Lemniscap backs $4.6 million raise for infrastructure provider Gateway.fm

Gateway.fm raised $4.6 million in a round led by Lemniscap to build decentralized blockchain infrastructure tools.

The seed round also saw participation from investors including CMT Digital, the LAO DAO, Very Early Ventures, Fantom Foundation and Unstoppable Domain Ventures, said the company in the release.

The startup is building decentralized remote procedure call (RPC) solutions, so that web3 companies don’t need to rely on centralized services such as Amazon Web Services (AWS) or Google Cloud. RPC nodes enable decentralized applications to connect to blockchains and easily access user data.

Gateway.fm offers three services: Gateway Grow, an institutional staking service; Gateway Access, its web3 RPC node infrastructure solution and Gateway Jumpstart, which enables blockchains and protocols to accelerate their mainnet launch.

«For too long, the spirit of decentralisation at the heart of the web3 movement has been undermined by limited access to scalable infrastructure,» said Cuautemoc Weber, co-founder and CEO of Gateway.fm in the release. «No more. We want to provide reliable node infrastructure, best-in-class validators and robust dev tooling to help web3 projects scale at pace, while enticing financial institutions and enterprises to explore blockchain technology with confidence.»

The funding from the raise will be used to accelerate product development as well as for marketing and hiring efforts, the company said.

Near, Fantom, Gnosis and 1inch are among the companies that use Gateway.fm’s infrastructure tools, according to its website.

«With a set of elite-grade, next-gen tools, Gateway is broadening the inclusivity, availability and reliability of blockchain networks and protocols,» said Roderik van der Graaf, founder of Lemniscap, in the release.

Infrastructure spending

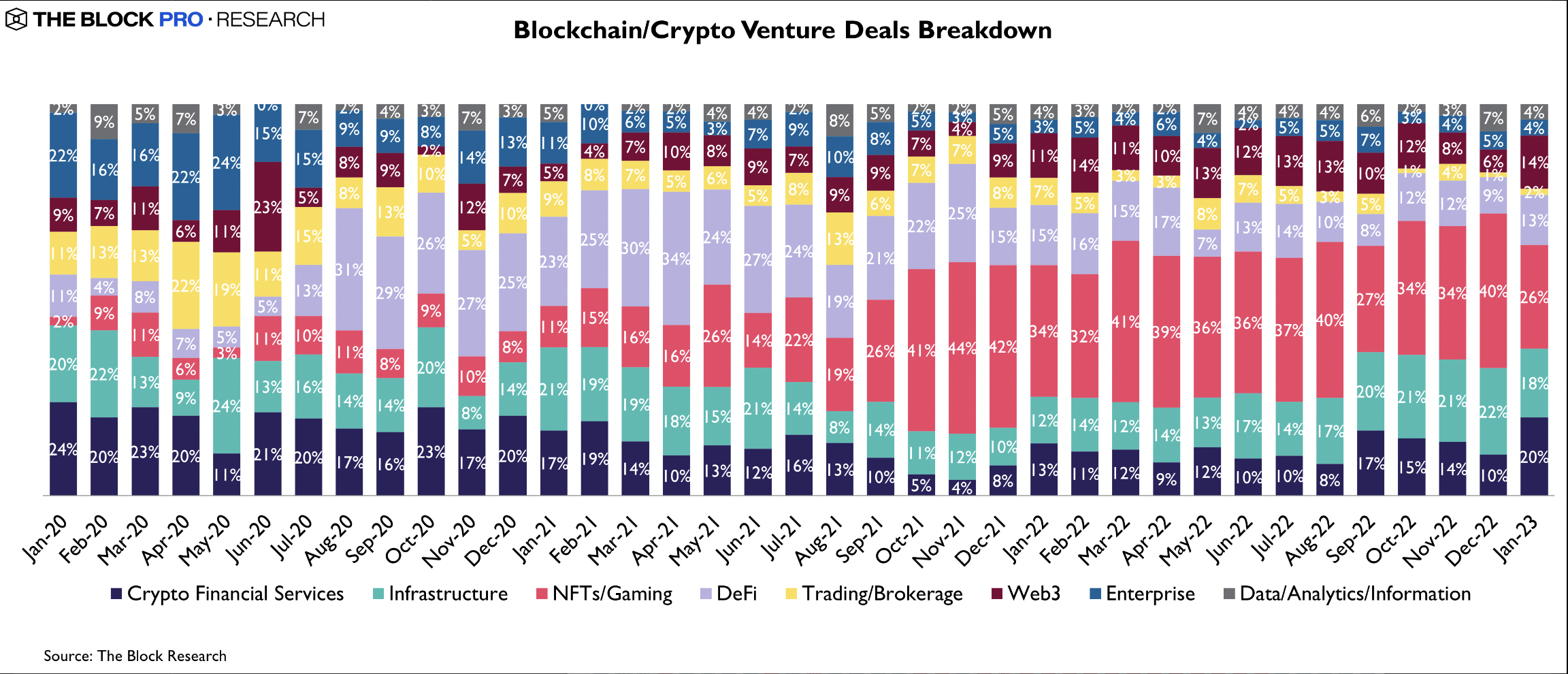

Infrastructure is the second category to receive the majority of venture funding in January, according to data from The Block Research.

«In past cycles, the Infrastructure category has attracted interest and investment as active investors who remained looked to discover foundational companies and projects,» said John Dantoni, research analyst at The Block Research, in the January report. «Over the past 6 months, infrastructure projects have accounted for roughly 20% of all seed deals.»

Breakdown of blockchain venture spend

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Nano

Nano  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD