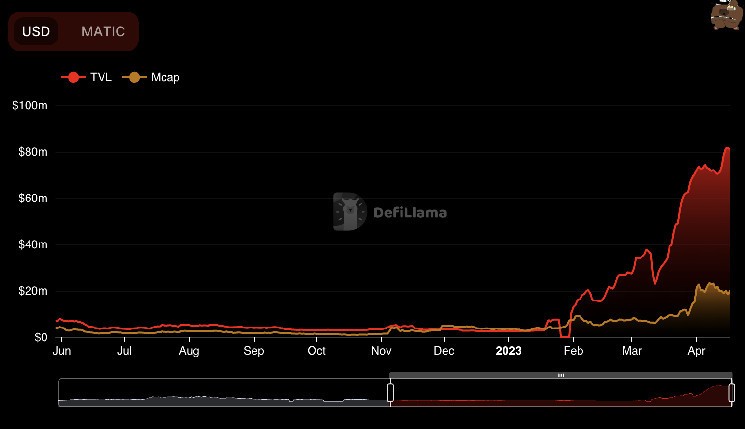

Attractive Yields Drive Millions Into DeFi Liquidity Manger Gamma; TVL More Than Doubles

The total value locked (TVL) on decentralized finance (DeFi) protocol Gamma has doubled in the past month as investors attempt to secure generous staking yields.

Gamma is described as a semi-automated liquidity manager that allows users to provide liquidity at the most lucrative pools across six different blockchains.

The protocol also features staking of its native token, GAMMA, which is currently producing a variable yield of 7.04%, according to the Gamma website.

The token has performed well since the turn of the year, rising from as low as $0.07 to its current traded price of $0.33. GAMMA has a market cap of $19.3 million and 2% market depth of $38,209, according to CoinGecko.

Market depth is a metric used to evaluate liquidity, it demonstrates how much capital is required to move an asset by a certain percentage based on the orderbook.

The Gamma protocol offers one product that is targeted at individuals and institutions as it offers a passive yield. Another is aimed at Web3 companies and decentralized autonomous organizations (DAOs), offering consultation and backtested strategies for treasuries.

While interest in Gamma has been muted since its 2021 introduction, Defillama data shows that it is one of the fastest growing yield products this year with TVL, market cap and fully diluted valuation (FDV) all surging as the DeFi sector bounces back. CoinDesk Indices’ DeFi index has risen 59% to 1,056.49 since Jan. 1.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Dash

Dash  Ontology

Ontology  Zcash

Zcash  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur