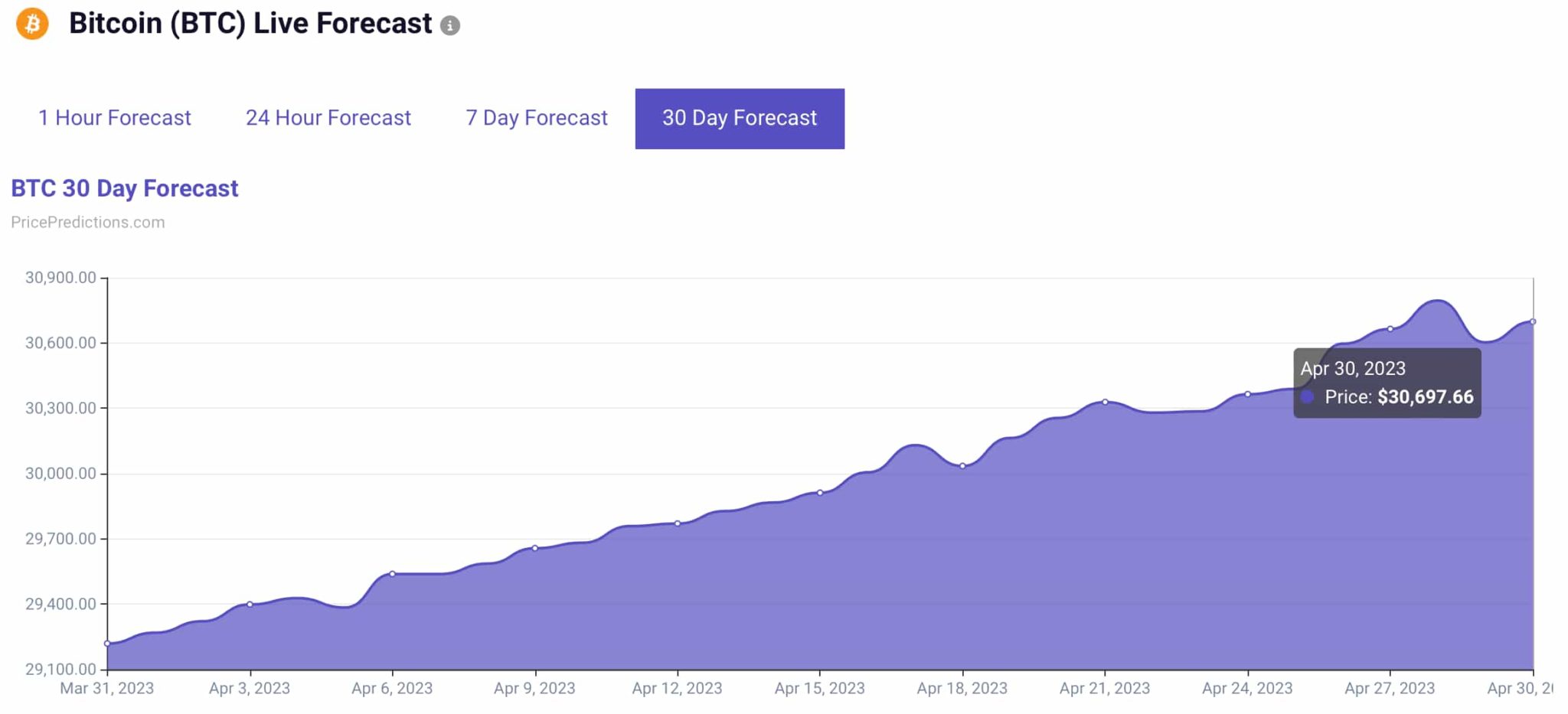

Machine learning algorithm sets Bitcoin price for April 30, 2023

Bitcoin’s (BTC) price briefly climbed above $29,000 on March 30 as the flagship digital asset continues its push to reclaim the $30,000 psychological level.

The largest cryptocurrency has climbed more than 20% since March 1, when it was trading slightly above $23,000. Given the bullish month for BTC, investors already have their eyes set on the near-term price for the end of April, hoping the asset can experience similar growth.

With this in mind, Finbold has consulted the machine learning algorithms at the crypto monitoring platform PricePredictions. Notably, the AI technology predicts BTC to trade above $30,000 by the end of next month. The forecast sets Bitcoin’s price at $30,697 on April 30, 2023, per the latest information accessed on March 30.

The projection is based on indicators such as relative strength index (RSI), moving averages (MA), moving average convergence divergence (MACD), Bollinger Bands (BB), and others. It represents a 6.8% increase from Bitcoin’s price at the time of publication.

Bitcoin price analysis

As things stand, Bitcoin’s current price represents an increase of 0.47% on the day and a more significant 3.54% across the previous week, with a total market cap of $553 billion.

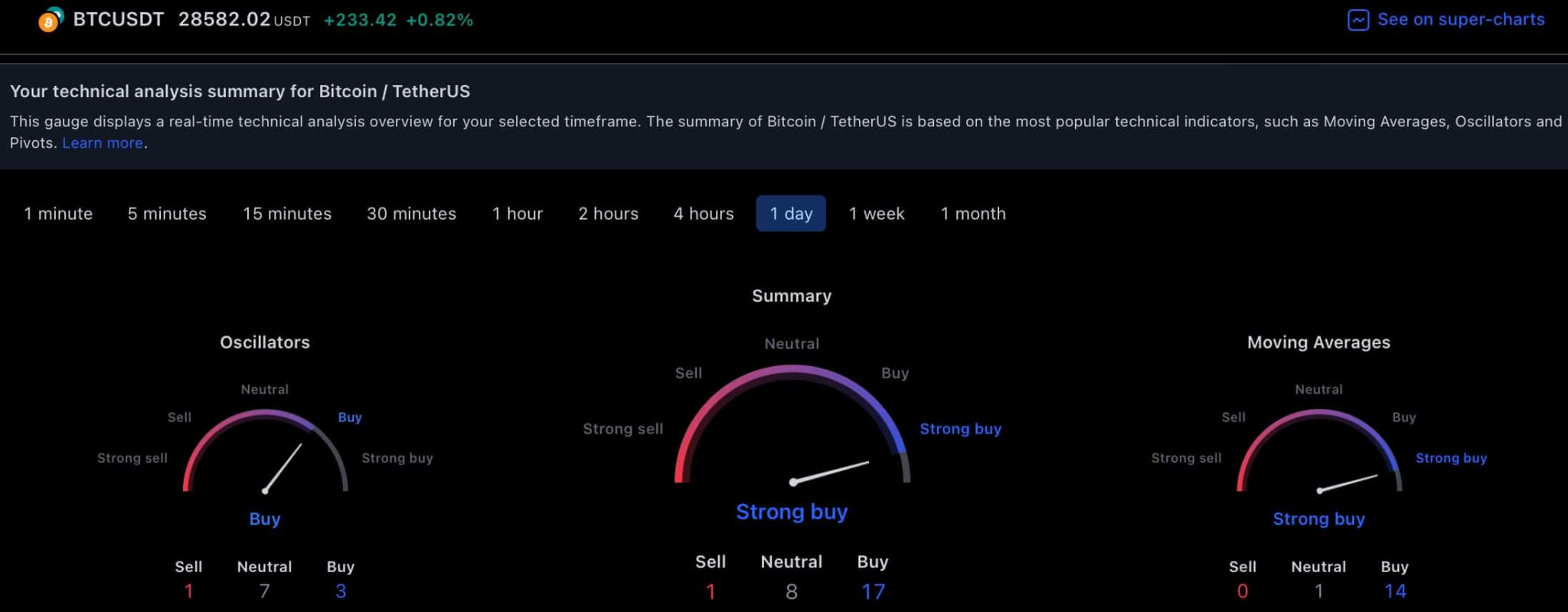

Meanwhile, the sentiment on the 1-day gauges at the finance and crypto tracking website TradingView is bullish. The summary suggests a ‘strong buy’ at 12, as summarized from the oscillators indicating ‘buy’ at three and moving averages in the ‘strong buy’ range at 14.

Despite the bullishness on the charts, Chief Market Strategist of InTheMoneyStocks.com, Gareth Soloway, believes the flagship digital asset will plummet to levels not seen since November 2020.

Soloway noted that as the financial system becomes more stable, Bitcoin’s value will decrease, potentially dropping to as low as $9,000 in 2023. Indeed, he hypothesizes that BTC will initially drop due to the ongoing banking crisis and potential stock market sell-off but will then recover and continue its long-term growth trajectory.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond