Long the Bitcoin bottom, or watch and wait? Bitcoin traders plan their next move

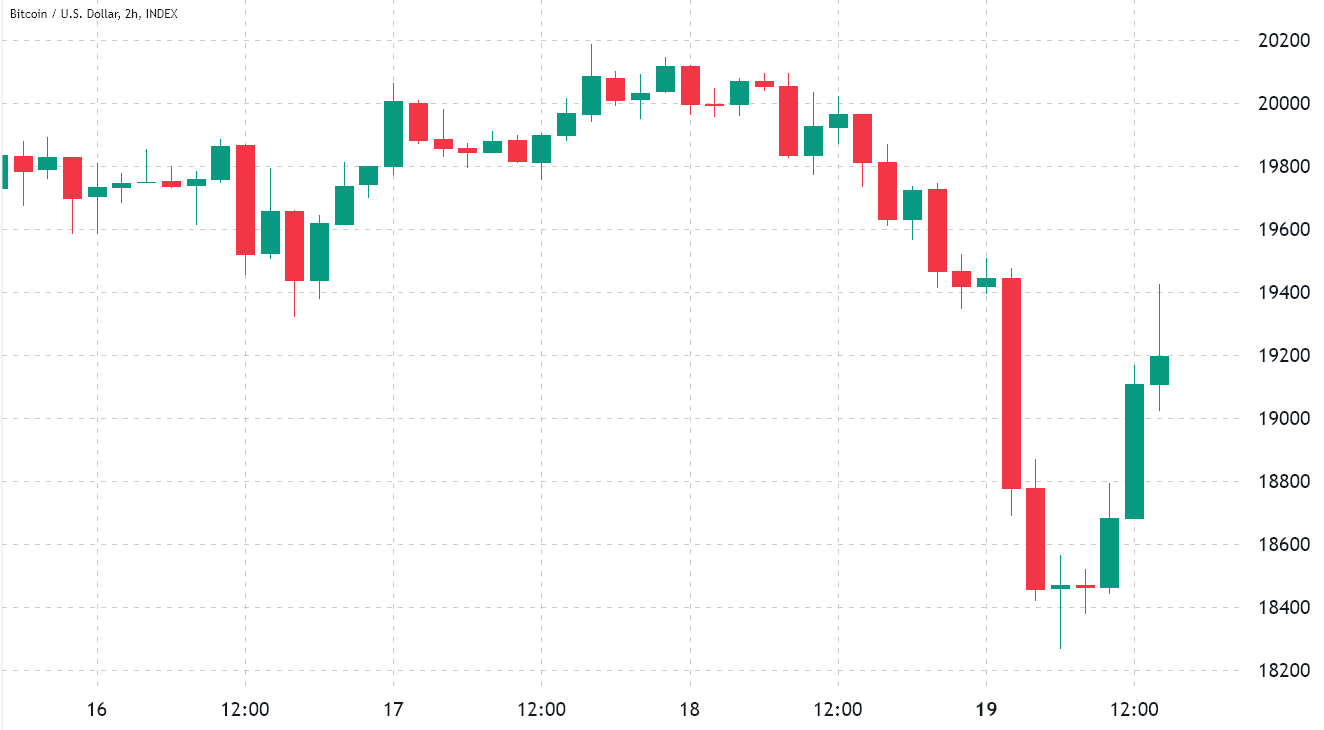

Bitcoin (BTC) faced a 9% correction in the early hours of Sept. 19 as the price traded down to $18,270. Even though the price quickly bounced back above $19,000, this level was the lowest price seen in three months. However, pro traders held their ground and were not inclined to take the loss, as measured by derivatives contracts.

Bitcoin/USD price index, 2-hour. Source: TradingView

Pinpointing the rationale behind the crash is extremely difficult, but some say United States President Joe Biden’s interview on CBS «60 Minutes» raised concerns about global warfare. When responding to whether U.S. forces would defend Taiwan in the event of a China-led invasion, Biden replied: «Yes, if in fact, there was an unprecedented attack.»

Others cite China’s central bank lowering the borrowing cost of 14-day reverse repurchase agreements to 2.15% from 2.25%. The monetary authority is showing signs of weakness in the current market conditions by injecting more money to stimulate the economy amid inflationary pressure.

There is also pressure from the upcoming U.S. Federal Reserve Committee meeting on Sept. 21, which is expected to hike interest rates by 0.75% as central bankers scramble to ease the inflationary pressure. As a result, yields on the 5-year Treasury notes soared to 3.70%, the highest level since November 2007.

Let’s look at crypto derivatives data to understand whether professional investors changed their position while Bitcoin crashed below $19,000.

There was no impact on BTC derivatives metrics during the 9% crash

Retail traders usually avoid quarterly futures due to their price difference from spot markets, but they are professional traders’ preferred instruments because they prevent the fluctuation of funding rates that often occurs in a perpetual futures contract.

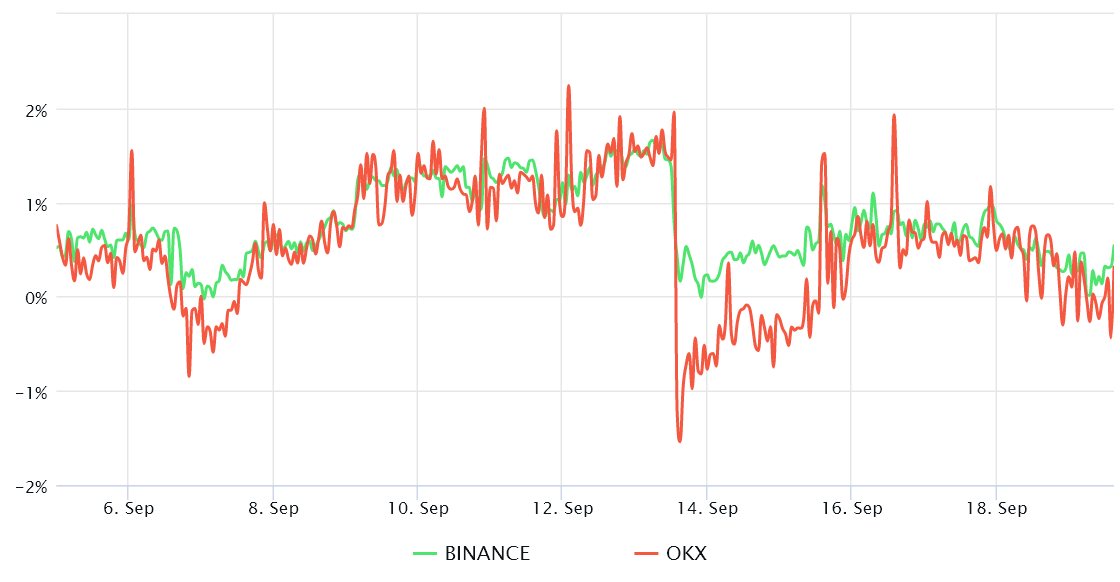

Bitcoin 3-month futures annualized premium. Source: Laevitas

The indicator should trade at a 4% to 8% annualized premium in healthy markets to cover costs and associated risks. Thus, one can safely say that derivatives traders had been neutral to bearish for the past two weeks as the Bitcoin futures premium held below 2% the entire time.

More importantly, the shakeout on Sept. 19 did not cause any meaningful impact on the indicator, which stands at 0.5%. This data reflects professional traders’ unwillingness to add leveraged short (bear) positions at current price levels.

One must also analyze the Bitcoin options to exclude externalities specific to the futures instrument. For example, the 25% delta skew is a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection.

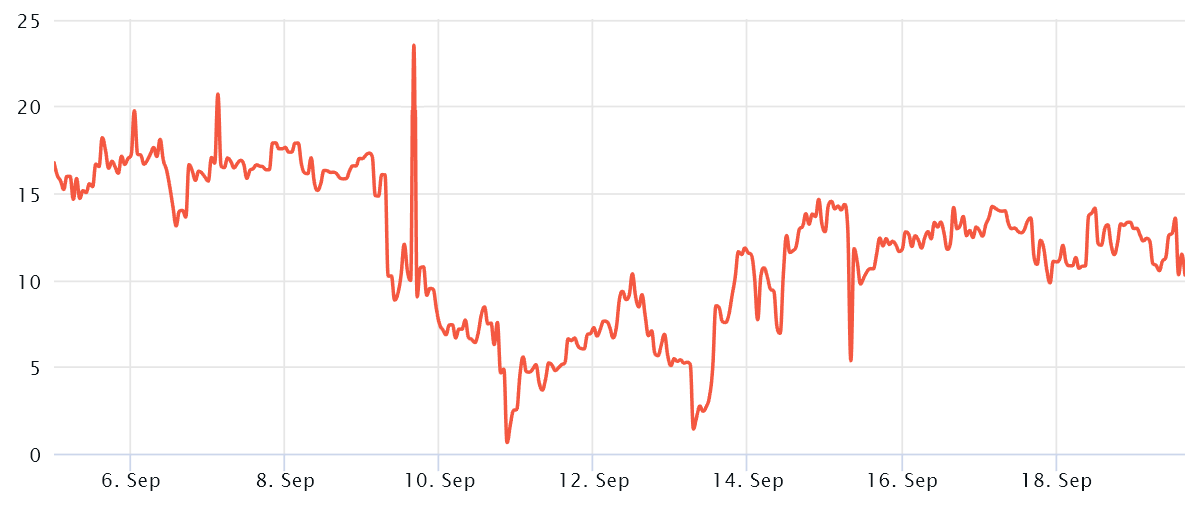

Bitcoin 30-day options 25% delta skew: Source: Laevitas

In bear markets, options investors give higher odds for a price dump, causing the skew indicator to rise above 12%. On the other hand, bullish trends tend to drive the skew indicator below negative 12%, meaning the bearish put options are discounted.

The 30-day delta skew had been near the 12% threshold since Sept. 15, and signaled that options traders were less inclined to offer downside protection. The negative price move on Sept. 19 was not enough to flip those whales bearish, and the indicator currently stands at 11%.

Related: Bitcoin, Ethereum crash continues as US 10-year Treasury yield surpasses June high

The bottom could be in, but it depends on macroeconomic and global hurdles

Derivatives metrics suggest that the Bitcoin price dump on Sept. 19 was partially expected, which explains why the $19,000 support was regained in less than two hours. Still, none of this will matter if the U.S. Federal Reserve raises the interest rates above consensus or if stock markets collapse further due to the energy crisis and political tensions.

Therefore, traders should continuously scan macroeconomic data and monitor the central banks’ attitude before trying to pin a flag on the ultimate bottom of the current bear market. Presently, the odds of Bitcoin testing sub-$18,000 prices remain high, especially considering the weak demand for leverage longs on BTC futures.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Zcash

Zcash  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond