another weekly close below $27,600, which means it has fully confirmed the breakdown from this level, according to an analysis shared by pseudonymous cryptocurrency market analyst Rekt Capital on May 22.

Furthermore, the expert explained that sell-side volume was the only thing missing for the other shoe to drop and prompt an even deeper downside for Bitcoin, where it has technically already positioned itself, as the chart pattern analysis suggests.

Earlier, when Bitcoin was also still rejecting from the above level, Rekt Capital said that “as long as it continues to act as resistance, there is a threat of an even stronger rejection to prompt extra downside” in a tweet shared on May 19.

On May 18, the analyst announced that a one-week close below $27,600 would double-confirm a breakdown from it and could set BTC up for downside continuation, whereas reclaiming this level would give it a chance at bullish momentum.

Bitcoin price analysis

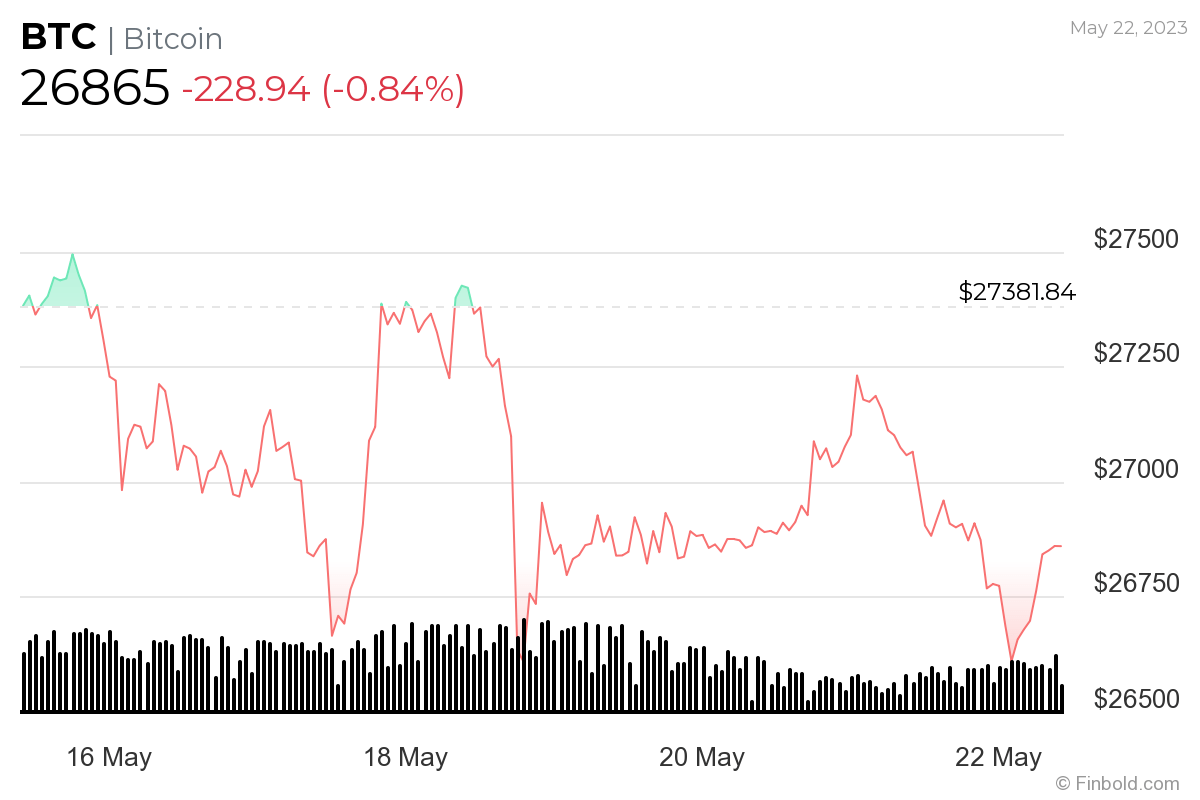

Meanwhile, Bitcoin was at press time changing hands at the price of $26,865, demonstrating a decline of 0.84% on the day and 1.89% across the past week, as well as losing 1.39% on its monthly chart, according to the recent data retrieved on May 22.

As Finbold reported on May 20, Bloomberg’s senior commodity strategist Mike McGlone suggested Bitcoin might be about to establish a new bear market low amid the period of turbulence as the stock market underwent a downward trajectory.

Interestingly, Bitcoin’s 60-day volatility has dropped to a historically significant range of 40%, and chart patterns over the last five years indicate that a price increase of about 46% could follow, although caution is necessary as it has not always been the case.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur