Let’s Dispel Some Misconceptions About Wrapped Bitcoin and Ethereum

Decrypting DeFi is Decrypt’s DeFi email newsletter. (art: Grant Kempster)

There’s been a ton of chatter about wrapped tokens like Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH) this week—some of it legitimate, some of it top-tier shitposting.

Earlier this week, several notable crypto Twitter accounts began peddling the idea that WETH was on the verge of collapse.

“ATTENTION: WETH is about to be insolvent,” tweeted crypto influencer Cygaar. “I will begrudgingly bail out anyone holding WETH at a rate of 0.5 ETH per WETH in order to save this space. You can thank me once the crisis has been averted.”

“We might see a bank run on redeeming WETH soon,” tweeted Gnosis co-founder Martin Köppelmann.

None of this was true.

Unlike the bank-run tweets that swirled around Twitter amid the FTX collapse, WETH doesn’t have the same counterparty risk. There is no centralized organization custodying the underlying Ethereum. There are no over-leveraged funds in the Bahamas taking a massive risk with user funds.

Instead, the key risk here is smart contract risk.

To mint WETH, users deposit Ethereum into a smart contract rather than giving it to an exchange or a crypto lender to hold on to it. The reason people use WETH instead of ETH (after all, they’re basically the same thing, right?) is that it, unlike Ethereum, is also an ERC-20 token. This makes it much easier to integrate into various decentralized applications.

Thus, there was never a risk of insolvency or a bank run on this asset. It’s simply another example of the rather obnoxious sense of humor that exists in the industry. Sure, the smart contract could somehow break down, but it has existed and operated smoothly for so long that something like that would’ve already happened by now if there was some sort of bug.

WBTC, however, is much different.

“BitGo is the custodian for the BTC backing for wBTC,” wrote Rugdoc.io, a community-driven project that reviews smart contracts. “Bitgo froze FTX assets, creating a 4k surplus of BTC and the wBTC depeg. It’s not your Bitcoin if you hold wBTC.”

This asset basically lets you create an Ethereum-compatible version of Bitcoin so that it can be used in different DeFi applications. Even more simply, it’s an ERC-20 token pegged to the price of Bitcoin.

It’s also backed by real Bitcoin, which, as mentioned above, is custodied by a firm called BitGo. For every 1 WBTC in circulation, BitGo has 1 real Bitcoin.

Whenever a user wants to “unwrap” their WBTC and redeem it for the real deal, they must go through a merchant (this could be an exchange, for example). Doing this means destroying (or burning) that WBTC and withdrawing one of the Bitcoin from custody.

Critically, you can also see this minting and burning activity occurring on-chain thanks to a convenient dashboard.

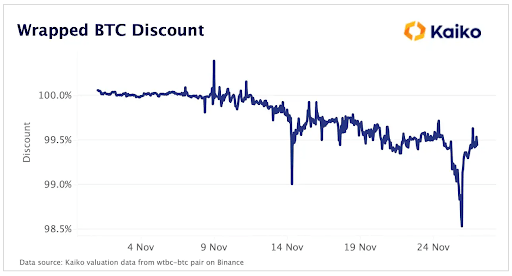

Last week WBTC depegged in price from the underlying Bitcoin, which—given its design—was actually a bit more worrisome (and not necessarily a mean-spirited Twitter joke).

Wrapped Bitcoin discount. Image: Kaiko.

Normally, when a discount like this emerges, market makers will swoop in and arbitrage the difference for profit by buying the cheaper WBTC and redeeming it for the real Bitcoin.

And that’s pretty much what they’ve been doing here, too. But because Alameda (the sister trading firm to the collapse FTX) was a huge WBTC user, their absence left a lot of arbitrage to do.

Thus, the market is doing a bit of catch-up as well as battling some serious FUD along the way.

Right now, WBTC is trading at roughly a $15 discount to the real deal. That’s peanuts. And it’s likely made some market makers all the richer along the way.

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay before it goes on the site. Subscribe here.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Zcash

Zcash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  0x Protocol

0x Protocol  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren