NFL superstars back Coolkicks founder’s $6 million raise for collectible trading platform

The team behind the legendary Coolkicks sneaker chain has raised $6 million for their new web3 endeavor, MynaSwap.

Built on the Avalanche network, MynaSwap is a trading and vaulting platform for collectibles, such as sneakers, sports cards and watches.

Investors include the Avalanche ecosystem fund Blizzard, Spartan Capital, Wave Financial and NFL superstars Odell Beckham Jr. and Kyler Murray, according to a company release.

Wait, what is Coolkicks?

Coolkicks is a collectible sneaker retail chain founded by sneakerhead Adeel Shams. The brand is best known for its flagship store on Melrose Avenue in Los Angeles, which has attracted visits from celebrities such as NBA player Ja Morant, NFL quarterback Drew Brees and entrepreneur Gary Vee.Over 1.4 million subscribers on YouTube tune in to watch celebrities drop by the store.

Shams’ collection of stores has inspired the vision for his most recent endeavour. He noticed that people were often trying to trade items from his collectible streetwear store with items from the sneaker store in LA.

Shams and his MynaSwap co-founder Sukh Singh saw potential in this business model and believed it could now scale globally with blockchain technology.

“The blockchain aspect allows you to do this much easier than the web2 [technologies],” said Shams in an interview with The Block. “There’s no brand out there that’s doing this currently and we feel like with the brand that we built in the last six to eight years and the relationships we’ve fostered, we feel like we could take the space over.”

Introducing MynaSwap

MynaSwap is a platform that enables individuals to discover, buy, sell and trade collectibles around the world.

Users will send physical items to MynaSwap’s vault for authentication. If the items pass the check, they will then be stored in a high-security, temperature-controlled vault and minted as a digital asset.The owner will then be able to trade and sell the corresponding digital asset on the MynaSwap platform.

“This is a common denominator across a lot of these verticals, whether it’s sneakers, watches, sports, cards, wine,” Singh said. “A lot of times collectors will keep a small portion of the collection at home, but they don’t necessarily need to keep 65 watches at home, right? They might keep three or four of their favorites and the rest they can vault it.”

When the owner does want custody, they just need to request it on the platform.

“In that case, it will just go through our outbound process,” Singh said. “Our outbound process ensures delivery in two to three business days, which is effectively 50% faster than any of our counterparts and then we would burn the digital twin from circulation.”

Coolkicks already has a subscription-based app with over 200,000 users, Shams said. They will be transitioning those users to MynaSwap, which is set to launch in the fourth quarter of this year.

“[MynaSwap is] gonna have a large Coolkicks imprint and there’s 100% support,” Singh said. “We even envision where Coolkicks, the brick-and-mortar physical footprint, will be used as an onboarding center for Myna users and Myna inventory in upon launch.”

The team believe it’s vital to provide services to both crypto natives as well as “no-coiners.” Users will be able to choose to either self-custody or sign up for a Myna custodial wallet with email and password.

Raising at a $50 million valuation

Coolkicks launched without any outside capital where everything was bootstrapped. The team knew how to build brand, but they were starting from scratch when it came to fundraising.

For the Coolkicks team launching MynaSwap is almost like working backwards, Singh said.

“We stuck to our guns at a $50 million valuation,” Singh said. “We didn’t want to budge from there. Multiple people told us to downsize the round as well to a lower valuation and that’s not something we wanted to compromise on, so it took us a little bit longer to raise.”

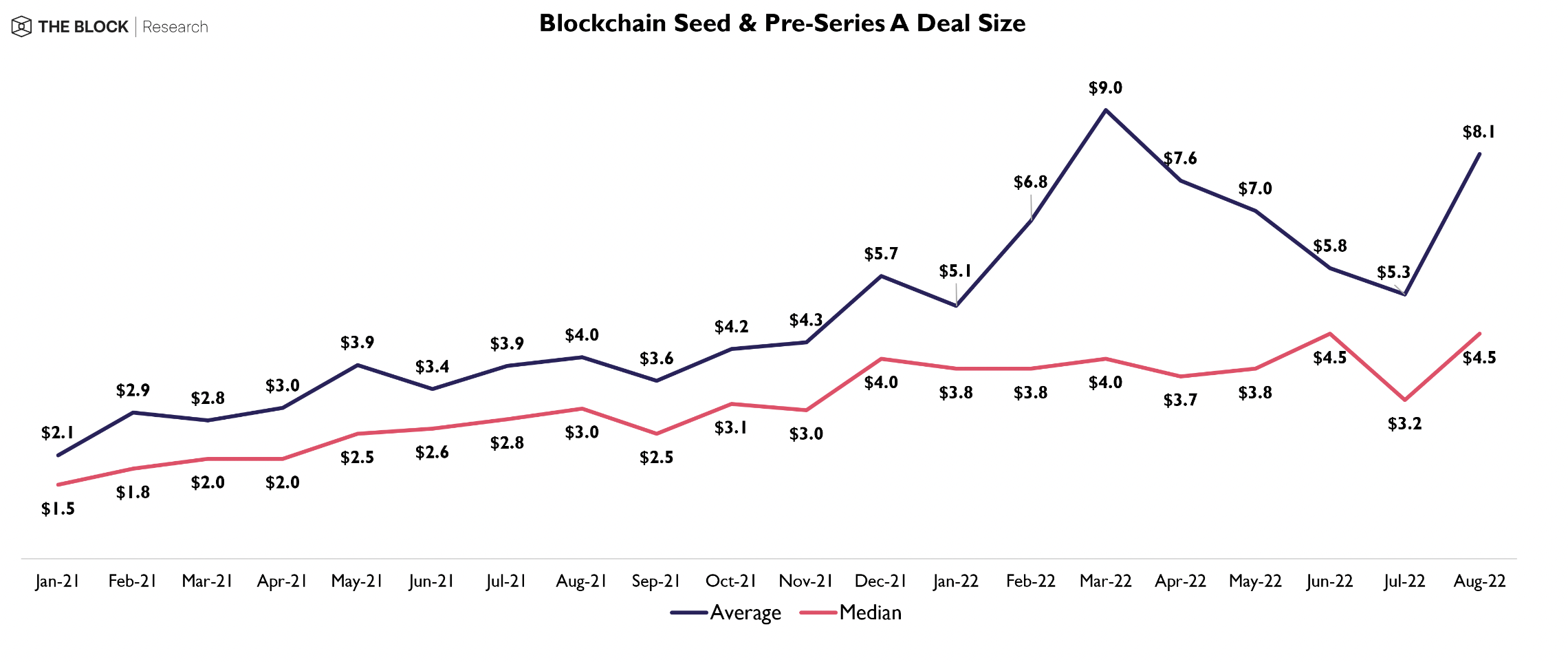

The Block Research

Blockchain seed and pre-Series A deal size

Ultimately the round ended up oversubscribed. The $6 million raise is above the median check size for a seed round in August, according to data from The Block Research.

“I think that speaks to the strength of the team, the product vision and just all-in-all execution and what we’ve done in the past,” Singh said.

The cap table features several top athletes. Many of these athletes connect with the MynaSwap platform because they are in lockstep with culture, Singh said.

“What’s more important is they also understand the concept of these assets going up in price,” Singh said. “These guys have been collecting for a long time, right? They’re one of us. They were collectors when they were younger, and now they’ve just reached a level of stardom and fandom where they could do that and amplify that even more.”

The funds from the round will be used to grow the team of nine and expand vault locations globally.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Chainlink

Chainlink  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Monero

Monero  Maker

Maker  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  Enjin Coin

Enjin Coin  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  Siacoin

Siacoin  Zcash

Zcash  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur  HUSD

HUSD