What Is Shanghai Update? Ethereum’s Upcoming Hard Fork Explained

The Shanghai update is a hard fork for the Ethereum network slated to go live on April 12, 2023. It will unlock ETH deposited on the Beacon Chain and allow validators to withdraw their funds.

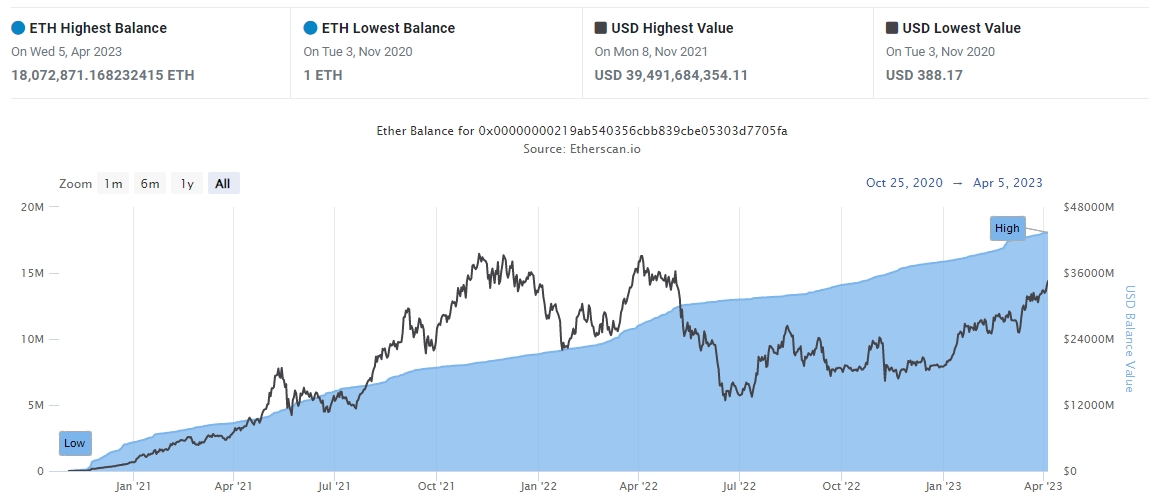

As of April 2023, there is nearly $34 billion worth of ETH in the Beacon Deposit Contract (about 15% of Ethereum’s entire circulating supply), which could have massive implications for the price of Ethereum should a large part of the funds be sold.

In this article, we are going to discuss how the sudden influx of newly released liquidity could impact Ethereum’s price and examine the technical aspects of the Shanghai update.

Ethereum’s Shanghai update key takeaways:

- The Shanghai update for Ethereum is launching on April 12, unlocking staked Ether (ETH) withdrawals from the Beacon Chain.

- There is currently over $33 billion worth of Ether staked in the deposit contract, prompting concerns about what could happen to ETH’s price if they find their way on exchanges.

- In addition to unlocking staked ETH, the Shanghai upgrade will introduce several other EIPs that will enhance the performance of the Ethereum network.

- In recent months, Shapella has become the favorite for the upcoming hard fork. It is a combination of Shanghai (the name of the upgrade of the execution layer) and Capella (the simultaneous upgrade of the consensus layer).

What is the Shanghai update?

The Shanghai update is a hard fork for Ethereum that will, among other things, unlock ETH deposited on the Beacon Chain, a Proof-of-Stake (PoS) blockchain that launched in late 2020. The Beacon Chain can be thought of as the backbone of the Ethereum network, providing the consensus layer necessary for the Ethereum protocol to operate as a PoS system.

The ability for validators to withdraw their ETH is just one of the improvements that will go live with the Shanghai update – here’s the entire overview of EIPs (Ethereum Improvement Proposals) that will be implemented as a part of the Shanghai update:

- EIP-3651 – Change the “COINBASE” address to start as warm at the start of transaction execution to lower the gas cost.

- EIP-3855 – Reduce contract code size and the risk of contracts misusing various instructions as an optimization measure.

- EIP-3860 – Optimize “initcode”’s length so that it is fairly charged and to minimize future risks, as well as to simplify Ethereum Virtual Machine (EVM) engines.

- EIP-4895 – Introduce a new operation to facilitate withdrawals and define an object called “withdrawal” that describes withdrawals validated at the consensus layer.

- EIP-6049 – Deprecate the use of the “SELFDESTRUCT” command due to a breaking change planned to this feature in the future.

The implications of staked ETH withdrawals

More than 18 million ETH (worth over $33 billion at the time of writing) has been deposited in the Ethereum staking contract since its 2020 launch. Source

With the launch of the Shanghai update, about $33 billion that has been locked on the Beacon Chain over the year will be unlocked. The first Ethereum validators deposited their funds on the Beacon Chain in December 2020, when Ethereum was trading at around $600.

Since Ether is currently trading about 3 times higher, it is not unreasonable to assume that early ETH stakers might be looking to sell their staked funds for a profit. This could introduce massive selling pressure and decrease the price of ETH.

A maximum of 1350 validators per day will be able to withdraw their staked Ethereum, which amounts to about 0.2% of all staked assets. This should significantly reduce the potential impact of withdrawals on ETH price and ensure a sufficient number of validators to support the network’s uninterrupted operations.

On the other hand, validators not having their funds locked on the Ethereum blockchain might actually increase the demand for ETH. The reason for this is that many Ethereum holders might find staking Ethereum more attractive post-Shanghai, since their funds won’t get locked and will be freely available for withdrawal.

In the long run, Shanghai could improve Ethereum’s investment prospects and increase the number of users participating in securing the network by staking their coins. The end result would be a more robust proof of stake consensus and, subsequently, a more secure smart contract platform as a whole.

What’s the difference between Shanghai, Capella, and Shapella?

For the longest time, the upgrade meant to bring staked Ethereum withdrawals was referred to as the “Shanghai” update. However, in recent months, some other names started to emerge related to the upgrade – such as “Capella” and “Shappella” – causing some confusion among Ethereum users.

The Shanghai update has different names depending on where it is implemented – either the execution or the consensus layer. Here’s how that works:

- Shanghai is the name of the upgrade on Ethereum’s execution layer.

- Capella is the name of the Shanghai upgrade on the consensus layer.

- Shapella is basically the combination of Shanghai and Capella, meant to describe the upgrade across both the execution and consensus layers.

What is the Shanghai update release date?

The Ethereum mainnet release of the Shanghai update has been confirmed for April 12, 2023. Initially, the update was set to launch in March 2023, but the release date back got delayed.

It is worth noting that the upgrade has previously been successfully implemented on Ethereum testnets – on the 28th of February on Sepolia, and on the 14th of March on Goerli.

Ethereum Shanghai upgrade price prediction: A bounce back to a new ATH?

Ethereum is predicted to nearly double its previous ATH and surpass $9,000 in early 2024.

According to our algorithmically generated Ethereum price prediction, the price of Ethereum could see notably positive price activity over the next 12 months and reach as high as $9,400 in April 2024. The road there could be bumpy, however.

The algorithm predicts the price of ETH to drop first increase to $2,500 in May, and then drop to $1,050 in the next 3 months. After that, a massive rally could commence that will see Ethereum nearly double its previous all-time high.

The bottom line: Shanghai update is ushering in a new era for Ethereum

Last year, the historic Merge upgrade saw Ethereum transition to a proof of stake consensus mechanism and reduced the power expenditure of Ethereum by over 99%. This year, the Shanghai update will take Ethereum a step further and enable validators to withdraw their ETH, which could turn out to be a major turning point for Ethereum’s price in the long term.

The upcoming Shanghai update has earned Ethereum the top spot on our weekly-updated list of best cryptocurrencies to buy and the number one ranking in our selection of best altcoins.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur