Ordinal NFTs: How They Are Made And What’s Special To Attract Bitcoiners

Only Casey Rodarmor, the creator of this set of standards, is not happy to call these things NFT. He thinks the term has become stigmatized, so he refers to these things as “electronic art.” Whether you call it “electronic art” or “ordinal NFT,” they use “ordinal theory” to mark and track these “inscriptions,” that is, data/content embedded in the blockchain.

The so-called “ordinal number” is a number that describes a specific position within a sequence (e.g., “first,” “second”). And here, “ordinal number” refers to the UTXO (unspent transaction output) of a specific Satoshi (satoshi, the smallest unit of Bitcoin). This Satoshi “contains” an inscription, which is the content of NFT, which can be text, pictures, HTML files, or even MP3 (music files); and the ordinal number marks this Satoshi with the inscription as a special transaction, So users can locate and track them. Surprisingly, such a sorting system for Satoshi was proposed as early as 2012.

Since its launch in January, more than 1,000 electronic artworks have been immortalized on the Bitcoin blockchain. These inscriptions include screenshots from Twitter, a burgeoning collection of NFTs, an ad for Keet.io software, and even an 8-pixel video game (like a clone of the traditional shooter Doom that you can play in the ordinal block explorer).

In addition to these trivial but fun pictures, video games, and more, ordinal NFTs can also be used as tamper-resistant, censorship-resistant storage for sensitive information.

Unlike previous NFTs based on the Bitcoin blockchain, ordinal NFTs do not use Bitcoin’s OP_RETURN output (this opcode also allows users to store arbitrary data on the chain). Instead, it uses the transaction witness (witness data) field of the Bitcoin block and tapscript (the scripting function that appeared because of the Taproot upgrade in 2021).

Ordinal NFTs are native to Bitcoin, so it doesn’t require a new blockchain nor a new token. And it also stores the entire content of the NFT on the chain, unlike other NFT standards that only put a link on the chain.

This innovation has unlocked new application scenarios for block space (at least lowered the barriers to entry). Naturally, this has some miners hoping that ordinal NFTs will further drive demand for block space and generate greater fee revenue, but not everyone is happy with the innovation – some in the Bittheism camp I think this is at best a trivial gadget, and at worst an attack on Bitcoin.

Counterparty, RarePepes, and the Return of Bitcoin NFTs

Before we dive into ordinal NFTs, let’s take a moment to look at past attempts to mint NFTs on Bitcoin.

Anyway, NFT did originate from Bitcoin. There were trading cards and “Pepe the Frog” on Bitcoin long before the prime punks and floppy-eyed monkeys on the Ethereum and Solana chains became celebrity toys. Pei is the one with the big eyes and the sad expression.)

NFTs first appeared in 2015 on Counterparty, a blockchain network that uses Bitcoin’s OP_RETURN output to make non-homogeneous assets. After OP_RETURN was introduced in March 2014, Robby Dermody, Adam Krellenstein, and Ouziel Slama launched Counterparty in November. In 2015, the first set of NFTs on this platform appeared, a card exchange game similar to “Magic-the-Gathering” called “Spells of Genesis.”

Traffic Jam, the real explosion of Counterparty, came after the launch of 1774 NFTs of the Frog Pepe Exchange Card series. Collectors use the Counterparty wallet to keep these NFTs, and Counterparty uses the OP_RETURN output to anchor the index of these NFTs to the Bitcoin blockchain. The size of the data that can be attached to the OP_RETURN output is limited to 80 bytes, which is only enough for the Counterparty to put the description, name, and quantity of the NFT.

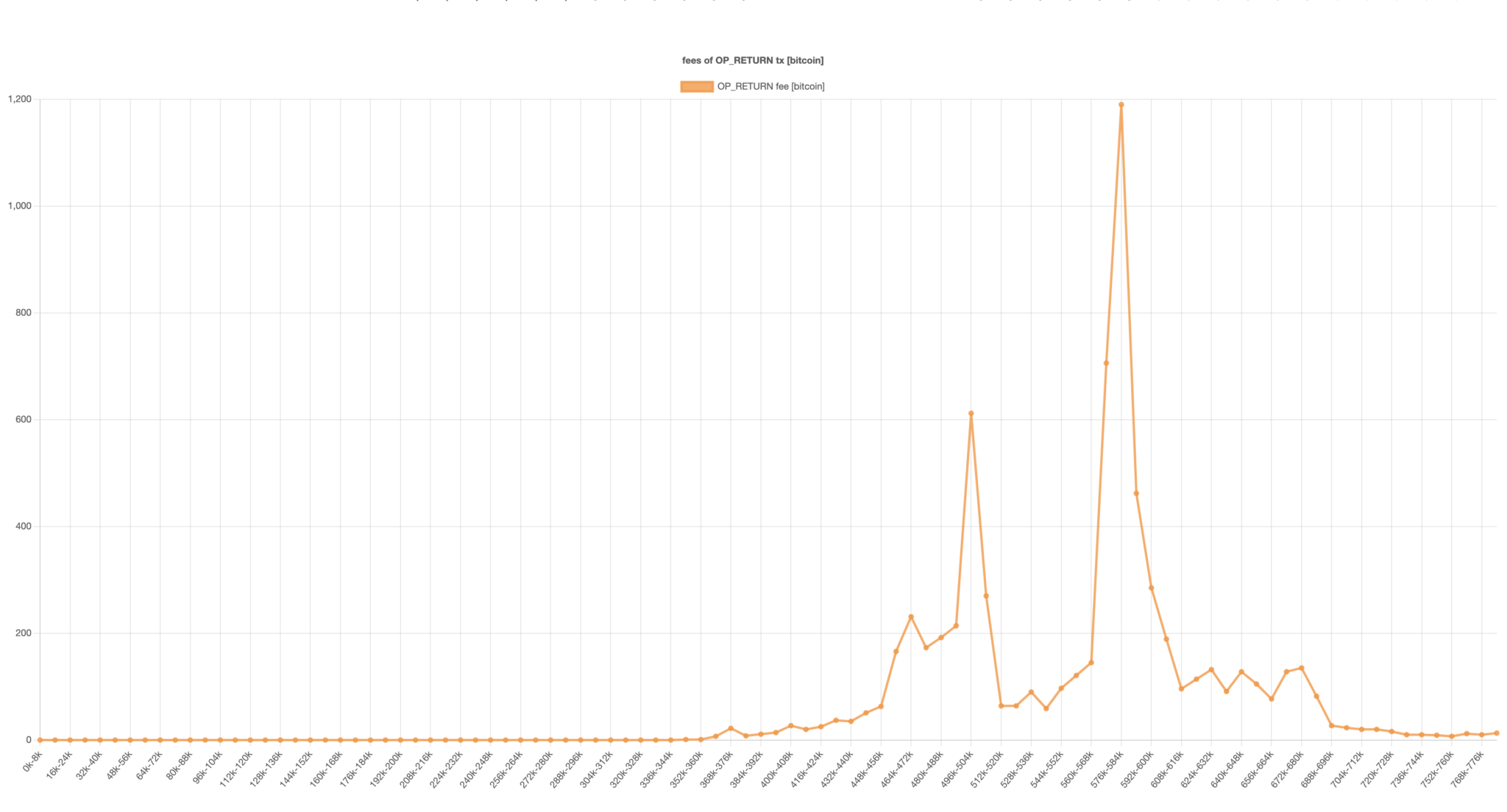

The volume of OP_RETURN transactions peaked in late 2018, bottomed out in the spring of 2019, and then faded away in 2020 with the exits of OMNI (the platform where Tether originally issued USDT) and Counterparty. 2019 ~ 2020 is also the time when USDT migrated to Ethereum, and early NFT projects on Ethereum emerged.

The image above raises a resounding question for ordinal NFTs that are still in their infancy: Will ordinal NFTs follow in their footsteps? Or can it have a greater impact?

What are Ordinal NFTs?

Continuing from the previous book, let’s take a look at several basic modules of ordinal NFT:

- The witness data field of the transaction is where the data and content of the NFT are stored.

- Inscription: It is the main body of NFT – the actual content put on the Bitcoin blockchain, and NFT represents the ownership of these contents. The inscription will be engraved in the witness data field of the transaction’s input, and the NFT will be given to the first satoshi of the first output of the transaction. You’ll also see people refer to inscriptions as “electronic artwork/serial NFTs”—these three words can already be used synonymously.

- Envelope: The inscription will be stored (within the witness data) in what Rodarmor calls the “envelope,” which comprises the OP_IF and OP_FALSE opcodes. Just like OP_RETURN, these opcodes send instructions to the Bitcoin blockchain. In the “envelope” usage, OP_IF holds the data being imprinted, and OP_FALSE ensures that the data is never actually executed and pushed onto the stack (so, while some cultists are panicking, in reality, The full node does not need to process and verify the inscription, it only needs to process and verify the UTXO set, and NFT is free in it).

- Ordinal: The mathematical theory of numerical ordering, used here to identify individual satoshis as “electronic artwork” (aka “ordinal NFT”). The ordinal number defines the first satoshi of the first output of a transaction as an NFT; once marked, this satoshi can change hands and be traded like any other NFT.

Unlike counterpart NFTs (only 80 bytes on-chain), ordinal NFTs have no size limit, limited only by the 4MB size of the transaction witness data field. So, if your files are big enough, you could theoretically mint a single order NFT that could fill an entire Bitcoin block with just its text.

The Tapscript brought about by the Taproot upgrade, and the transaction witness data field brought by the Segregated Witness upgrade allow all of this to be combined.

After the isolated witness upgrade in 2017, the signatures of Bitcoin transactions can be moved from the “ScriptSig” field to the witness data field, and the data in this field will not be included in the transaction Merkle tree. of the block and is placed exclusively in a separate area (hence its name, “Segregated Witness”).

Segregated Witness expands the block size limit since none of the data in the witness data field takes up the 1 MB that Bitcoin originally allocated to blocks. For this reason, the Segregated Witness upgrade introduces a new method of measuring block sizes called “block weights.” The data placed in the witness data field will be “heavier” than the data placed in the initial block space, which is light.” Therefore, it is cheaper to store data in the witness data field of a separate witness transaction than with in-block data storage. This is called “witness data discounting” and is key to performing conventional NFTs.

Another key is upgrading Taproot. Despite introducing a discount on witness data, Segregated Witness still limits the amount of data a single transaction can include in the witness data field. The Taproot upgrade relaxes these requirements, removing the restriction entirely, so you could theoretically use the entire block space to write an NFT of up to 4MB of content.

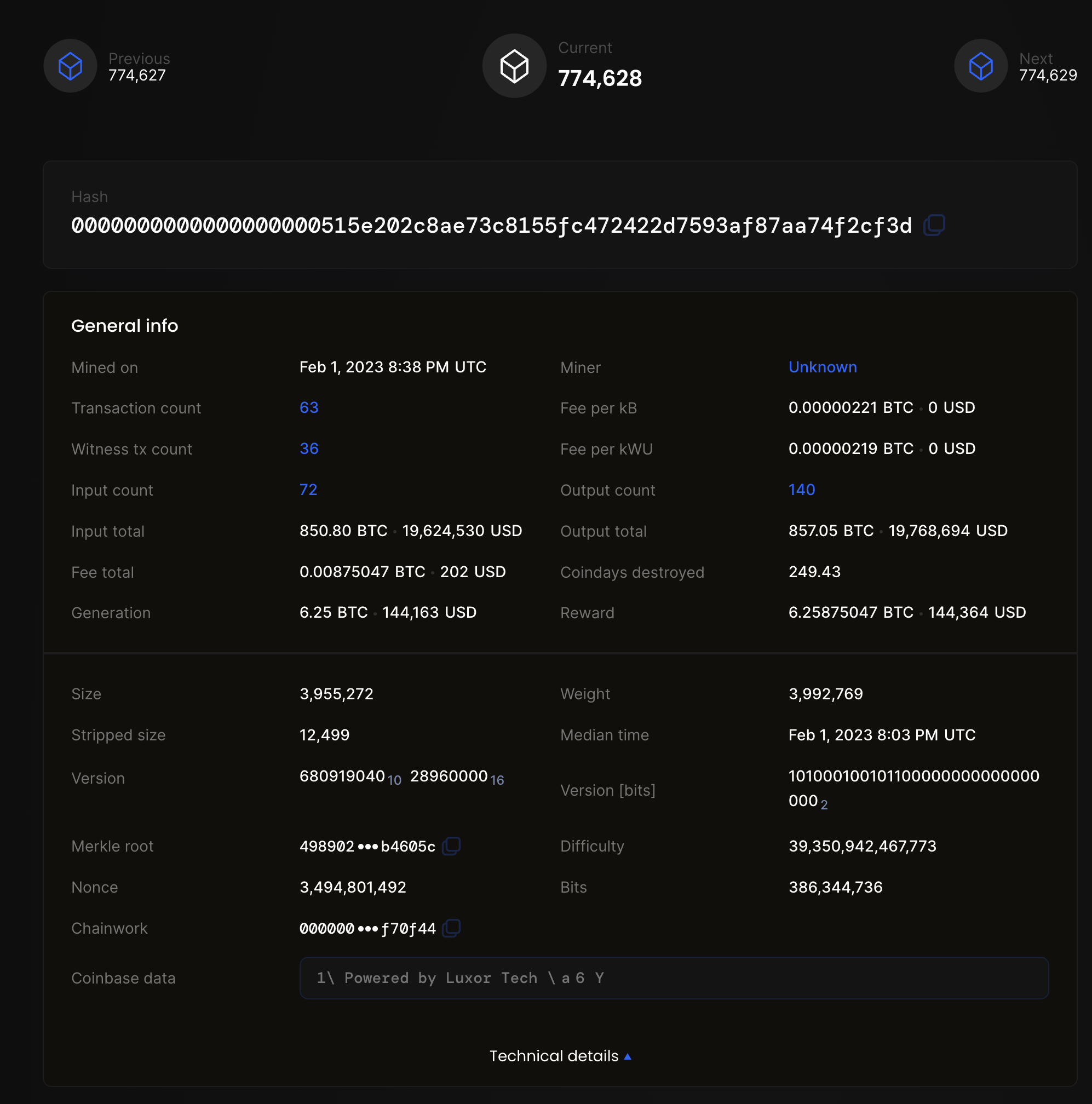

The biggest block ever, NFT has credited 3.94 MB, total block size of 3.96 MB

What Ordinal NFTs Mean for Bitcoin Miners?

Ordinal NFTs have become a hot topic among Bitcoiners, although their creators have tried to avoid controversy by calling them “electronic art.”

There are basically two camps. Those who support it argue that Bitcoin’s block space is a free market; if you can pay the transaction fee, you can use the block space, no matter how large or what the transaction contains. The opposing party claims that NFTs are all scams and will take up block space. These junk transactions will crowd out more meaningful economic transactions (such as ordinary transfers); bandwidth requirements.

Ordinal NFTs have also entered the larger debate over Bitcoin’s security budget. Proponents argue that this new application will drive demand for block space, which is good for the future of Bitcoin as its block reward eventually drops to zero. Naturally, miners are also interested in the debate about block space and fees, which once accounted for 30% of their total income, but now, in good times, only account for 3%.

There are just over 1,000 ordinal NFTs in circulation right now, so they haven’t achieved parabolic growth in transaction fee rates.

That said, both Bitcoin transaction fees and block sizes did increase significantly in the last two days of January, but some of the increase may be due to a 3% drop in Bitcoin’s hash rate from its all-time high, which is The time to produce a block is longer, which leads to a longer time for transactions to enter a block and higher handling fees. But without the inscription craze for ordinal NFTs, we likely wouldn’t see increases in transaction fees and block sizes.

Ordinal NFTs most likely will not increase transaction fees. Of course, they can lead to higher fees, but not in the way you think. After all, a block full of digital artwork could theoretically carry fewer fees than a block full of regular Bitcoin transactions, thanks to the SegWit discount.

But suppose enough users start minting ordinal NFTs. In that case, they will compete fiercely with ordinary transactions for block space, and users who broadcast ordinary transactions will need to increase their handling fees to get their transactions packaged. In this way, miners may prioritize packing as many ordinary transactions as possible because they pay higher fees per their data, so the more ordinary transactions they pack, the higher the fee income.

Therefore, even if ordinal NFT will generate upward pressure on handling fees, miners may prioritize packaging more ordinary transactions to generate higher handling fees.

Scarcity

Transaction fees could not be miners’ main income source, but rather the discovery of rare Satoshi.

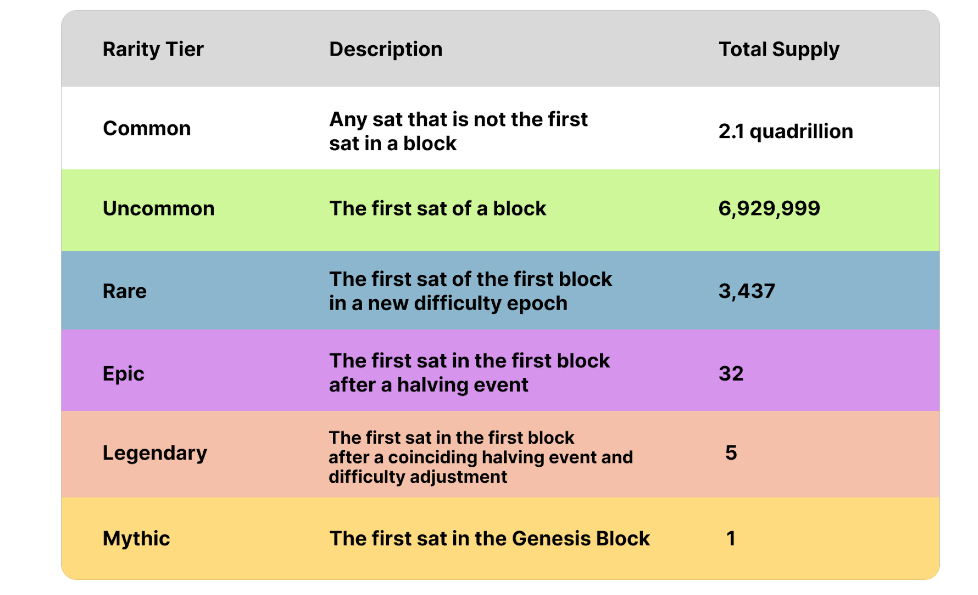

Casey Rodarmot presents a graph illustrating the rarity of various satoshis in a blog post on ordinal number theory. The self-regulating events of Bitcoin’s proof of work, notably the difficulty adjustment event and the halving event of the issuance rate, are the major focus of this taxonomy. For instance, the first Satoshi in the first block following a halving of the issue rate will be labeled as “Epic” Satoshi; if there is a market for such Satoshi, such Satoshi might be sold to collectors for a higher price.

The table looks like this:

When such a collectible market exists, miners can make a lot of money selling that Satoshi to collectors. This scarcity is, of course, based purely on the assumption that such a market would arise. But with everything from monkeys, rocks, and even chickens finding their collectors in the frenzy of NFT transactions, imagine some Bitcoiners jumping in, chasing satoshi’s first of the new halving, the first new satoshi of the difficulty cycle is also not surprising.

Once such a collectible market exists, miners can make a lot of money selling such Satoshi to collectors. Of course, this scarcity is entirely based on the assumption that such a market will arise. But with everything from monkeys to rocks, to even chickens finding their collectors in the frenzy of NFT transactions, imagine some Bitcoiners jumping on the bandwagon, chasing the first satoshis of a new halving cycle, the new first satoshi of the difficulty cycle is not surprising either.

Ordinal NFTs: Anomaly?

Casey Rodarmor’s innovation has only been around for about a month and has already become the most controversial topic in Bitcoin circles this year.

The opposition is so strong that Bitcoin Core contributor Luke Dashjr has written a crude filter for node operators’ retweets), although the efficacy and impact of this tool are in doubt. OP_FALSE means that the inscription data does not need to be verified, and the pruning node will not save the witness data of the transaction at all.

There are also people on the other side, and many people — including Bittheists and ordinary cryptocurrency enthusiasts — are excited about this new way of minting NFTs. In addition to images and collectibles, ordinal NFTs can also be used to publish sensitive documents that can benefit from permanent, censorship-resistant storage and replication. Bitcoin users can curate an “immutable library” by inscribing ordinal NFTs to borrow the words of Galaxy Digital’s Brandon Bailey.

For miners, this innovation can lead to increased transaction fees in the future, open additional income streams for miners (mining rare Satoshi), and even generate “miner extractable value (MEV).”

Regardless, ordinal NFTs are not going away. The only question is how much impact they will have and whether inscription will be able to create the NFT craze that Ethereum and other blockchains have.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Decred

Decred  Dash

Dash  Zcash

Zcash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur