Let’s Take A Look At Bitcoin Scaling Solutions Impressive Growth In Recent Times

Notwithstanding the dispute, “Bitcoin fundamentalism” thinks that the Bitcoin network should be maintained as basic and reliable as possible, while “Bitcoin extenders” aim to introduce new financial use cases to Bitcoin. In any case, the introduction of Ordinals prompts a new wave of software creation on top of Bitcoin. Let’s take a look at Coincu’s recent development of popular Bitcoin scaling methods.

Stacks

Stacks makes use of a pyramid-shaped stack. The bottom layer is Bitcoin’s fundamental settlement layer, followed by Stacks, which adds smart contracts and programmability, and finally, Hiro, which increases scalability and speed.

Stacks is a Bitcoin Layer 2 since it employs its own smart contract language, Clarity, and writes historical transaction records into the Bitcoin network. The special thing is that Stacks also called itself Layer 1 before. Stacks has its own cryptocurrency, STX. As a representation of Bitcoin smart contracts, STX has recently been one of the best-performing assets.

Because the majority of existing apps based on Stacks are still Arkadiko Protocol, ALEX, Stackswap, CityCoins, and STX NFT, there is no change from PANews’ figures from a year ago, therefore I won’t go into depth here.

According to DefiLlama’s research, asset on Stacks have lately surged dramatically. TVL increased 190% in the last 30 days from $7.79 million to $22.66 million.

DEX ALEX has witnessed the most growth of all of them. Its TVL has grown by 247% in the last month. ALEX’s price has likewise grown from $0.011 in February to $0.079 currently.

Rootstock/RIF

Rootstock (RSK) is a Bitcoin EVM-compatible sidechain. It employs the same SHA-256 algorithm that Bitcoin does. Bitcoin miners have the option of “Merged Mining” while mining. More resource consumption is necessary, however, transaction fee revenue in Rootstock may be gained at the same time. Rootstock’s native token is Smart BTC (RBTC), a Bitcoin anchor coin that is also used to pay transaction fees.

Rootstock Infrastructure (RIF) is a Rootstock-based platform that promises to give developers with blockchain infrastructure and services, such as domain names, storage, authentication, and so on, to aid in creating and deploying dApps. Although Rootstock does not issue any other tokens outside RBTC, IOV Labs developed both Rootstock and RIF, and RIF has its own token, RIF.

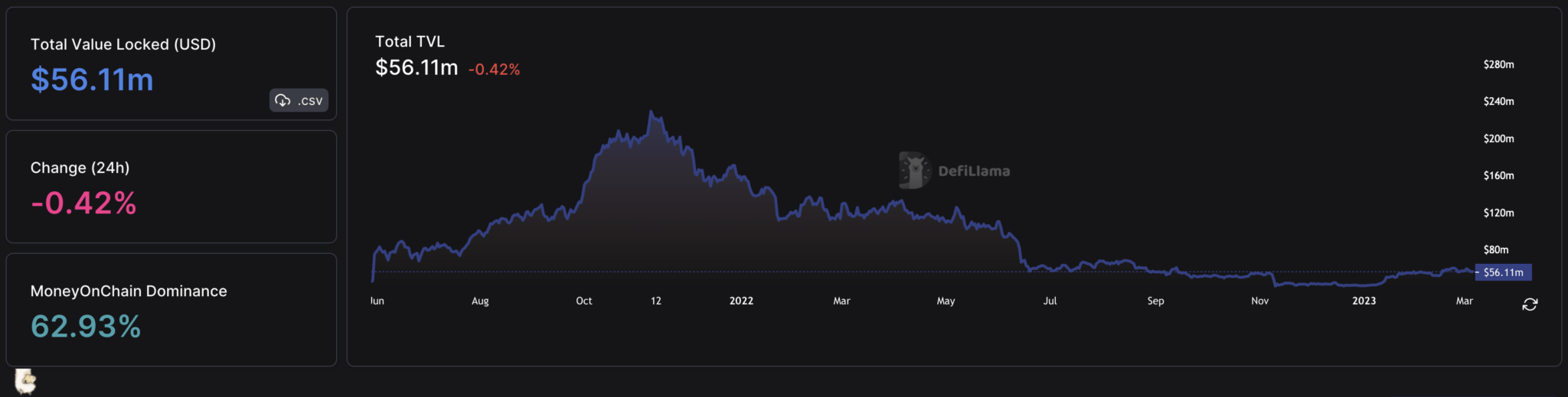

Rootstock’s TVL is $56.11 million, as shown by DefiLlama, although the recent rise is not visible, with a 3% increase in the last 30 days.

In the ecosystem, there are projects such as DEX, loan agreements, stable currency, and other sorts, and cross-chain assets from other chains like Ethereum may also be employed. However, Rootstock’s support for EVM and asset for ecosystem initiatives has not increased much in the last 30 days. DEX Sovryn has the highest gain, with a current TVL of $20.19 million, up 17.62% in the last month.

Liquid Network

Liquid Network is a side chain technology (also known as Layer 2) developed in September 2018 by Blockstream that seeks to give Bitcoin users with a quicker and more comfortable transaction experience while guaranteeing transaction security and privacy. The Liquid Joint Council, which comprises exchanges, financial institutions, and other Bitcoin-focused businesses, maintains and governs it.

In addition to rapid, inexpensive, and private transfer operations, Liquid Network can implement a variety of smart contract functions, such as developing DeFi apps (DEX Sideswap, lending platform Hodl Hodl, and so on), issuing stable coins, issuing security tokens, minting NFTs, and so on.

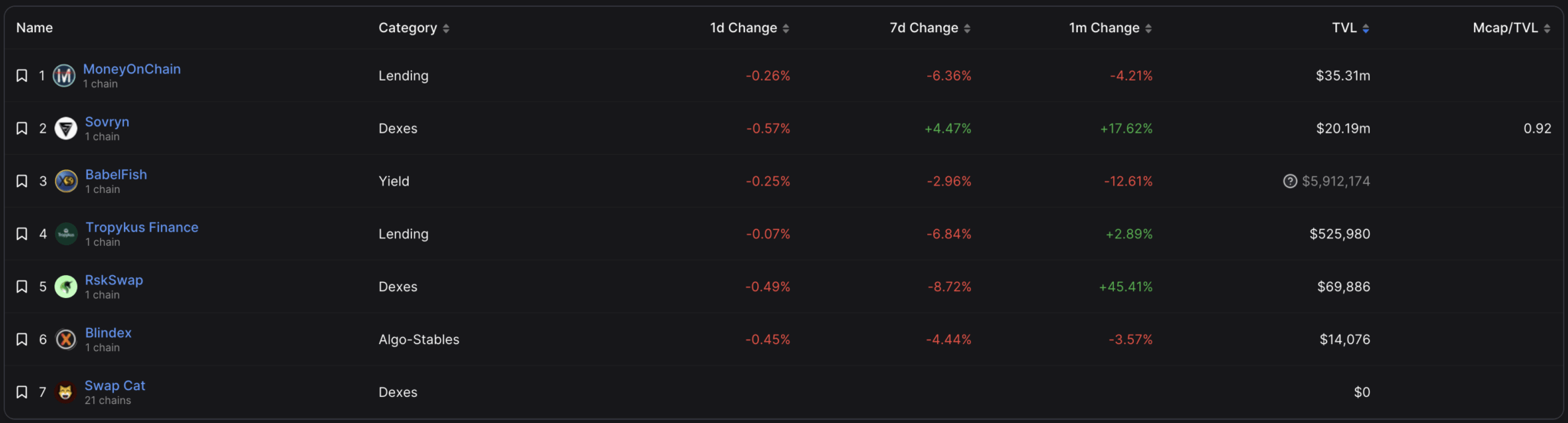

The Liquid Network’s L-BTC is still anchored by Bitcoin 1:1. According to Liquid’s official website, the circulation of L-BTC on the network has recently been constant, now at 3,552. The figures for January and February are 3567 and 3562 pieces, respectively.

Lightning Network

Bitcoin Lightning Network is a Bitcoin Layer 2 protocol that increases the speed and secrecy of Bitcoin transactions by providing a payment channel between transaction parties.

When the payment channel is created, both parties can conduct transactions by sending off-chain transactions. Because the transaction is simply recorded between the two participants in the channel and does not need to be confirmed on the Bitcoin network, it is fast and inexpensive. At any point, both parties to the transaction can submit the transaction records to the Bitcoin network for settlement, completing the Bitcoin transfer.

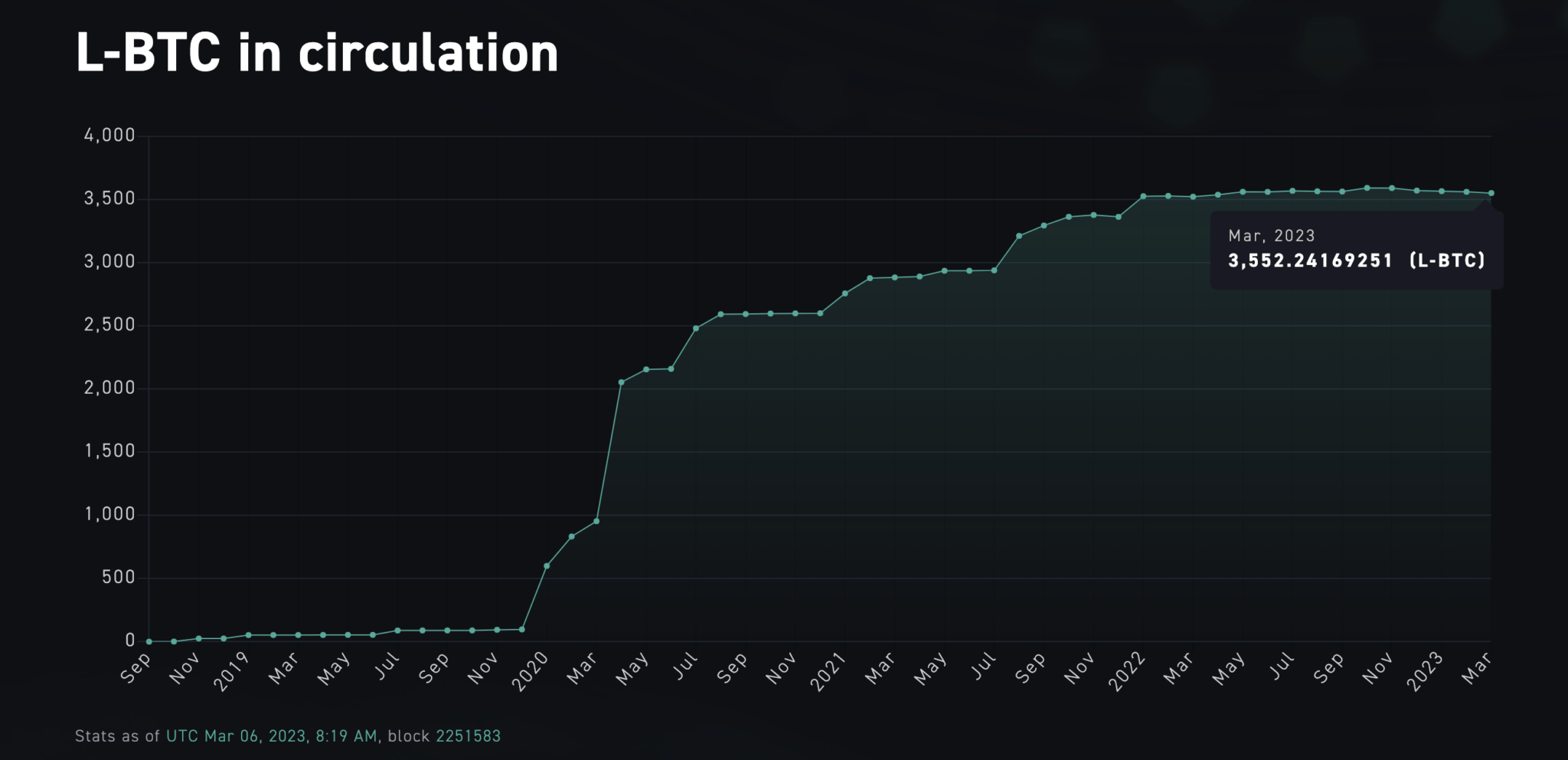

According to 1ML statistics, the current asset in the lightning network is 5388 BTC, up 1.1% in the last 30 days, there are 16,311 nodes, and there are 76,316 channels.

Statechains

Statechains, a scaling solution for off-chain Bitcoin transfers, are comparable to but not the same as the Lightning Network. The ownership of the channel transfers assets in the Lightning Network, whereas the ownership of the BTC deposit (UTXO) private key transfers assets in Statechains (ephemeral key).

Statechains will initially build a multi-signature wallet with various private keys that will store the bitcoins linked with it between depositors and statechain organizations. The private key holder can generate transaction records on Statechain and transfer the private key to others, resulting in the transfer of Bitcoin assets. Statechain transactions do not require every confirmation, enhancing transaction speed and lowering handling fees.

The Mercury wallet developed by Commerceblock is one solution to Statechains technology.

The total deposit in the Mercury wallet is now 23 BTC, and the total withdrawal is 19.8 BTC; nevertheless, the program is still in its early stages. BTC liquidity must be a specified amount, such as 0.001 BTC, 0.01 BTC, 0.1 BTC, and so on. As a result, whether recharging or transferring, only a certain quantity may be used.

Drivechain

Drivechain is an open sidechain technology for Bitcoin that allows users to design multiple sidechains to meet their own needs. It is based on two Bitcoin enhancement proposals: BIP 300 “Hashrate Escrows,” which compresses 3-6 months of transaction data into 32 bytes using “Container UTXOs,” and BIP 301 “Combined Blind Mining” (Blind Merged Mining). The network’s security, like RSK, is maintained by current Bitcoin miners through collaborative mining.

Drivechain’s emergence is intended to compete with Ethereum, Zcash, and Bitcoin forked chains, among others, while retaining Bitcoin’s security and decentralization and introducing new features to Bitcoin. These side chains also make use of Bitcoin. The anchor currency is utilized for transfers as well as other purposes.

Layer 2 Labs, Drivechain’s development business, reported the conclusion of a $3 million seed round of fundraising in December 2022. The project has yet to find any large-scale applications.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Qtum

Qtum  Synthetix

Synthetix  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur