No Sell-Off After Ethereum’s Shapella Upgrade, Claims On-Chain Expert

Profit and loss analysis suggests lower-than-expected selling pressure following the Ethereum Shapella upgrade

The highly anticipated Shapella upgrade of Ethereum, a hard fork scheduled for April 12, 2023, brings with it significant implications for the crypto market. Combining elements from the proposed Ethereum Improvement Proposals “Shanghai” and “Capella,” the Shapella upgrade will allow stakers and validators to withdraw assets from the Beacon Chain.

Ethereum Price Prediction After Shanghai Upgrade: Subdued Selling Pressure

With staked Ether accounting for roughly one-seventh of the total supply of about 16 million coins, this development carries immense weight. The current value of all staked Ether is over $26 billion.

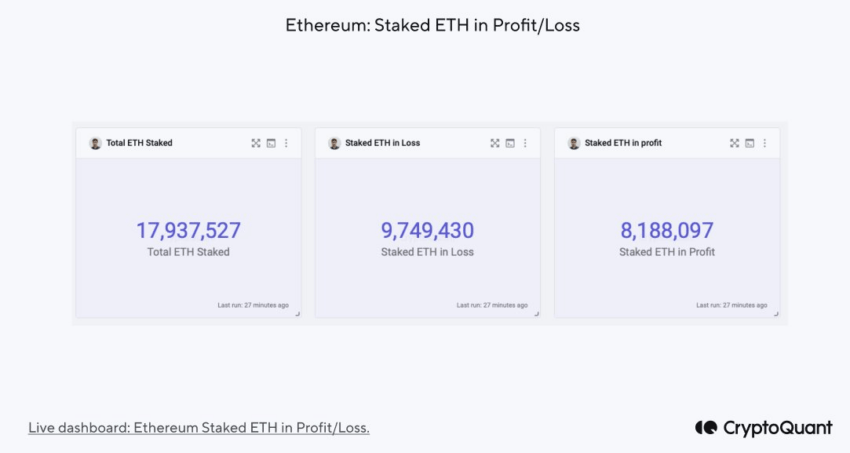

Despite fears of increased selling pressure following the activation of withdrawals on April 12, a profit and loss analysis by CryptoQuant offers a different perspective.

At present, over half of the staked ETH (9.7 million out of 17.9 million) is operating at a loss.

Ethereum Staked. Source: CryptoQuant

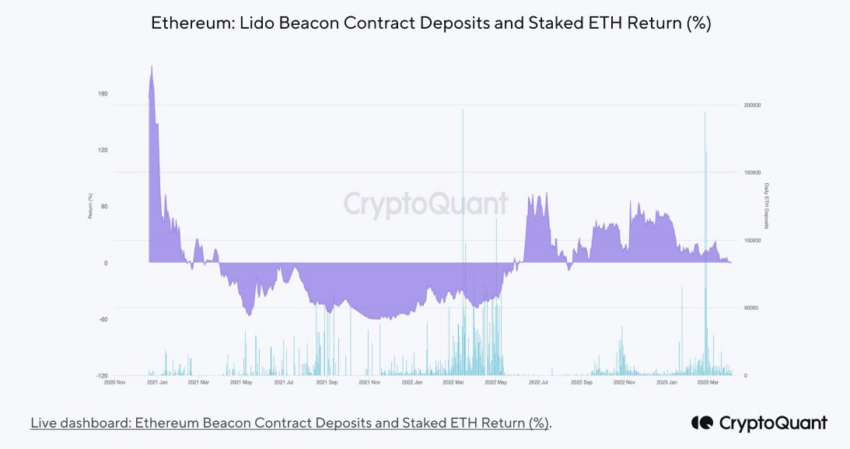

Additionally, a significant portion of deposits made by the Lido pool is currently underwater.

Given the substantial amount of staked ETH in a loss, experts anticipate the selling pressure to be lower than expected. This projection is based on the assumption that holders may be hesitant to sell at a loss.

Ethereum Deposit Contract. Source: CryptoQuant

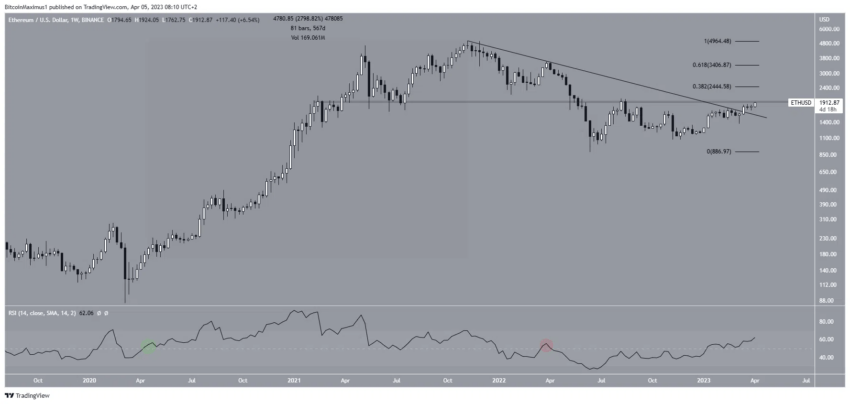

From a technical standpoint, the ETH price has yet to surpass the $1,940 horizontal resistance area. Should the upward trend continue and the price close above this threshold, the cryptocurrency could potentially reach the next resistance levels at $2,440 and $3,400.

These values correspond to the 0.382 and 0.5 Fib retracement resistance levels. As the former aligns with the previous channel’s resistance line, it is more likely to serve as a local top.

Ethereum Price Chart. Source: TradingView

The Shapella upgrade will undoubtedly impact the Ethereum ecosystem. Still, the selling pressure after the hard fork may not be as significant as initially feared. With a large portion of staked Ether operating at a loss, holders may be more inclined to wait for a price rebound before liquidating their assets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Holo

Holo  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Enjin Coin

Enjin Coin  Ontology

Ontology  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur