Major Bitcoin Whales Abandoning Crypto Exchanges

Bitcoin whales, or individuals holding large amounts of the cryptocurrency, appear to be gradually retreating from crypto exchanges, according to a critical indicator known as the exchange-whale ratio.

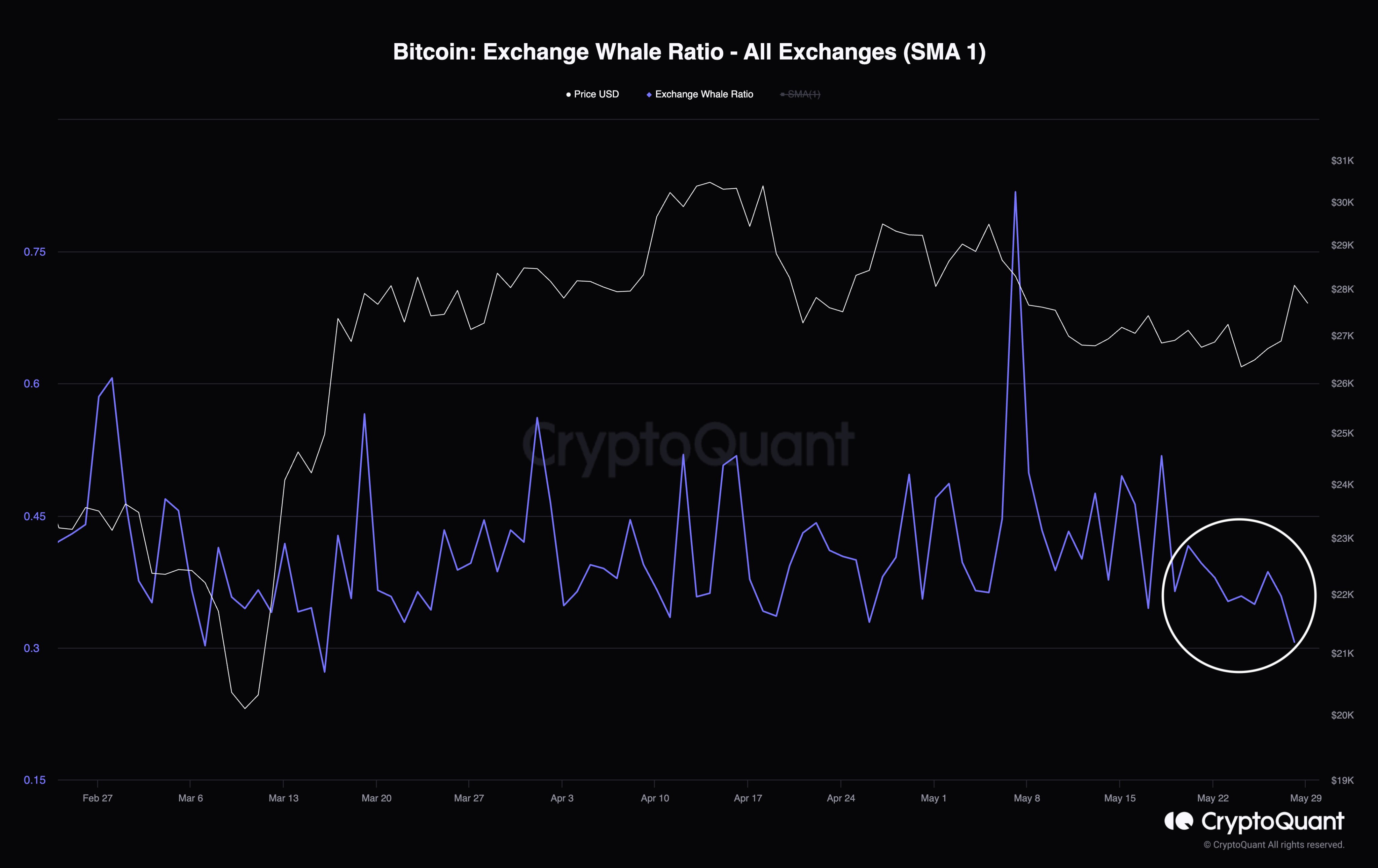

This metric, which is the total BTC amount of the top 10 transactions divided by the total BTC amount flowing into exchanges, has slid to around 0.3, a level not seen since March.

As per this figure, large bitcoin holders seem to be either hodling or possibly moving their assets into other forms of investments or private wallets.

The exchange-whale ratio is primarily used to identify the exchanges favored by these so-called whales. Analyzing the relative size of the top 10 inflows to total inflows sheds light on where the big players are most active.

For instance, Gemini, which is known to cater predominantly to whale users, often witnesses dramatic price fluctuations. This behavior can lead to potential risks for some traders while simultaneously opening opportunities for arbitrage.

Meanwhile, the Bitcoin price seems relatively stable, sitting at $27,642, according to data from CoinGecko. This calm pricing in the face of whales’ movements might suggest a growing resilience in the market to large sell-offs.

What remains unclear is the reason behind this massive whale migration. This might be due to whales feeling more comfortable with their coins in personal wallets. Others might speculate that these large holders could be diversifying into other investment avenues or cryptocurrencies.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond