MakerDAO adds 27% to lead weekly gains, outperforms bitcoin and ethereum

The governance token of MakerDAO, MKR, topped gains last week, trackers on Mar. 5 show.

MakerDAO leads weekly gains

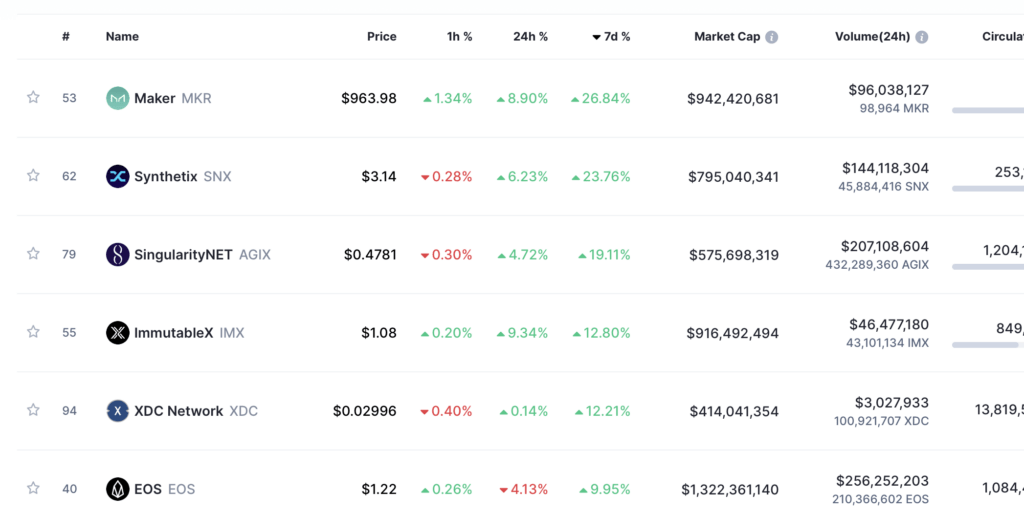

MKR roared roughly 27% in seven days ending Mar. 5, pushing its market cap to over $942m. At this level, MKR outperforms the broader crypto market, including bitcoin (BTC) and ethereum (ETH).

Top weekly performers: CoinMarketCap

As an illustration, BTC and ETH are down 4.5% and 3.5%, respectively, in the past week of trading.

As of writing, MKR is changing hands at $963, up about 9 percent in the past 24 hours and stable in the last hour.

There are several factors behind the MKR surge. Among them is news that the protocol might soon allow users to borrow DAI, their algorithmic stablecoin tracking the USD, using MKR.

It’s devastatingly disappointing to see @MakerDAO’s co-founder pushing this plan. It’s as if nothing was learned this cycle. pic.twitter.com/XQq8NydHqb

— PaperImperium (@ImperiumPaper) February 23, 2023

MakerDAO also reduced fees to as low as 0.5% on its staking product that’s anchored on Rocket Pool ETH (rETH). The 0.5% annual fee is one of the lowest among competitors.

• Annual fees as low as 0.5%.

• Maker Protocol.

• @Rocket_Pool staked ETH.

• DAI stablecoin.

The cheapest $rETH borrowing product through the largest DeFi lending protocol with the most liquid decentralized stablecoin. pic.twitter.com/xDsApOt7an

— Maker (@MakerDAO) March 1, 2023

Besides the fee change, the protocol also increased its debt ceiling from 5m to 10m DAI. Relaxing the debt ceiling means the liquidation ratio for the rETH vault is more attractive, a net positive for MKR.

MakerDAO is a decentralized money market and one of the first DeFi platforms. It allows token holders to lend out assets in return for a yield. Meanwhile, borrowers can take loans by depositing collateral. The protocol remains one of the largest DeFi solutions.

As of Mar. 5, DeFiLlama shows that it had a total value locked (TVL) of $7.02b, down two percent in the last week.

Top DeFi protocols by TVL: DeFiLlama

Even so, it remains the second largest DeFi protocol by TVL only after Lido Finance, a decentralized liquidity provider allowing users to stake on, among other proof of stake blockchains, Ethereum.

Synthetix among other top performers

Besides MakerDAO, Synthetix’s native token, SNX, comes in second, adding 23%.

After a successful security audit, the decentralized derivatives DEX recently deployed their v3 on the Ethereum mainnet. Synthetix v3 on Ethereum is more efficient and allows developers to create even more complex derivatives.

The Road to Synthetix V3 has officially begun!

Learn more ?https://t.co/y1CLOG1TRF https://t.co/ZoJukjKQlR pic.twitter.com/6LrCanqZeQ

— Synthetix ⚔️ (@synthetix_io) February 22, 2023

Meanwhile, SingularityNet coin, AGIX; ImmutableX, IMX; and the XDC Network, XDC, posted double-digit gains, capping the top five by adding 19%, 12.8%, and 12.2%, respectively.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD