Research: BTC Hash Ribbon indicator signals miner capitulation could be almost over

Bitcoin (BTC) holders had it tough in 2022, but it was an even tougher year for BTC mining — mining stocks fell over 80%, and mining company bankruptcies solidified the bear market — but the worst of miner capitulation could be over, according to CryptoSlate analysis.

With BTC price down 75% from its all-time high (ATH), the hash rate too reached an all-time high as miners increased efforts to ensure profitability in the energy crisis.

BTC Miner capitulation decreasing

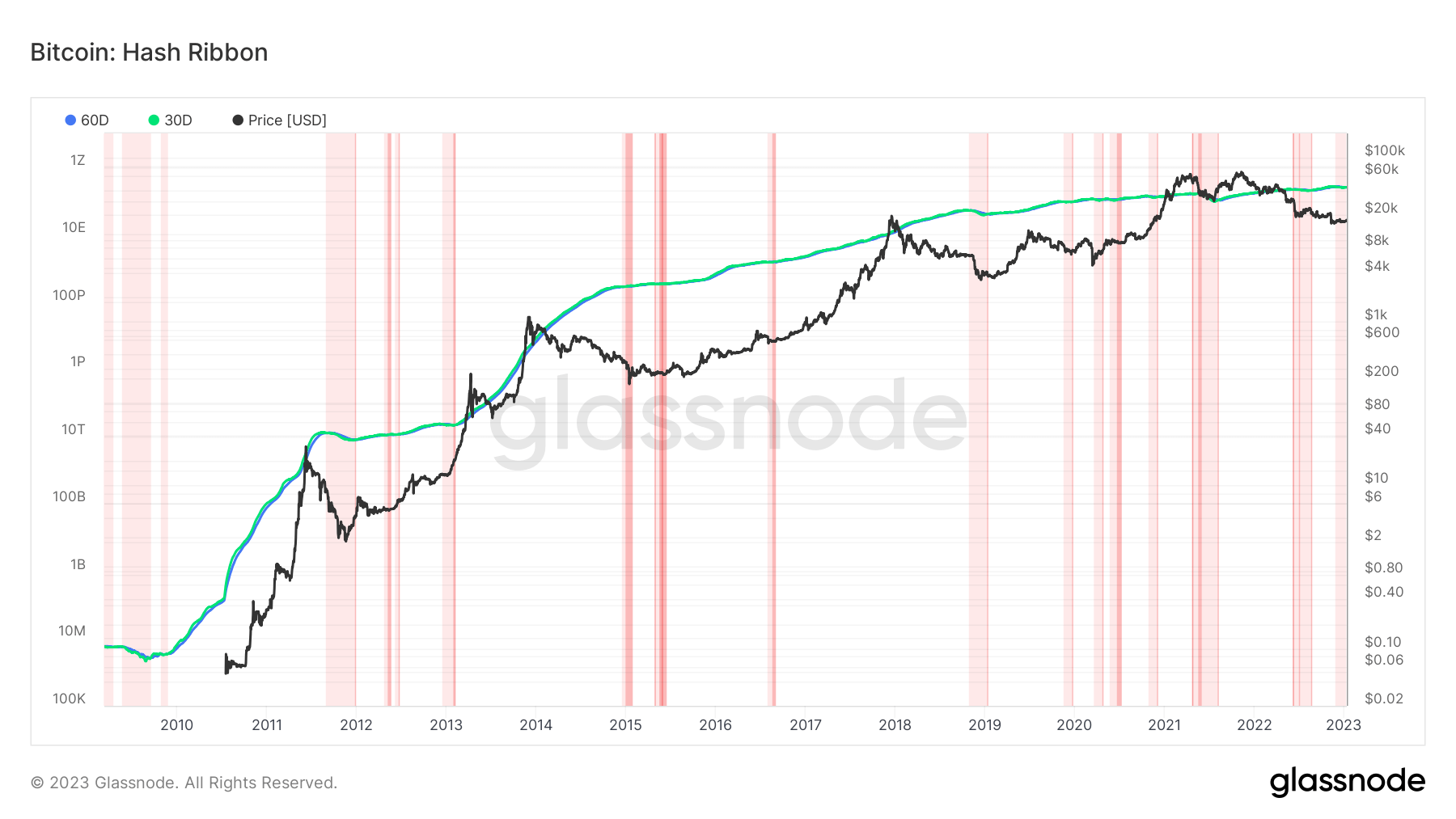

The Hash Ribbon indicator chart above indicates that the worst of miner capitulation is over when the 30-day moving average (MA) crosses the 60-day MA — switching from light-red to dark-red areas.

When this paradigm shift occurs, a switch from negative to positive price momentum is expected, which historically reveals good buying opportunities (switching from dark-red back to white).

It is suggestive that the worst of miner capitulation is almost over as BTC turns bullish and breaks out towards $19,000, according to Glassnode data in the chart above analyzed by CryptoSlate.

BTC miner supply sell pressure abating

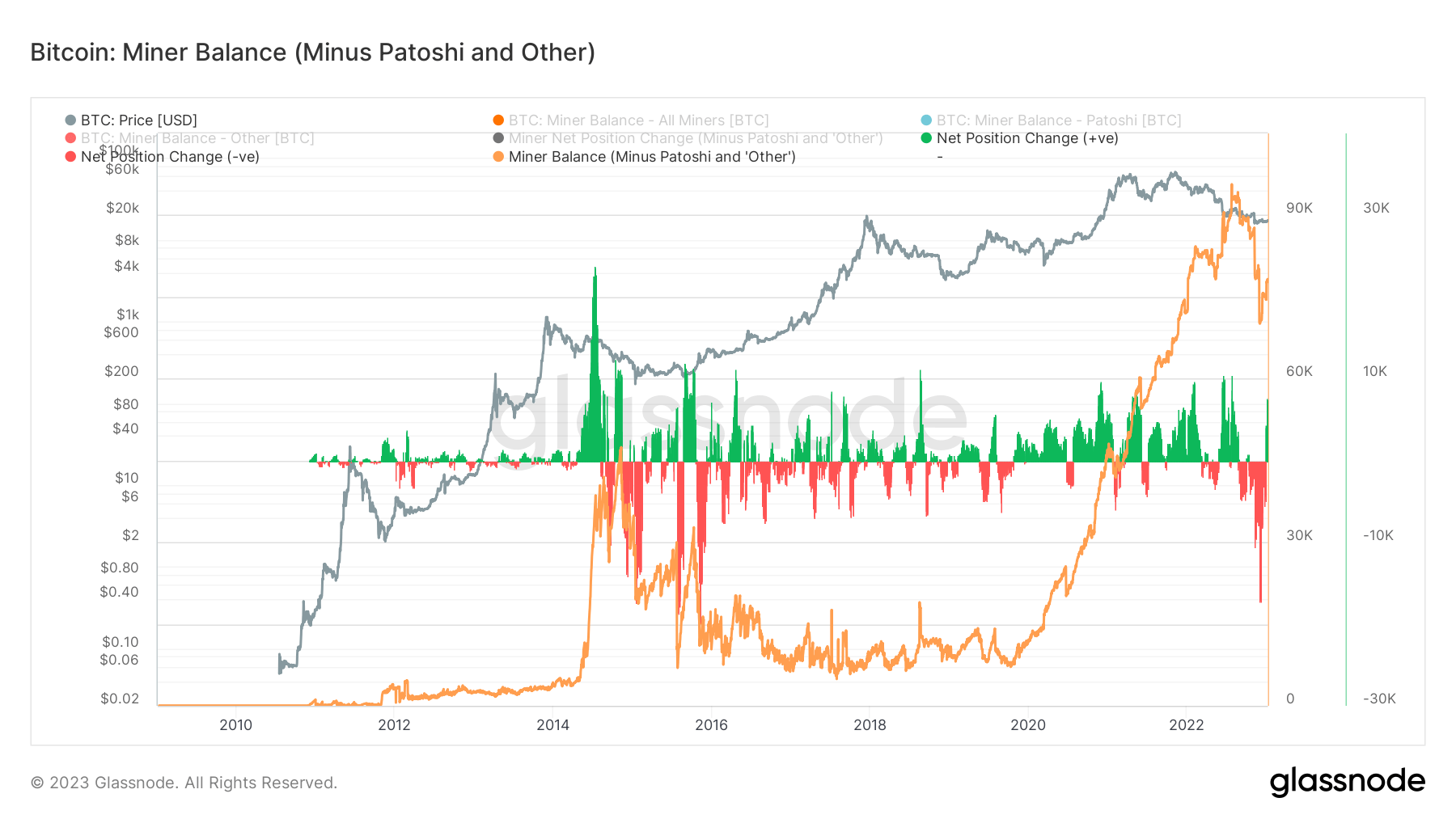

The total supply of BTC currently held in miner wallets has hit roughly 1.8 million BTC after a drawdown of roughly 30,000 BTC. This doesn’t directly indicate that the BTC was sold but could, in fact, have been moved to another wallet for long-term storage.

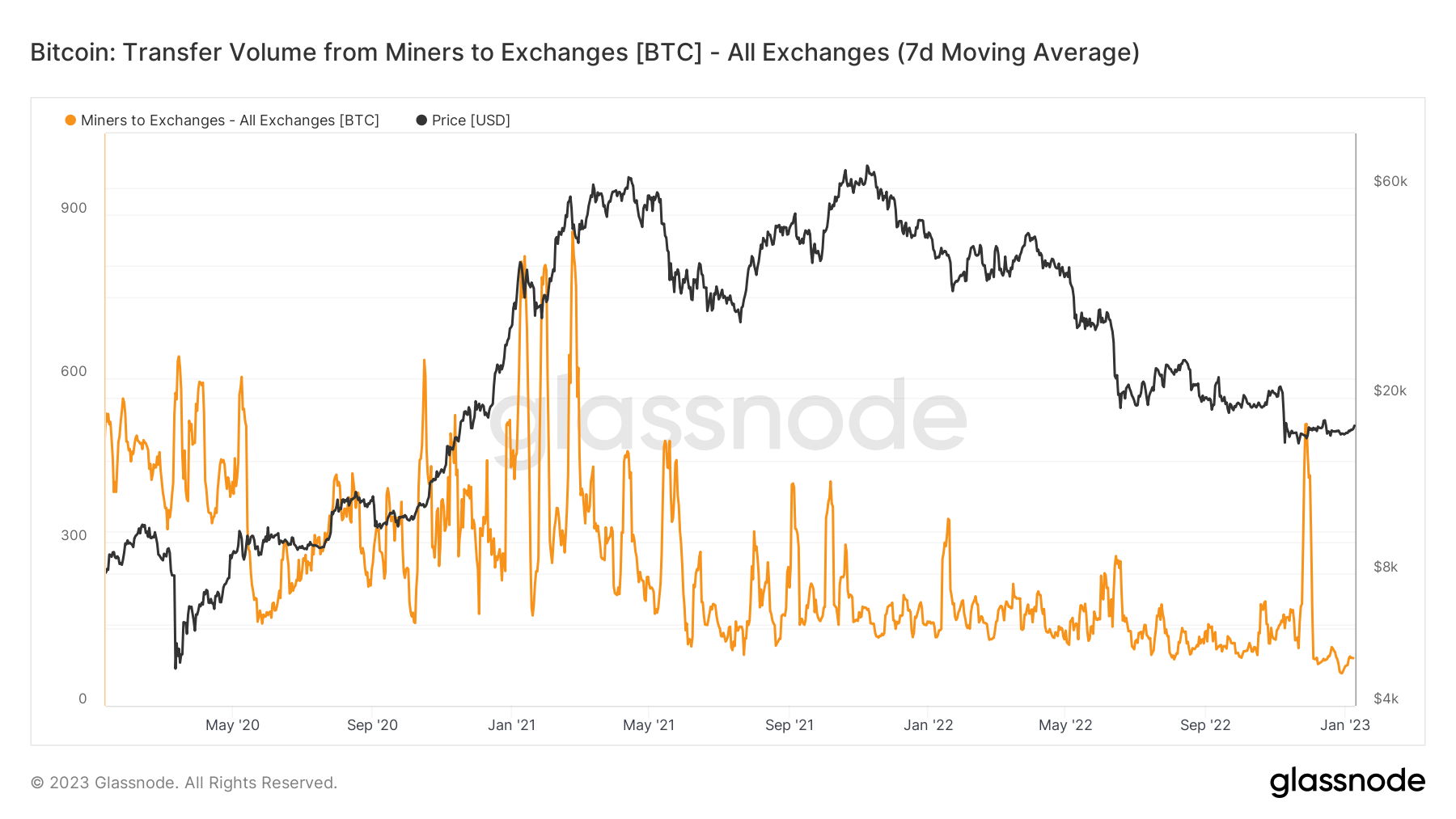

Meanwhile, miner spending has drastically decreased as transfer volume from miners to exchanges falls greatly, as shown in the chart below.

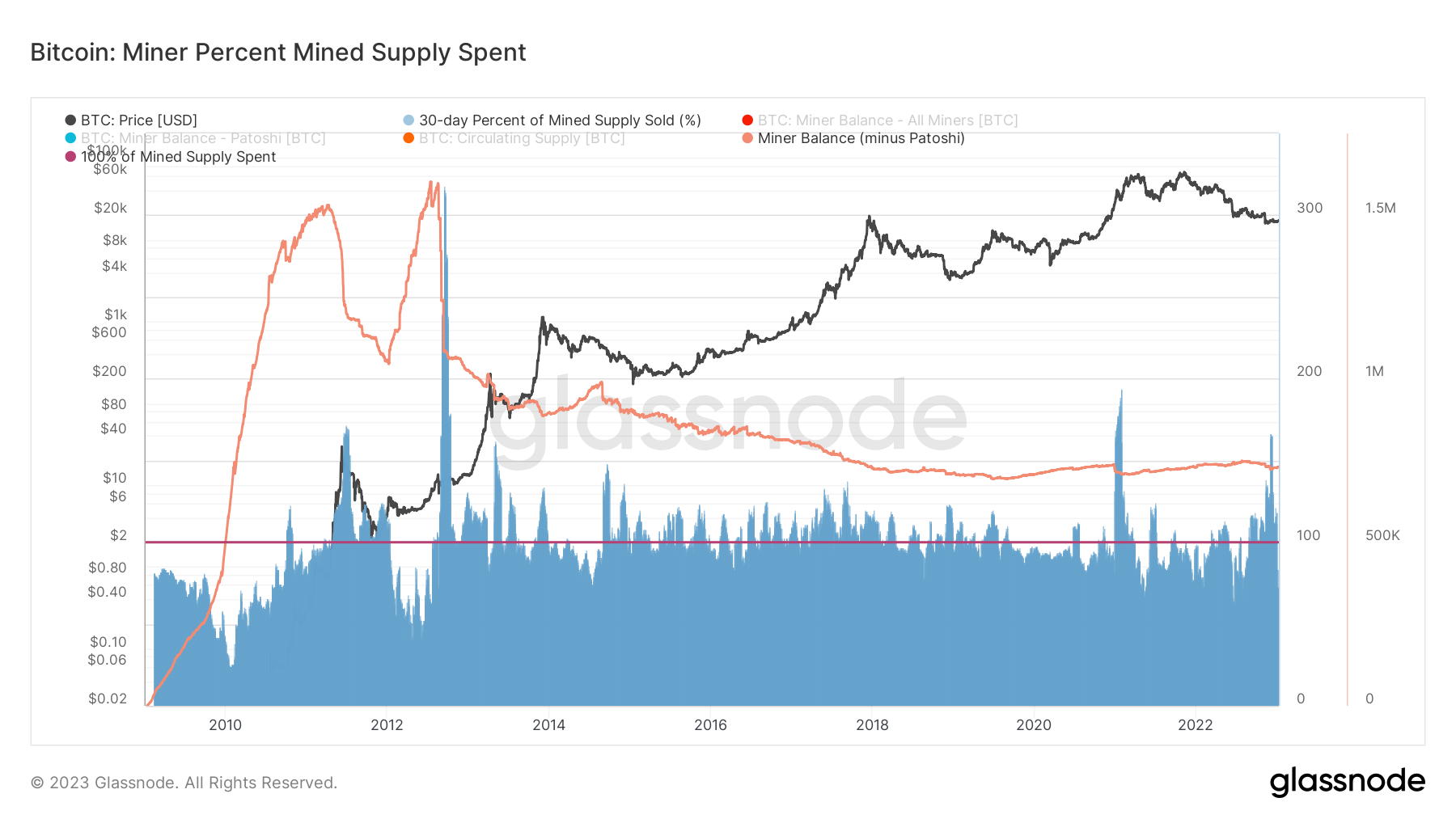

Miner sell pressure has reached its lowest in the last three years as less than 100 BTC is being sold on a seven-day MA. When compared to the vicious drawdown in 2022 — where miners were spending more BTC than was being mined — all charts indicate selling pressure is set to switch to buy pressure.

»

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD  Bitcoin Diamond

Bitcoin Diamond