Popular Analyst Predicts Bitcoin (BTC) Price Could Fall Below $15,000

Bitcoin (BTC) price tumbled nearly 8% in the last 24 hours as the U.S. dollar index continues to move above 110, making the crypto and equities markets weak ahead of the Fed‘s FOMC meeting on September 20-21. Popular crypto analyst Rekt Capital predicts BTC price could fall below $13,900, and to $11,500 in an extreme scenario.

Historical Data Indicates Bitcoin (BTC) Price Can Fall Further

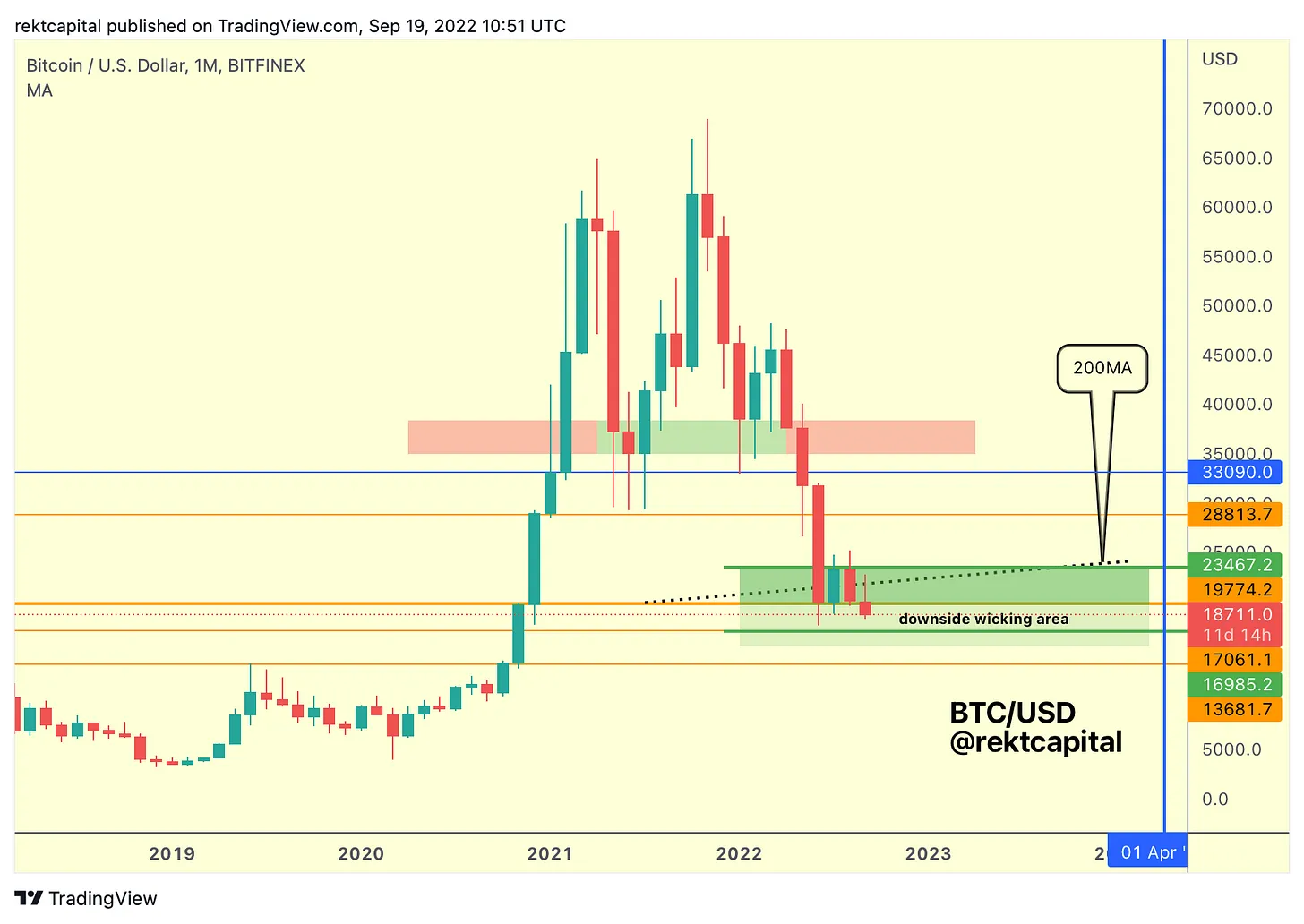

In the monthly timeframe, the Bitcoin price is currently struggling to surpass the $20,000 level, showing a weakness. The $20,000-$23,350 range will mostly decide bears and bulls here. The price movements in July and August indicate the difference in the buy-side pressure, with $20,000 as support.

Bitcoin BTC Price Monthly Timeframe. Source: Rekt Capital

However, price movement in September has been so weak and suggests $20,000 is now turning into a resistance level. If the month ends with Bitcoin (BTC) price below the $20,000 level, the next support levels are $17,165 and $13,900.

Historically, the Bitcoin (BTC) price forms a bottom at or below the 200-weekly moving average (WMA) after a Death Cross. The post-Death Cross retracements have been in the range of -42% to -73%.

Bitcoin (BTC) Price Bottom. Source: Rekt Capital

Therefore, considering the historical post-Death Cross retracements and support levels, the Bitcoin price to bottom at around $13,900. In the extreme scenario, the BTC price to bottom at $11,500.

As the BTC price is already below the 200-WMA and psychological level of $20,000, the downside seems most likely. However, there is a massive difference in market cap size, liquidity, and institutional and retail adoption of Bitcoin now as compared to earlier times.

Bitcoin bottomed 547 days before the Bitcoin Halving in 2015 and 517 days before the Bitcoin Halving in 2018. Therefore, if Bitcoin is going to bottom 517-547 days before the upcoming April 2024 Halving, then the bottom will occur in Q4 this year.

Macros Impacting BTC Price

Despite a growing number of new daily addresses, the Bitcoin price continues to dive below $20,000.

The Bitcoin (BTC) price will mostly depend on the Fed rate hike on September 21. Wall Street experts such as Goldman Sachs predict a 75 bps rate hike in September and 50 bps rate hikes in November and December. According to the CME FedWatch Tool, the probability of a 75 bps rate hike is 80%.

Currently, the BTC price is trading above the $19,000 level after recovering nearly 4% from the 24-hour bottom at $18,390. If the U.S. dollar index remains near 110, the BTC price will be under pressure.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur