Just-In: Bitcoin (BTC) Price May Remain Below $20,000 This Year, Here’s Why

Bitcoin (BTC) price struggles to surpass $20,000 as the bear hug tightens further. The rise in selling pressure, the Fed’s hawkish rate hikes, and whales selling their BTC holdings degrade the chances of any revival. Moreover, the increasing dormant BTC supply is making the bear market stretch longer.

Bitcoin (BTC) Price Goes into Hibernation Mode

Bitcoin (BTC) has failed to reclaim the $20,000 level after the recent sell-off. The weak macroeconomics, bearish sentiment, and massive selloff by whales and miners have bleak the chances of a strong recovery. These signs can be seen as the Bitcoin dominance drops to an all-time low.

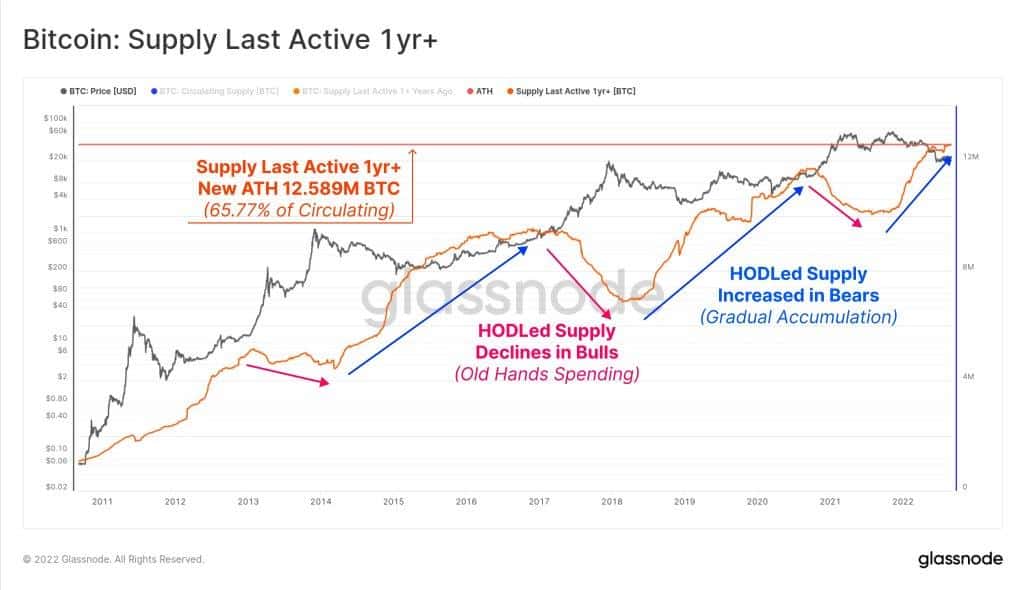

As per Glassnode data, the volume of Bitcoin supply that remained unspent for over a year has reached a new ATH of 12.589 million. Therefore, about 66% of the current circulating supply is dormant. Moreover, the increasing dormant supply is an indicator of a bear market. It means the Bitcoin (BTC) price has moved deeper into the bear market.

Bitcoin Supply Last Active 1yr. Source: Glassnode

Recently, several dormant whale addresses have become active and sold their Bitcoin (BTC) holdings. A whale dormant for 7-10 years sold 5000 BTC in a single block and another whale dormant for 9 years sold 5000 BTC to crypto exchange Kraken. The movement of dormant bitcoins after several years is an important bearish signal.

The next Bitcoin fall may be happening due to dormant whales and miners selling their BTC holdings. Moreover, September month seems to be bad again for Bitcoin as BTC options and futures expiry will witness massive liquidations.

BTC Price May Remain Below $20,000 This Year

The Bitcoin (BTC) price is most likely to fall below $15k. Historically, the BTC price had bottomed at the delta level, which is $14,478. Notable analysts including Peter Brandt and Big Cheds earlier warned the BTC price risks falling to $13k as there is no strong support below $19K.

The rising selling pressure and dormant BTC supply may stretch the bear market for a longer period. The chances of every bullish pressure getting negated by bears are quite high. Moreover, Ethereum has taken the spotlight with its upcoming Merge, and Cardano records strong activity and demand amid the Vasil hard fork.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD