Lido DAO Surges by 12% and Now Aims at 25% Rally Continuation

Lido DAO’s most recent price surge was fairly unexpected, considering its price performance in the last few months. However, Ethereum’s most recent rally played in favor of Lido Finance, which remains the biggest validator on the network.

Thanks to the biggest ETH stake in the whole industry, LDO holders become beneficiaries of almost every major update on Ethereum and its positive price performance. The correlation between LDO and Ether still remains at an extremely high level, and the most recent rally is another confirmation of it.

However, Lido should not be considered an asset separate from Ethereum, considering its current state in the market. Most investors either choose LDO as a way of being exposed to staked Ethereum or as a spot asset with more volatility.

However, the market analysis shows that Lido’s volatility has not been any higher than Ethereum’s, which makes exposure to Ether with the help of Lido almost pointless.

LDO technical analysis

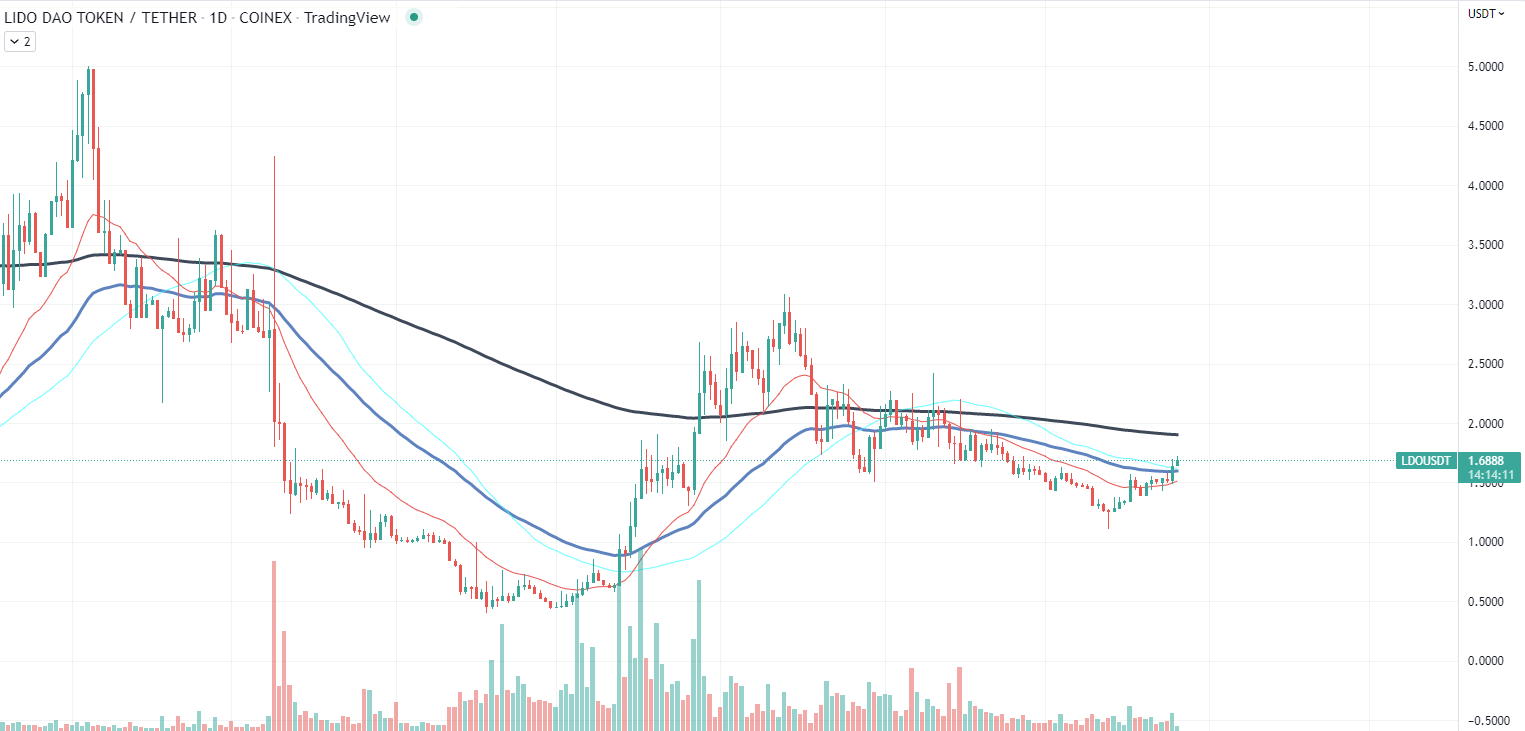

Despite almost a complete replication of Ethereum’s price performance, the difference in listing timings can provide additional insights for those who are willing to invest in LDO. According to the daily chart, the assets successfully broke through the local resistance level of the 50-day moving average in the same manner as Ethereum.

However, the low trading volume suggests that Lido itself is not interesting to investors, and most of the buying power appeared because of the aforementioned correlation. In the long term, LDO is moving in a downtrend despite some success it had prior to the implementation of the Merge update on the Ethereum network.

In order to end the year-old downtrend, Lido has to gain a foothold above the 200-day MA resistance level, located 25% above the current price.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD